Best size investment apartment to rent out in NYC

Posted by Wei Min Tan on April 23, 2025

Best size investment apartment to rent out in NYC — The size of condo apartments for investment in Manhattan range from a studio to 4-bedroom+. Global investors usually buy apartments in Manhattan to rent out as a form of diversification. Our role as a buyer’s broker is to advise clients on what is the right apartment, and we go through the process of identifying what’s a good buy.

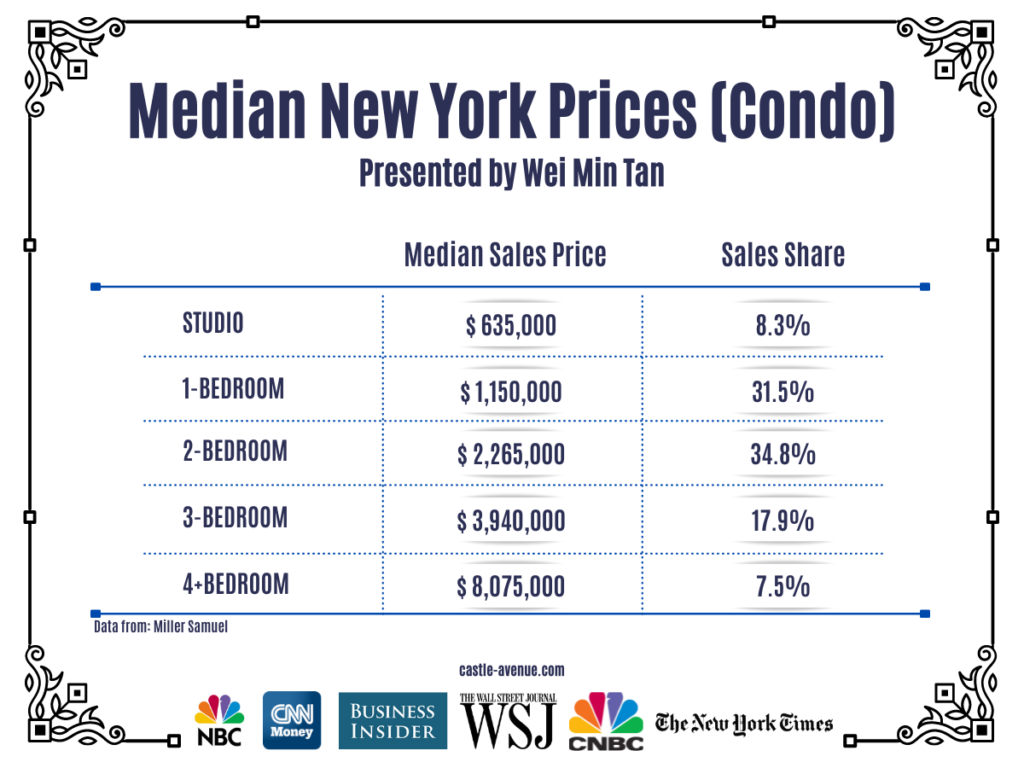

The median sales price for a studio and one-bedroom apartment are $635,000 and $1.15 million respectively. Meanwhile, a larger apartment, generally a two or 3-bedroom, ranges from $2.2 million to $3.9 million. Anything that is 4-bedroom and above is considered a mansion by Manhattan standards. People don’t usually buy a 4-bedroom+ apartment to rent out, but rather to live in or to use as a vacation home or pied-a-terre.

Weimin’s article: Buying a vacation or second home in Manhattan

The most important factors that we look at when choosing the best apartment are the location, the building and the layout. We want to ensure that there will be rental demand after the purchase and we can secure a good tenant for the investor client.

Deal example: Client’s water view apartment that looks out to New York Harbor.

Studios and 1-bedroom

Studios and 1-bedrooms are entry-level apartments. In terms of studios, there’s not much to choose from because there are not many studios in luxury buildings that have good rental returns. We tend to recommend clients to invest in luxury buildings because luxury buildings command premium rents. For example, plenty of studios in Midtown East or Midtown West are in non-luxury buildings, and they do not command high rents. These apartments also have low rental yield.

Pricing for 1-bedrooms range from $800,000 to $2 million. The sweet spot for 1-bedrooms is between $1.2 million to $1.8 million. This is where you get the most options in terms of highly desirable buildings and apartment lines within the buildings. There are definitely 1-bedrooms at less than a million, but those are usually in non-luxury buildings. The rent they get will be much lower as well.

Weimin’s article: New York Apartment Prices

Two and three bedrooms

Since the Covid-19 pandemic, demand for larger apartments, as in two and 3-bedrooms, has increased a lot. This is because people want more space, as many are working from home either part-time or full time. There has been an uptick in rental demand for 2 and 3-bedrooms.

Having a 3-bedroom investment condo is a prized asset because of high demand and low inventory. As result of 40-year high inflation, rents have increased a lot. The current average rent in Manhattan is about $5,400. A two-bedroom in a luxury building used to be $7,000 to $8,000, now they are about $10,000 to $12,000. For three-bedrooms, rents are now from $17,000 to $25,000.

Weimin’s article: Investing in large 3-bedroom apartment to rent out in Manhattan New York

Deal example: Client’s 3-bedroom condo that rented out in 1 week.

Look at location, building, layout

The first buying driver we look at is location, whether the location has strong demand for studio, 1-bedroom, 2-bedroom or 3-bedroom. Secondly, we look at the building. The building must have strong demand, and one way to easily look at this is to look at the number of units for sale and for rent.

Lastly, we look at the layout of the apartment, and it has to be clean and practical. Layout also includes exposure of the unit. Since buildings in Manhattan are all side by side, there’s usually a preferred exposure, which means facing outside. For example, if facing outside in a building means facing North, then the South exposure would be facing inside, which means it stares at the building behind.

Selecting the right apartment is both science and art. Science because it’s driven by numbers and art because it’s based on experience of what the market wants, what will rent out fast and at premium rents.

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale

Follow On Instagram