How recessions impact Manhattan property

Posted by Wei Min Tan on May 4, 2022

How does a recession impact Manhattan property? Deutsche Bank recently warned of a coming recession because of high inflation, a very strong job market and spike in oil prices due to the war in Ukraine. Let’s look at reasons behind the cause for concern and at how Manhattan property performed during the past three recessions: Covid 19 of 2020, Lehman collapse of 2008 and Sept’11 2001. Finally, we’ll look at why Manhattan is such a resilient property market.

Why A Coming Recession?

The inflation rate hit 8.5 percent in March 2022, a 40-year high. This was driven by pent up demand post Covid lockdown and recently by the war in Ukraine which caused a spike in oil prices.

To combat inflation, the Fed increased interest rates, hence tightening money supply and making it more expensive to borrow. Using mortgage rates as example, the 30-year fixed rate mortgage was at 2.65 percent in Jan 2021, increased to 3.11 percent in December 2021, and in April 2022 it was at 5.10 percent. Since the U.S. GDP is driven by consumer spending, higher interest rates leads to decreased spending and hence a lower GDP.

In addition, the job market has been very strong since the reopening post Covid. The March 2022 unemployment rate was at 3.6 percent, just a tad higher than the 20-year low of 3.5 percent in Jan/Feb 2020, right before Covid hit the U.S. This is another reason the Fed is increasing interest rates, to cool down the economy.

If there is a coming recession, how will Manhattan real estate do? For that, let’s look at how Manhattan real estate performed during the past three recessions: the Covid-19 Recession of 2020, the Lehman collapse of 2008 and the Sept 11 attacks of 2001.

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

The Covid-19 Recession

The Manhattan property market experienced a slowdown from 2017 to 2019. In the first two months of 2020, sales volume jumped and it appeared as if the market was starting to recover. Then in March 2020, COVID-19 hit New York City at unprecedented levels. NYC became the Covid hotspot of the U.S. The real estate market was shut down from March 2020 to June 2020.

Was it the end of big city living? The sale market came to a standstill. Rental prices slumped 25 to 30 percent as tenants moved out of NYC due to the logistical flexibility of work-from-home. For the sale market, the bottom was between May to July 2020 when it was a true buyer’s market. Supply hit a high of about 9,500 units in Q4’2020. After the market reopened in July 2020, the real estate industry slowly resumed amid a lot of new protocols. eg Covid forms, very limited showings.

By late Oct/Nov 2020, the market recovery started – inventory started decreasing while contracts in pipeline started growing. By early 2021 it became a seller’s market because of low interest rates, limited supply, pent up demand and people moving back into NYC.

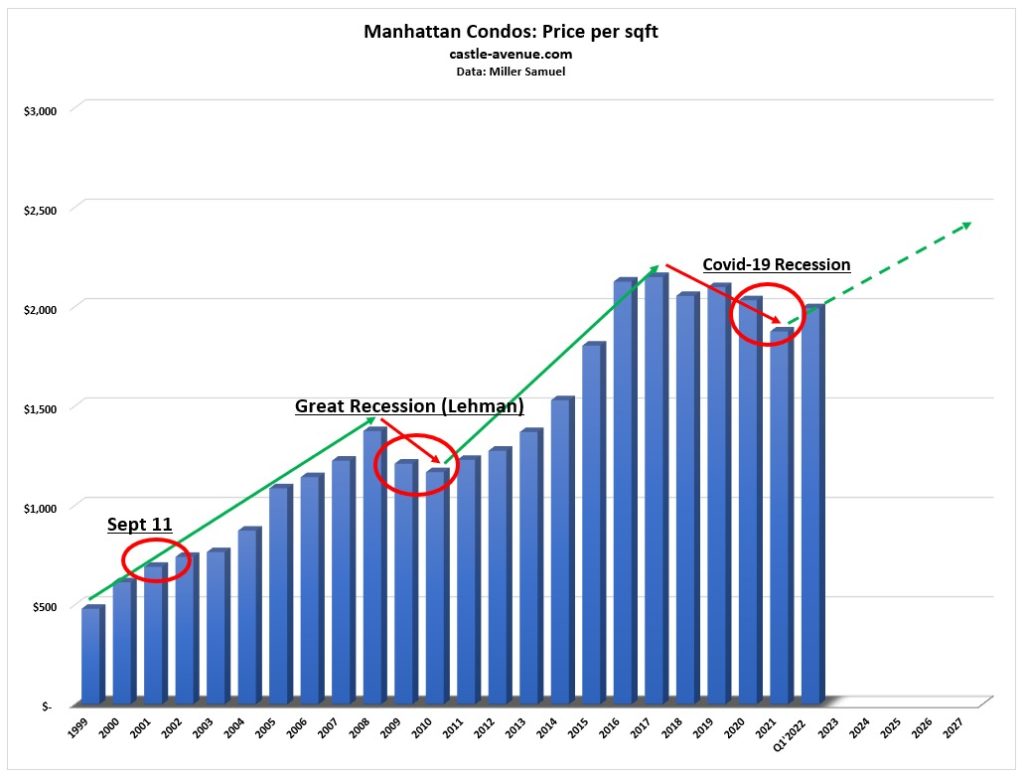

The condo price per sqft peak was $2,149 in 2017. In 2020 (Covid year), price per sqft was down 3 percent, and in 2021 it was down another 8 percent to $1,875. While the bottom in terms of buyers getting maximum advantage was May – July 2020, the published price per sqft bottom was $1,714 in Q1’2021. This was because of delayed 2020 closings, and Q1’2021 reflected contracts entered into in late 2020. By Q4’2021 price per sqft was back up to $1,989.

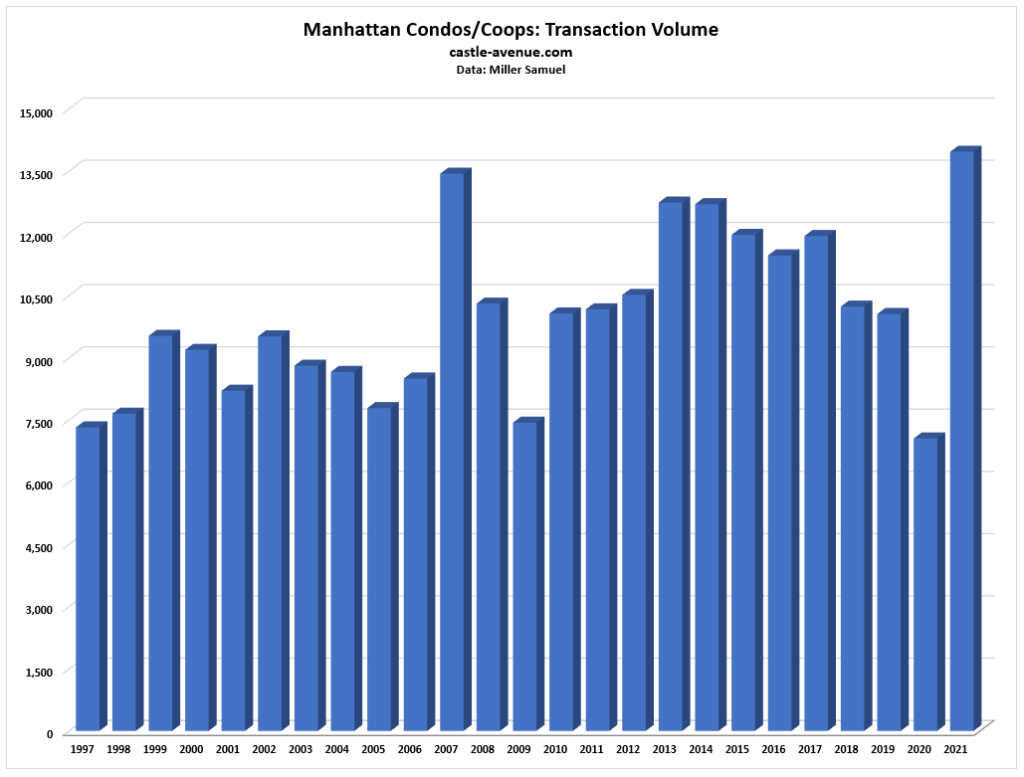

The most recent Q1’2022 price per sqft was at $1,992. Sales volume for the overall coop/condo market was the highest ever recorded in 2021, surpassing 2007. For buyers, prices are still lower than the peak of 2017. The challenge is securing a good property as supply is at a low of around 6,000 units (vs the 9,500 peak in late 2020).

2021 had the highest sales volume ever recorded in 32 years

Deal example: Client’s three-bedroom apartment purchased post Covid reopening. We anticipated strong demand for larger apartments as people wanted more space. Rented out in 1 week.

Read Weimin’s article, How to buy Manhattan property to rent out

The Great Recession (Lehman)

In Manhattan, the Great Recession is commonly referred to as “Lehman” because this was when Lehman Brothers, one of the world’s largest investment banks, collapsed in September 2008. While the Great Recession started in Dec 2007, we thought Manhattan was immune to it because prices in Manhattan didn’t drop until 2 years later, in 2009. That was the year I became a real estate broker.

In 2009, Manhattan condominium sales volume dropped 30 percent to 4,029 transactions, from 5,713 transactions in 2008. Sales activity peaked in 2007 when there were 6,969 transactions. In 2009, price per square foot of a Manhattan condo dropped 12 percent to $1,210. Median price dropped a commensurate 13 percent to $1.05 million. In 2010, Manhattan condo price per square foot dropped another 4 percent. Price recovery started two years later in 2011 when prices were up 5%. That was also the beginning of the boom cycle which lasted from 2011 to 2017. Prices reached $2,149 per square foot in 2017.

Lehman had a major impact on Manhattan because it affected a lot of high paying finance jobs. Bear Stearns, also a major investment bank, failed. The insurance giant AIG had to be bailed out. Manhattan is home to many financial services professionals affected by Lehman. Unlike rest of the U.S., Manhattan didn’t see many subprime defaults and foreclosures because homeowners in Manhattan have higher income and credit, not the subprime category of homeowners. Also, the nature of Cooperatives, representing 75 percent of apartments in Manhattan, require substantial financial liquidity from buyers. This played a big role in ensuring Manhattan home buyers were not over-leveraged.

Deal Example: View from client’s apartment negotiated during Covid lockdown, when uncertainty and fear was at the highest. We got great terms and recently increased rent significantly as the rental market surged to the highest levels ever.

Read Weimin’s article, Benefits and Risks of Investing in Manhattan Property

Sept 11’2001

Right after September 11, the Manhattan property market froze. Nobody wanted to be downtown because of the 3 months of smoke/haze continually coming out of the World Trade Center site. Neighborhoods like Battery Park, Tribeca and Soho had zero activity.

By the way, Tribeca in 2001 was nowhere like today’s Tribeca. Miller Samuel’s Jonathan Miller, the data guru of New York property, said that after the Federal Reserve decreased interest rates and mortgage rates fell, the surge in demand came back, 5 weeks after the attacks. The Manhattan recovery post 9/11 was driven by entry level home buyers. Miller mentioned that in one example, a one-bedroom in midtown had a five-way bidding war!

Manhattan condo prices were up 13 percent from 2000 ($613 per square foot) to 2001 ($691 per square foot). In 2002, prices went up another 7 percent to $741 per square foot. Median prices of a Manhattan condo showed a similar trend, increasing 9 percent and 5 percent in 2001 and 2002 respectively.

Read Weimin’s article, Manhattan property investment performance

Deal Example: The Sutton, Turtle Bay, Midtown East. This Toll Brothers development only required 10 percent reservation deposit. Represented multiple buyers at the $2 million price point. Location, classic style windows and luxury finishes make this a good investment. Close to United Nations, Citigroup Center, Blackstone, Blackrock. Rented at premium rents from the beginning.

Why Is Manhattan So Resilient?

The Manhattan market is so resilient because of three key reasons:

Top tier international city: There is only one Manhattan, with its diversity, international ambiance, culture, entertainment and food. So many people moved out of Manhattan in 2020. In my building, 70 percent moved out of Manhattan during 2020. But they all came back after realizing nowhere else can compare. People moving back is a key reason why the sales and rental markets are so hot currently. It wasn’t the end of city living, history proved this repeatedly during past pandemics.

Limited supply: Manhattan is a landlocked island where only 10 percent of inventory are condominiums where the buyer will own title to the apartment and there is no restriction on renting out. 70 percent are rental or mixed use buildings where one needs to buy the whole building (and not individual apartments). The other 20 percent are cooperatives which require board approval and has limitations on renting out.

Financial and Technology Center: Google and Facebook have been expanding in Manhattan, and Facebook is now Manhattan’s largest corporate tenant. Google expanded to a second campus in Hudson Square and purchased a $2.1 billion building there while occupying two other buildings. Facebook took over an entire block of office space close to Hudson Yards. Top companies require access to top talent and Manhattan has that.

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale

Follow On Instagram