Is now a good time to invest in Manhattan, New York residential property?

Posted by Wei Min Tan on December 15, 2025

Is now a good time to invest in Manhattan residential property is a question I am often asked. In short, the Manhattan property market has been going sideways since 2017 but now appears to be coming back.

How did Manhattan perform during Covid? Where are prices now? What are the key metrics? Let’s understand the overall historical context a bit more, from the 2017 to 2019 downturn cycle to Covid 2020 to market recovery in 2021 and the present high mortgage rate environment.

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

2017 to 2019: Market Slowdown

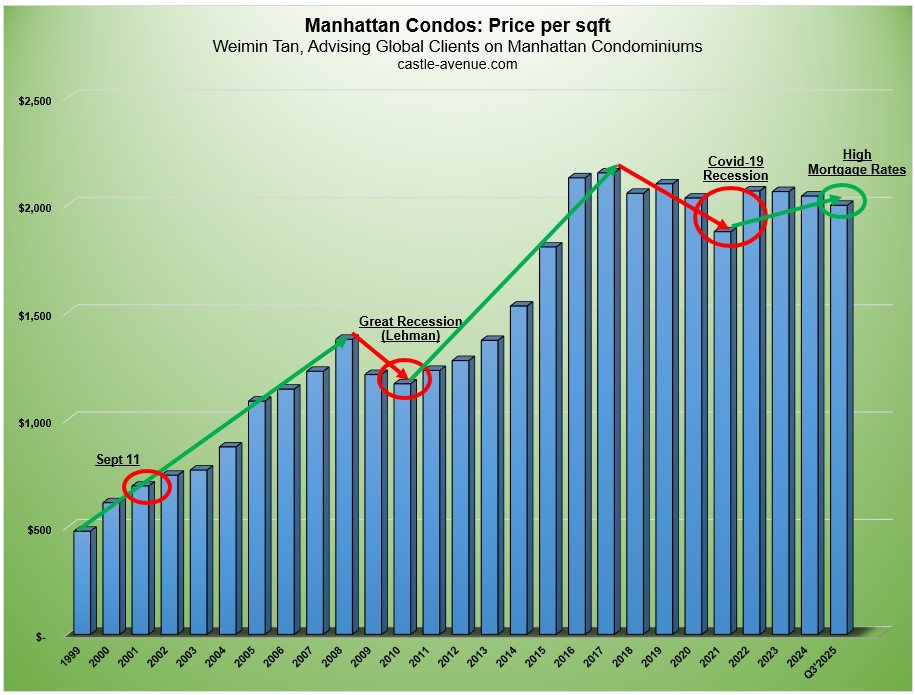

Manhattan residential property experienced a slowdown from mid 2017 through 2019, typical with property cycles. Looking at property price data going back to 1999, Manhattan condominium prices were going up from 1999 to 2008, had a dip in 2009 and remained flat in 2010, and then went back up from 2011 to 2017.

The 7-year up cycle ran its course and 2017 to 2019 was a down cycle. The original 2017 to 2019 slowdown started with the market’s reaction to the decreased tax deductibility on primary residence property. And then it was driven by (i) increased mansion tax and oversupply in the $5m+ high end segment, (ii) increased inventory, (iii) the typical down cycle after an up cycle (2011-2017).

Weimin’s article, Manhattan condo price trend

2020: Covid hits Manhattan and the death of big cities?

In Q1’2020, it first appeared that we were starting the recovery as evidenced by an increase in sales volume (before March 15, 2020). Then after March 15, 2020, New York City was hit by COVID 19 at unprecedented levels and the property market came to a standstill.

The real estate market was locked down from mid March 2020 to end of June 2020. As the market reopened end of June 2020, uncertainty was at the highest. Clients didn’t know how long the recovery would take, retailers closed down, restaurants could not reopen for indoor dining.

The rental market was hit even harder. Because of work-from-home policies at companies, renters didn’t renew leases and moved out of Manhattan. New Yorkers had a once-in-a-lifetime opportunity to work from anywhere they want while saving on Manhattan rents. Market rents dropped 25 percent, inventory shot up 3x and vacancy rate shot up 5x.

Looking back, May to July 2020 was the bottom of the Manhattan market. My clients who bought during that time made the right move and got the best deals. But this is hindsight. The uncertainty then was how long was the Covid impact going to last, and whether it was the end of cities and dense living.

The media talked about the death of big cities. People started moving out of Manhattan and to the suburbs. The suburbs saw a surge in the real estate market starting around July 2020.

Client’s West Village investment condo which we negotiated during Covid lockdown in May 2020. Got amazing terms and price. This 12th floor apartment has a lot of blue sky views, a rare feature in Manhattan.

After the market reopened in July 2020, the real estate industry slowly resumed amid a lot of new protocols. eg Covid forms, very limited showings. Urbandigs, a Manhattan data analytics firm, started tracking weekly activity including the charts below.

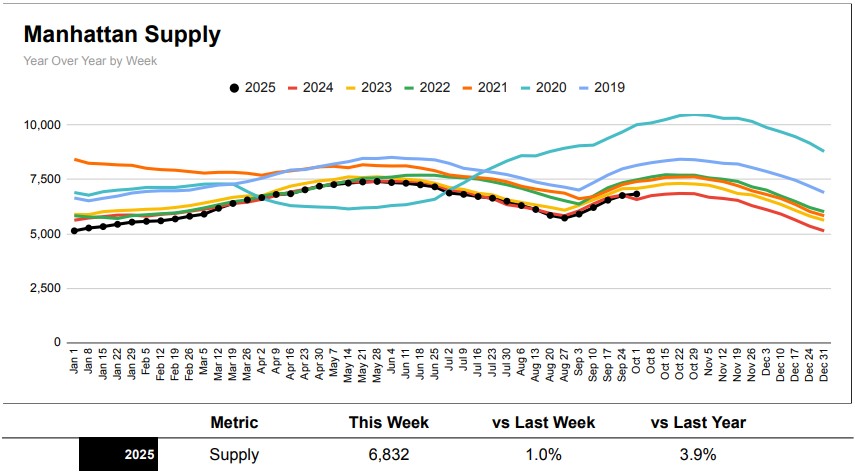

Market Supply was at a peak in late 2020 (green line).

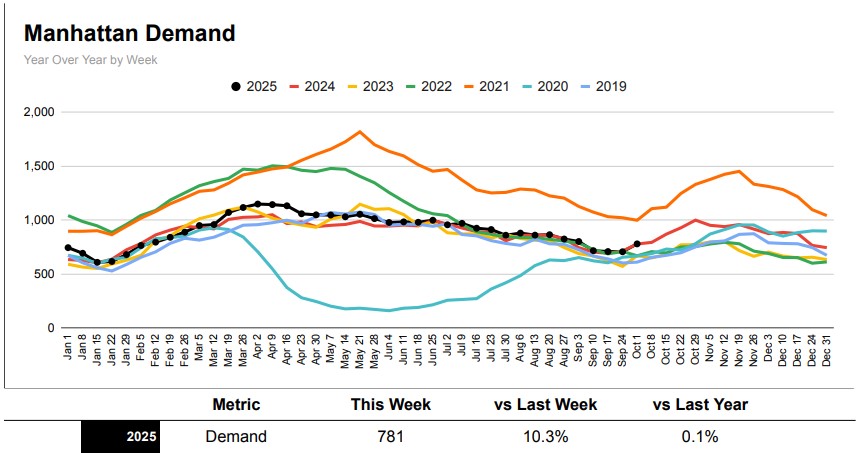

Demand: Refers to contracts in pipeline waiting to close. Notice the bottom was May to July 2020 (green line).

2021: Manhattan recovers to record sales volume

From the bottom of the Covid market, May to July 2020, demand, referring to contracts in pipeline waiting to close, was increasing weekly until mid 2021 when it started stabilizing. In 2021, we experienced record number of weeks with 300+ contracts signed.

Supply in 2021 was decreasing dramatically as contracts signed exceeded number of new listings coming onto the market. For context, Q4’2021 sales volume was 82 percent higher than Q4’2020. The surge in the sales market was dramatic in 2021 and it was driven by low mortgage rates, pent up demand and overall optimism on the New York economy recovering. People who moved out of Manhattan moved back. 2021 ended up with the highest sales volume ever recorded.

There was no death of big cities. Conversely, demand for Manhattan property was stronger than it has ever been!

Client’s three-bedroom condo with open views, we rented out in 1 week. We targeted larger sized apartments post Covid in anticipation of the market’s need for more space. Weimin’s article, Investing in large 3-bedroom apartment to rent out in Manhattan.

2022 and 2023: Interest rate jumps

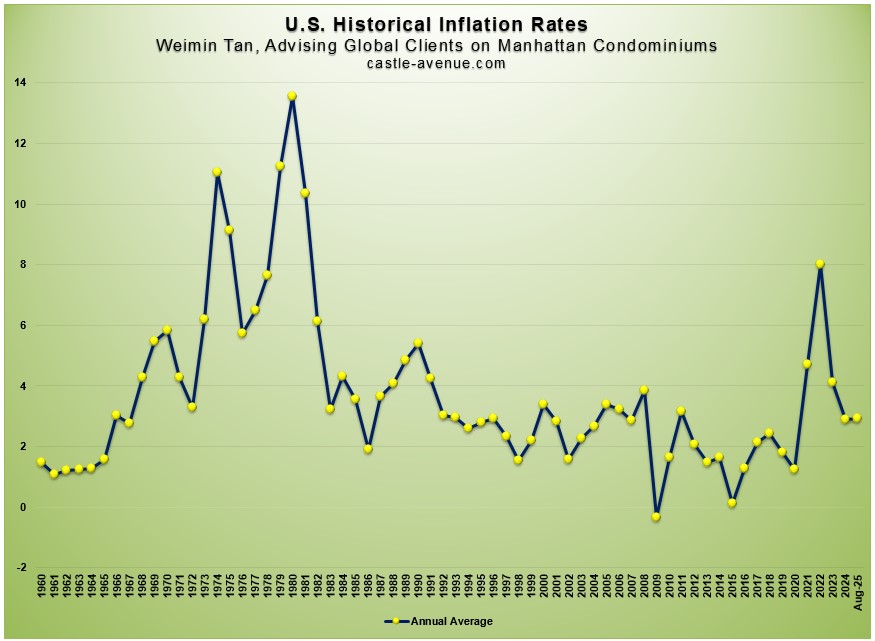

The strong demand from 2021, fueled by low mortgage rates and pent up demand, stretched into early 2022. But sales volume in the second half of 2022 slowed down. This was because mortgage rates increased, driven by the Federal Reserve’s rate increases to combat inflation. Inflation reached 9.1 percent in June 2022, a 40-year high. Recession fears were everywhere despite strong job growth (in 2022) and a record low 3.5 percent unemployment rate.

The Federal Reserve increased interest rates tremendously in effort to bring inflation back down to the 2 percent range. Fortunately, inflation started decreasing. In December 2022 it was at 6.5 percent, and in September 2025 it was at 3 percent.

Inflation (below): In 2022, we had the highest inflation levels since the 1980s. This was because of the Covid stimulus packages, pent up consumer demand, a robust job market, energy supply disruptions from the Russian invasion of Ukraine and supply chain issues. The Fed’s interest rate increases have brought inflation down from a high of 9.1 percent in June 2022.

Mortgage rate (below): Inflation led to the Federal Reserve increasing interest rates. This in turn led to increasing mortgage rates. The 30-year fixed mortgage rate is now at 6-7 percent, more than doubling the rate in early 2022. Since 50 percent of Manhattan buyers need mortgage financing, it became a lot more expensive for them in terms of monthly payments. As result, many potential buyers became renters.

Deal example: Client’s 2 bedroom condo at 111 Murray, Tribeca’s top condo, which we are renting out at top rents.

Weimin’s article, Investing in Tribeca property.

How much Manhattan residential condos cost now

Back in 1999, price per sqft was $480. The prior annual peak was in 2017 at $2,149. The below are key data points on a Manhattan condominium in Q3, 2025.

Average price $2.65m (-5.1% vs prior year)

Price per square foot $1,998 (-2.3%)

Median price $1.65m (+2.2%)

Transactions 1,407 (+16.6%)

Months of supply 8.7 months (-6.5%)

Rents at record level

During Covid 2020, because of work-from home policies, a lot of renters did not renew their leases and moved out of Manhattan. One year later in 2021, as companies required employees to be back at the office, those who moved out of Manhattan moved back, driving up the rental market.

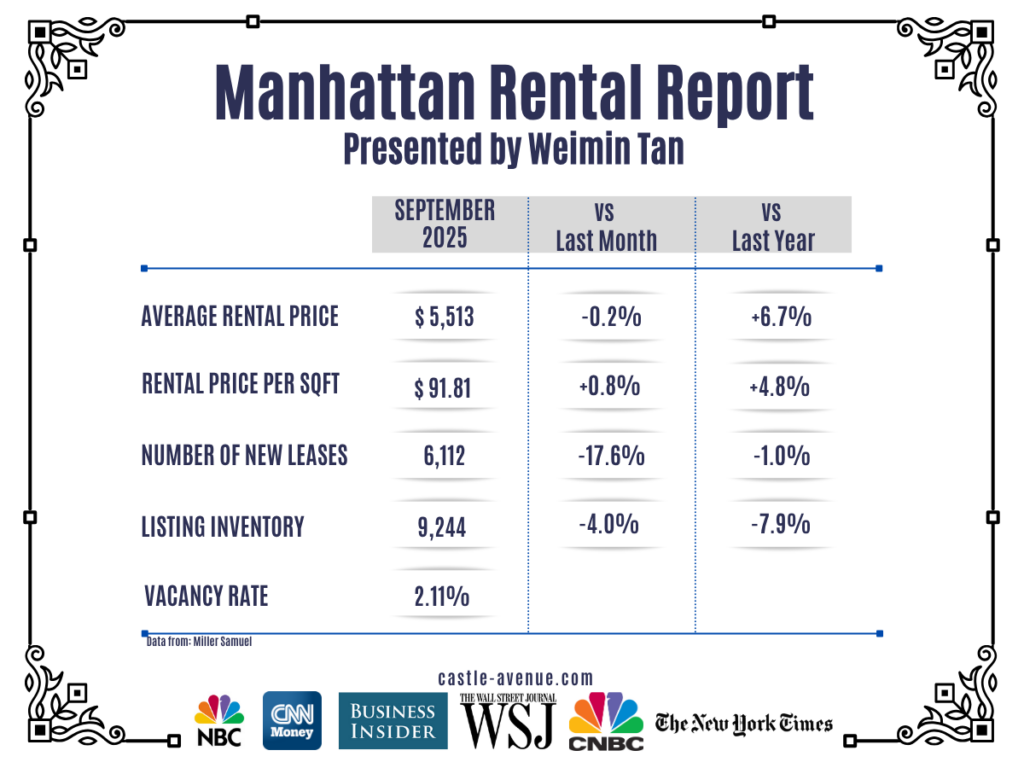

The rental market kept going up and in June 2022, the average Manhattan rent exceeded $5,000 for the first time. It was all over the news. Rents kept going up from June 2022, and in September 2025 (graph below) it was at $5,513. Rental price per sqft in September 2025 was $91.81 or 4.8 percent higher compared to prior year.

Investors are experiencing record rental yields with the rent increases. With our investor clients’ condo properties, we have increased rents between 40 to 70 percent relative to rents during the pandemic.

Investor client’s prewar condo purchased post pandemic which we rented in 2 days. Weimin’s article, Strategy of investing in distinguished prewar condos.

Why investors globally invest in Manhattan property

During the pandemic, I represented international clients in negotiating the best terms in memory. Recently, the increase in foreign demand increased even further. Manhattan and London are deemed the world’s top two cities for asset diversification and price stability. These are the world’s only two Alpha++ cities.

Key reasons high net worth individuals globally invest in Manhattan are:

(1) Asset diversification

(2) Stable price increases

(3) Low credit risk

(4) Tax breaks such as depreciation

Investing in a penthouse Manhattan apartment

When does life in Manhattan return to normal

True normalcy will come when all the shut down storefronts get occupied again. Currently, subway ridership is back to normal, tourists are back and restaurants are busier than ever. The only signs we had a pandemic are vacated storefronts and less occupied office buildings.

Weimin’s article, What does a luxury apartment in Manhattan mean?

2025: Is now a good time to invest in Manhattan property?

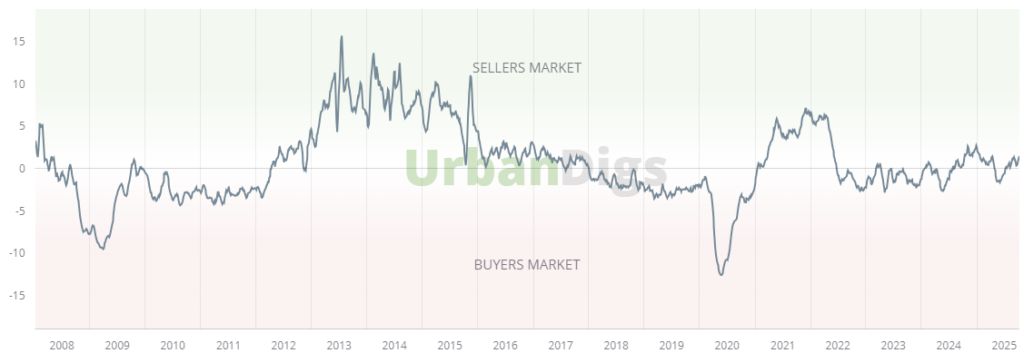

In 2021 and early 2022, we were in a seller’s market. From mid 2022 to 2023, we saw interest rate hikes which resulted in doubling of mortgage rates and have been in a buyer’s market. From 2024 onwards, we started going sideways, mainly because of high mortgage rates and this has continued to present.

Market Pulse shows we are in a Neutral Market.

Yes, it’s a good time to buy Manhattan property now, especially if you are a cash buyer and plan to rent out the property. Mortgage rates are still high but the trajectory is decreases in the future which will bring back buyers needing financing.

The stock market is at record levels despite prior concerns about the impact of tariffs. Inflation was at 3 percent as of September 2025. We are expecting reduced regulation in finance and banking. These are all positive for the Manhattan property market.

The price per sqft trend for Manhattan condos is stable appreciation in the long run. It dips during recessions but being the most valuable real estate in the world, Manhattan always recovers. Q3’2025 price per square foot at $1,998 is still lower than the 2017 peak. And sales volume increased 16 percent compared to prior year. This happened while mortgage rates are still high.

I am optimistic Manhattan is starting an upward price trend again. After almost a decade of going sideways.

Weimin’s articles, How recessions impact Manhattan property and How to buy new launch property in Manhattan

Deal example: Represented buyer in acquiring this condo at Four Seasons Downtown. We bought at a significant discount to original sale price and added a bedroom to increase value even more.

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale

Notes: This article was updated December 15, 2025

Related Articles

Parents buying apartment for child attending Columbia / NYU