New York Property Report

Posted by Wei Min Tan on January 23, 2026

New York property report: Manhattan residential condominium market

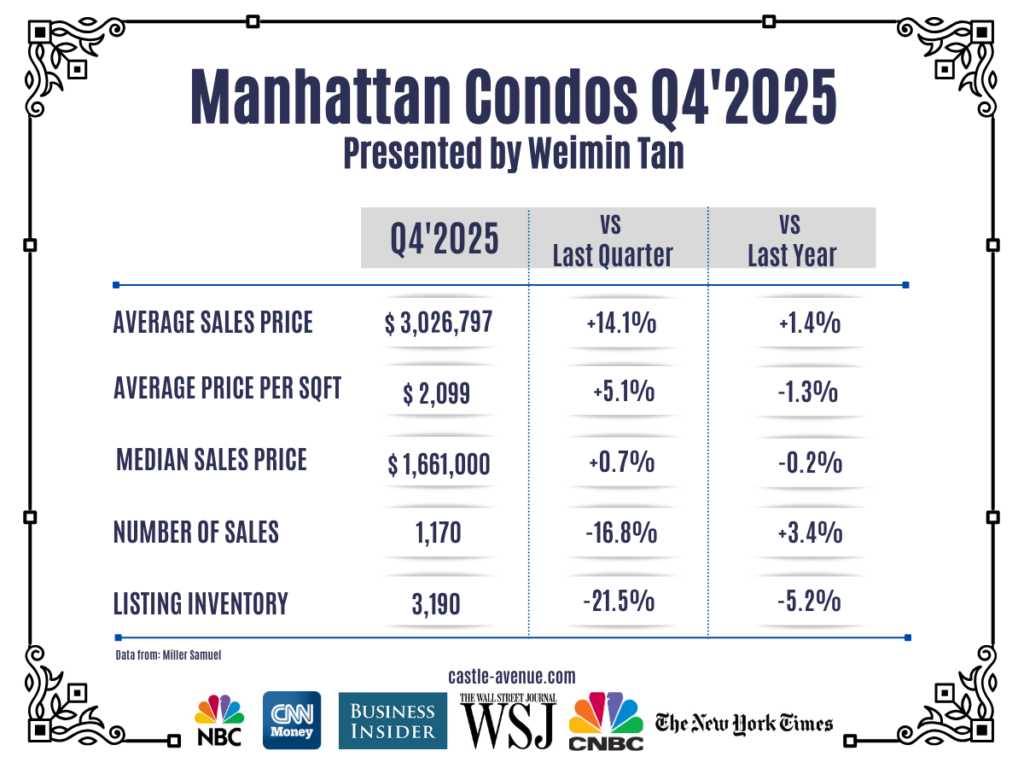

Key Point 1: Sales volume up 3.4 percent

In Q4, 2025, sales volume was up 3.4 percent compared to Q4, 2024. This is welcome news in this market characterized by still-high mortgage rates and low supply. While the Fed has been cutting interest rates, mortgage rates are still at 6+ percent, sidelining a lot of potential buyers who became renters instead. Meanwhile, supply is low because sellers are holding off on selling and opting to keep their locked in low mortgage rate instead of getting a new higher mortgage if they buy.

Currently, the national average 30-year mortgage rate is around 6.1 percent. For context, in early 2022 it was around 3.5 percent.

Contact: tan@castle-avenue.com

Weimin’s article, New York historical condo price trend

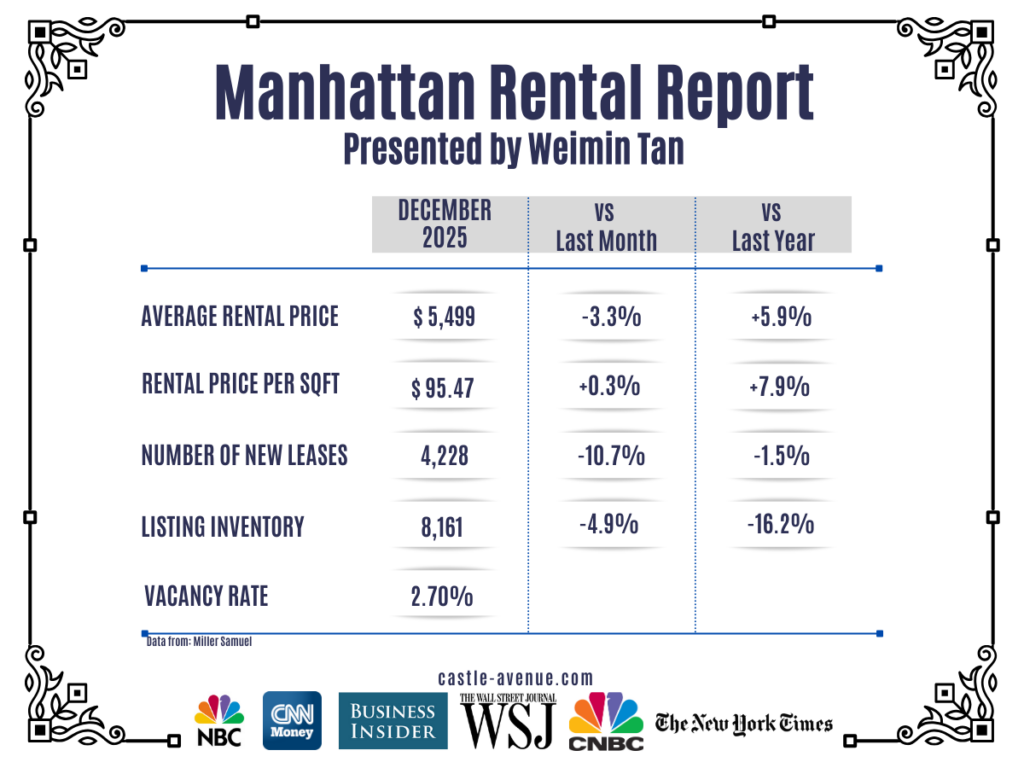

Key Point 2: High rents

Rental expense is about 30 percent of the inflation index. With inflation that peaked at 9 percent about 2 years ago, rents commensurately increased. Further, there is added demand from buyers who became renters as a result of high mortgage rates. In December 2025, average rent was at $5,499 while vacancy rate was 2.7 percent.

Deal Example: Investor client’s condo at Devonshire House, one of Manhattan’s distinguished prewar condos designed by Emery Roth. Rented out in 2 days after receiving multiple applications. This was our prewar condo investment strategy and it worked out tremendously well.

Key Point 3: Buying for price stability and yield

All cash buyers who are buying to rent out have the advantage. This is because they are not exposed to high mortgage rates and are not competing with buyers needing a mortgage who have since converted to being renters. The market can be summarized as follows:

1) Cash buyers have better negotiating position.

2) Investors can expect strong rents and rental yields.

3) Preferred lines in high demand condos are selling fast. Meanwhile, in lower demand buildings, listings can sit for a long time if sellers don’t price correctly.

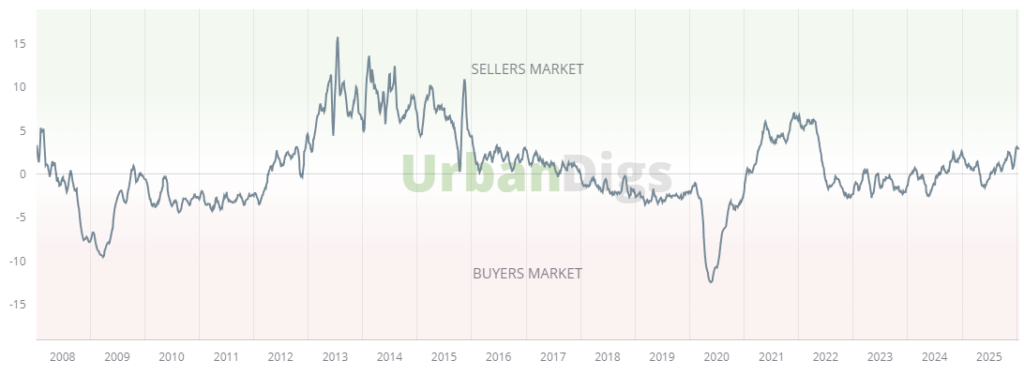

Market pulse below shows we are in a seller’s market.

Deal Example (below): Client’s condo in West Village’s top prewar building, 299 W 12 St. Notice the beamed ceiling, fireplace and southern view of World Trade Center. We received top rents at $115 per sqft.

Weimin’s article, Investing in a Manhattan penthouse apartment

Deal Example: Client’s condo in Midtown East, close to Blackstone, Blackrock, United Nations. We booked at pre-construction, rented out immediately after closing.

Weimin’s article, Buying a vacation home in Manhattan

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale

Follow On Instagram

Related Links

Best Manhattan Property Agents