Property investment in New York

Posted by Wei Min Tan on December 15, 2025

Property investment in New York, specifically in Manhattan, is a prudent decision taken by successful individuals as part of their portfolio planning. For foreigners, investing in New York property is seen as a safe haven for assets because of the limited supply and high demand coming from people who live here and investors from all over the world. New York property is a hedge for investors as the world experiences inflation, political uncertainty, disruptions in global trade and currency volatility.

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

New York’s desirability globally

The Wealth Report by Knight Frank consistently ranks New York (Manhattan) and London as the world’s top cities. But in terms of price, New York is relatively inexpensive, ranking at #6, behind pricier cities like Monaco, Singapore, London and Geneva. Property ownership remains a top priority for global investors for stability, diversification and generational wealth transfer.

According to Henley and Partners, New York is the world’s wealth capital with the most millionaires. San Francisco and Tokyo are runners up.

New York is the U.S. East Coast’s Silicon Valley

New York is now the East Coast’s Silicon Valley. We are no longer solely reliant on the financial industry. For example, Facebook (Meta) and Amazon are expanding in Manhattan while Google has built a second campus in Hudson Square. The largest corporate tenant in Manhattan is now Meta!

New York is also one of the most vibrant cities for startups. Yes, costs are high, but the talent pool, diversity, culture, entertainment and opportunities are unbeatable. The top startups to watch in New York include Knoetic, a human resources analytics platform and Mesh, which converts sales data into actionable revenue strategies.

Weimin’s article, Investing near Google and Disney.

Deal example: Client’s 4 bedroom at Four Seasons Downtown, 30 Park Place. Purchased at a good discount, renovated and then rented in 2 weeks.

Property prices in New York

Investors typically invest in condominium apartments and these start at $650,000 for a studio. One bedrooms range from $800,000 to $2 million, 2 bedrooms from $2 million to $5 million. Three bedrooms start at $3.5 million. Anything larger than a 3 bedroom is a mansion by Manhattan standards.

Our investor clients usually rent out the condo investment property. Here in Manhattan, about 75 percent of residents are renters while 25 percent are owners. Hence, being a landlord means having a large renter pool.

For historical context, price per square foot for a condominium was $480 in 1999, $1,374 in 2008, $2,149 in 2017 and decreased to $2,032 in 2020. Prices dipped to $1,714 in Q1’2021 and this period reflected the pandemic deals. By Q4’2021 price per sqft was back up to $1,989, and in Q3’2025 it was $1,998. Current median price is $1.65 million, still lower than the peak of 2017 which was at $1.713 million.

Weimin’s analysis, Manhattan Condo and Coop historical price trend and Manhattan Condo historical price trend

2017 – 2020: Property price correction and COVID

Despite the strong economy, New York property in 2017-2019 experienced a price correction. Price per square foot increased from 2011 to 2017. In 2018, price was down 4 percent. This down cycle was mainly driven by changes in tax laws and global uncertainties. In 2019 condo prices were up 2 percent to $2,098.

In 2020, from January until middle of March, Manhattan appeared on the recovery path. Sales volume went up considerably and we thought the up cycle was returning. Then COVID-19 hit New York City which consequently became the COVID epicenter of the world. Listing volume was already low from Jan – Mar 2020 as sellers didn’t want to list their apartments for fear of strangers entering their homes. From mid March to end of June 2020, we had a lockdown and all real estate activities were banned by the government. We had a stay-at-home mandate.

The best deals were those signed during this lockdown as uncertainty was at the highest level. I represented a buyer client who had an accepted price at $3.2 million. Contract wasn’t signed yet and we entered lockdown. We renegotiated the price down by $400,000 during the lockdown. It was in a new development too.

Prices came down 7 to 10 percent as result of COVID. Based on various analysis on metrics such as median price, sales volume etc, the impact of COVID matches the Great Financial Crisis of 2008.

Weimin’s article, Is now a good time to invest in Manhattan property?

Deal example: 40 Mercer in Soho. Ultra luxury apartment building commanding premium rents, in Soho. In this deal, we also took over with tenant in place which meant no vacancy period having to look for a tenant.

2021: Recovery and record sales volume

For the sale market, the lowest point of the pandemic was between May to July 2020. Note that the entire property market was closed between March to June 2020. The Manhattan market started picking up from November 2020, and 2021 was a very strong seller’s market.

Transaction volume for condos and coops combined was the highest ever recorded, even higher than in 2007. This was driven by low interest rates, people moving back into Manhattan, pent up demand from buyers who didn’t buy in 2020 and reopening of the economy.

2022 to 2024: Inflation and mortgage rate hikes

Sales volume was still strong through Q2’2022 but dropped by 24 percent and 28 percent in Q3’2022 and Q4’2022 respectively. This was because of high inflation which started in mid 2022 and resulted in the Federal Reserve increasing interest rates which led to mortgage rates increasing.

The 30-year mortgage rate rose to 7 percent in November 2022 compared to 3 percent a year ago. Since half of Manhattan buyers need financing, this segment became renters instead, as mortgage payments would have increased significantly if they were to buy. Mortgage rates and inflation have decreased since. Inflation peaked at 9.1 percent in June 2022 and decreased 6 months straight. In December 2022 it was at 6.5 percent, and the most recent September 2025 datapoint has inflation at 3 percent.

The Federal Reserve has cut interest rates but mortgage rates are still in the 6 to 7 percent range.

Average 30-year mortgage rates from 1972 to present.

2025: The current Manhattan property market

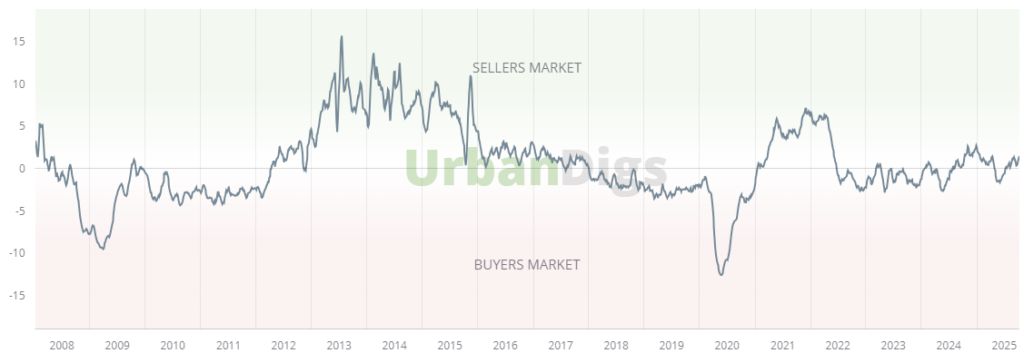

We were in a buyer’s market from 2020 to 2024. But now the market is neutral, with low supply and buyers constrained with high mortgage rates.

Trump is deregulating the banking and finance sector which would increase investment banking and private equity deal flows. Also, we expect interest rates to decrease further from the lowered inflation environment. All these are factors that should positively impact the Manhattan property market.

The most recent Q3’2025 data shows average price per sqft at $1,998, which is almost back to the peak of 2017. Sales volume for Manhattan condos increased 16 percent compared to the same period a year ago.

Market Pulse shows we are in neutral market territory.

Meanwhile, rents are strong as they have been increasing with inflation. September 2025 average rent was at $5,513 while vacancy rate was 2.11 percent. Currently, all-cash buyers have the most negotiation power. For investors who can buy all cash, rental yields are at a high because of inflation and increased rental demand given the decreased affordability to buy.

In viewing properties for clients, limited supply is the biggest challenge. Desirable condos are snapped up within a week while less desirable ones can sit on the market for up to a year.

Weimin’s article, Manhattan Property Market Trends

Where to find listings

The U.S. market is very transparent. All properties for sale are listed on the major websites so the buyers and brokers have access to the same properties. The main website for Manhattan inventory is streeteasy.com, but the same inventory will show on other websites as well.

Weimin’s article, Manhattan Property Review

Deal example: The Sutton in Midtown East. Reserved at pre-construction stage and always rented at premiums rents. Read about Pros and Cons on new property launches in Manhattan.

Have a New York property team

The broker usually is the key coordinator for your local team. In our model, I, as the broker would bring in the lawyer, mortgage banker, accountant and contractor to play the different roles needed. The buyer’s broker’s main role is in recommending the right buy and managing the process. An equally critical role is in coordinating the team.

Downsides of property investment in New York

Price appreciation is not aggressive: New York property appreciates steadily so don’t expect prices to double in a year or two. Rather, prices grow at between 5 to 10 percent per year. For a more aggressive property investment strategy, the developing markets is better.

Structure and paperwork: Be prepared for a lot more structure, paperwork and bank verifications than in other countries. There are licensure and regulations for all functions. Everything is verified by the lending bank and there are formal processes for everything, from appraisals to title reports to closing processes. Some clients have mentioned that in their country, the transaction can take place behind a coffee shop. Absolutely not so with a New York transaction.

Weimin’s article, Investing in a West Village apartment

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale

Follow On Instagram

Related Articles

Buying new property in Manhattan