Manhattan Property Market Update

Posted by Wei Min Tan on January 21, 2026

The Manhattan property market is one of the most prized property markets in the world. Our clients invest in Manhattan property for asset diversification and price stability. Manhattan is a prime market where prices are high, appreciation is stable and rental yields are low but predictable. Foreigners investing in Manhattan, New York property is a normal and daily event. There are no additional stamp duties imposed on foreign buyers.

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

Key points of this Manhattan Property Market Update

Sales volume: Condo sales volume was 3.4 percent higher than prior year. Overall transaction volume in 2025 jumped as mortgage rates decreased.

Cash buyers: The market share of cash buyers in Q4’2025 was at 74 percent, the highest ever recorded.

Price per sqft and median price: In the condo market, price per sqft is at $2,099 while median price at $1.661 million.

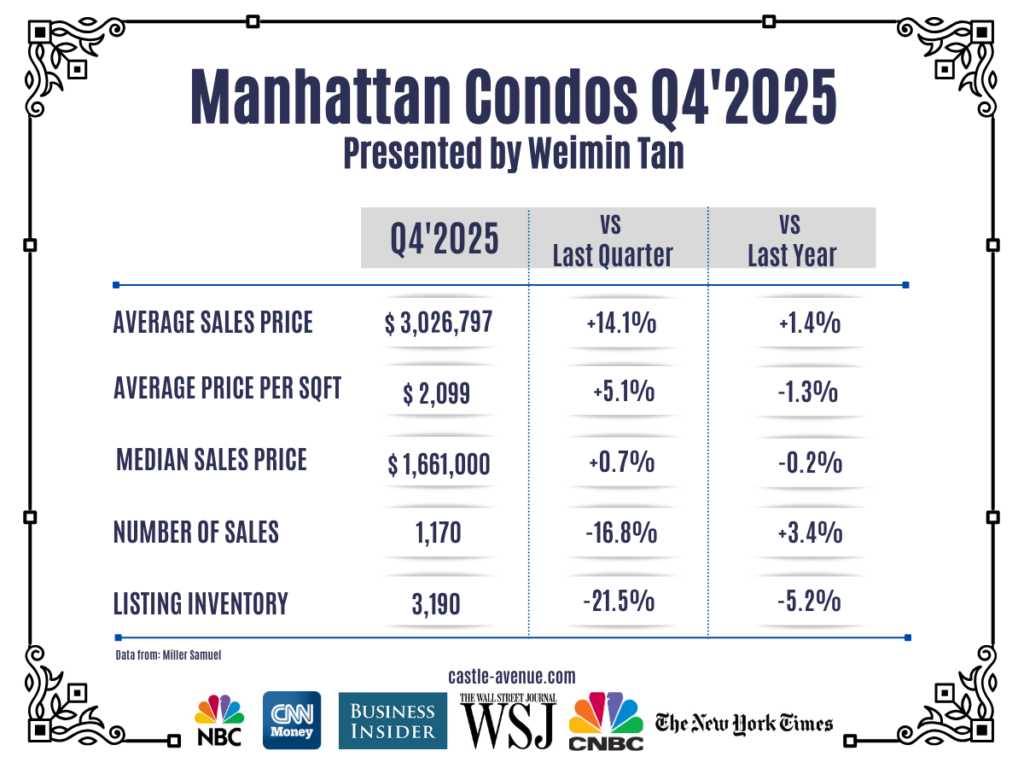

Manhattan Condo Market’s Key Metrics

The most recent Q4’2025 data from Miller Samuel shows average price per square foot for a Manhattan condo at $2,099. This is a 1.3 percent decrease compared to prior year. Number of sales was at 1,170, a 3.4 percent increase from a year ago. Median sales price was at $1.661 million, or 0.2 percent lower than a year ago.

Read Wei Min’s article: New York (Manhattan) Property Investing Strategies

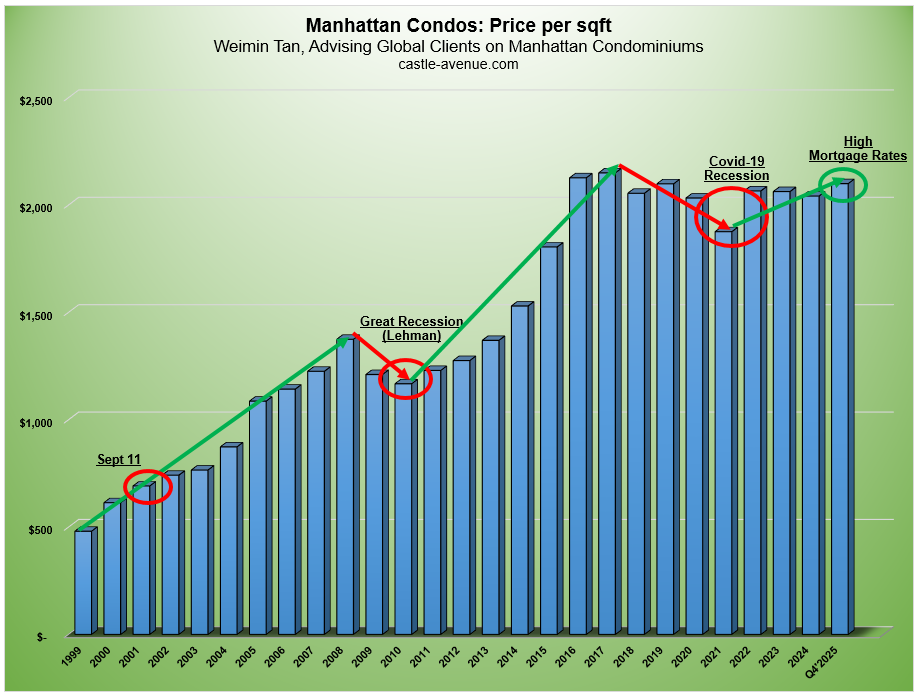

Manhattan Condo Historical Price Trend

Data: Miller Samuel

The chart above shows the historical appreciation trend for Manhattan condos, with significant events circled in red. Prices tend to appreciate over the long term, with dips during recessions. Price per square foot was $480 in 1999, increasing to $2,099 in Q4’2025.

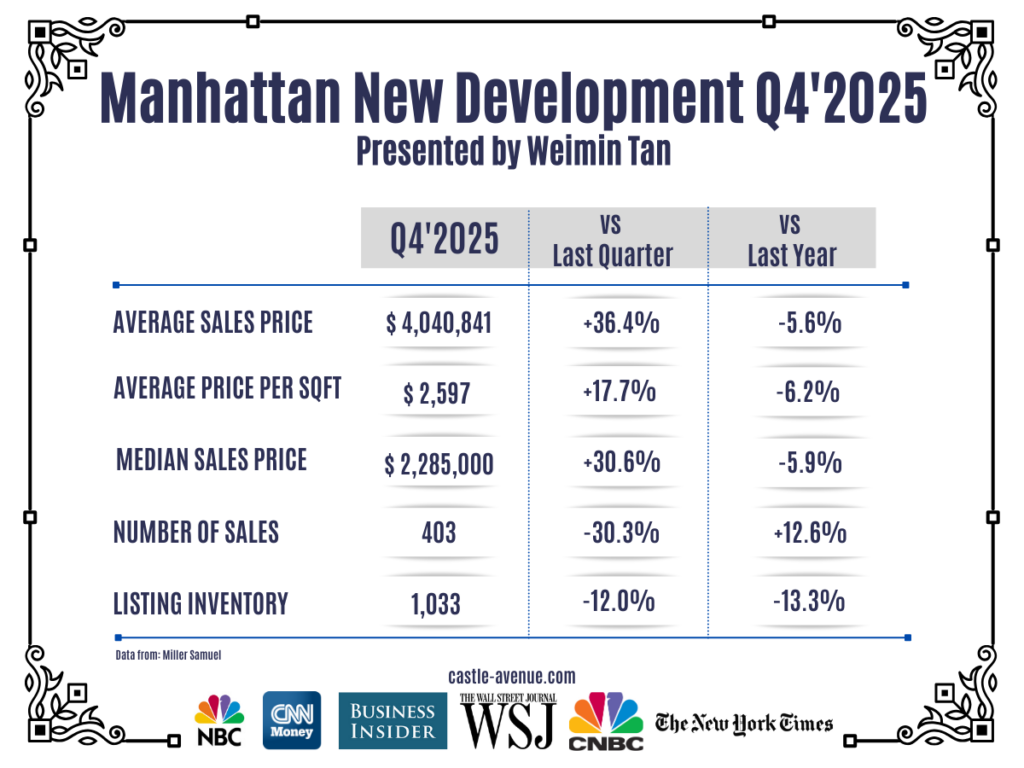

Prices at New Developments

New developments refer to buying a brand-new property from the developer. These are usually sold 1–2 years before completion. The buyer puts down a reservation deposit, waits for construction, and balance is due at eventual completion. The average sales price of a new development was $4 million, 5.6 percent lower than a year ago. Number of sales was 403, or 12.6 percent higher than a year ago.

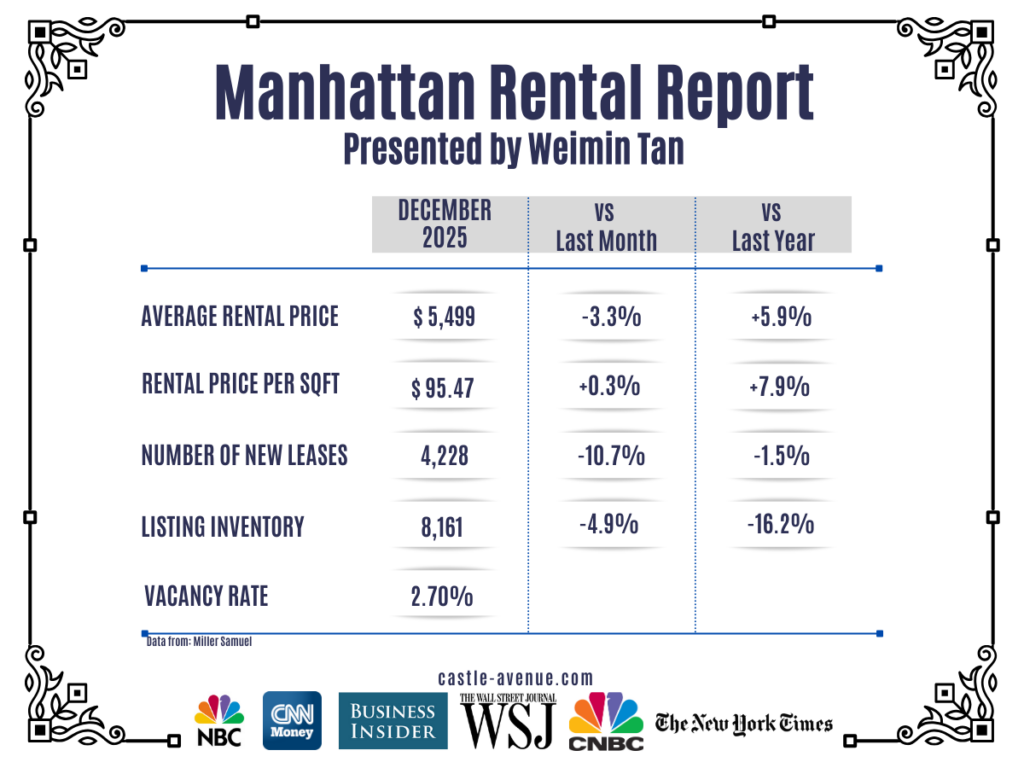

Manhattan Rental Prices

The most recent December 2025 data shows average rental price at $5,499, or 5.9 percent higher than prior year. Number of new leases was 4,228, 1.5 percent lower than a year ago. Manhattan has perhaps the lowest residential vacancy rate in the U.S., at 2.7 percent.

Read Wei Min’s article: Foreigner Buying Property in New York, 8 Questions That Matter

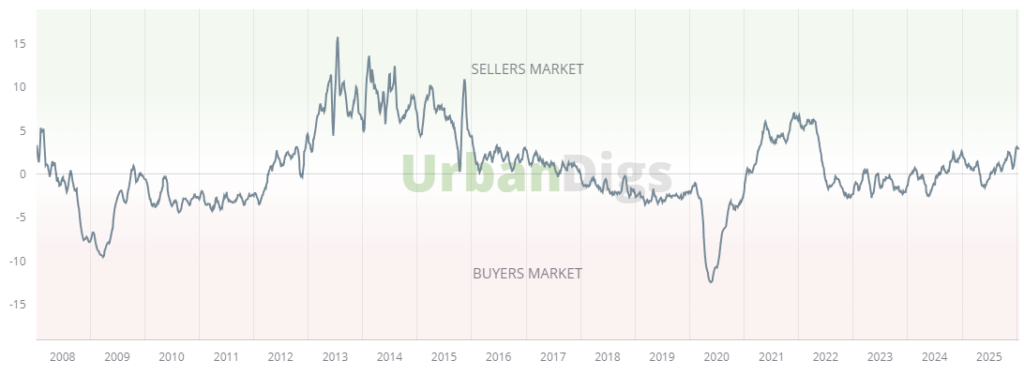

Is now a buyer’s market or seller’s market?

We are currently in a slight seller’s market as shown in the chart above. The two most significant buyer’s markets were during the Lehman collapse in 2008/2009 and Covid, which hit Manhattan in early 2020.

Read Wei Min’s article: Buying property in New York to rent out

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale