October 2022 Manhattan Property Market Update

Posted by Wei Min Tan on October 19, 2022

October 2022 Manhattan Property Market Update

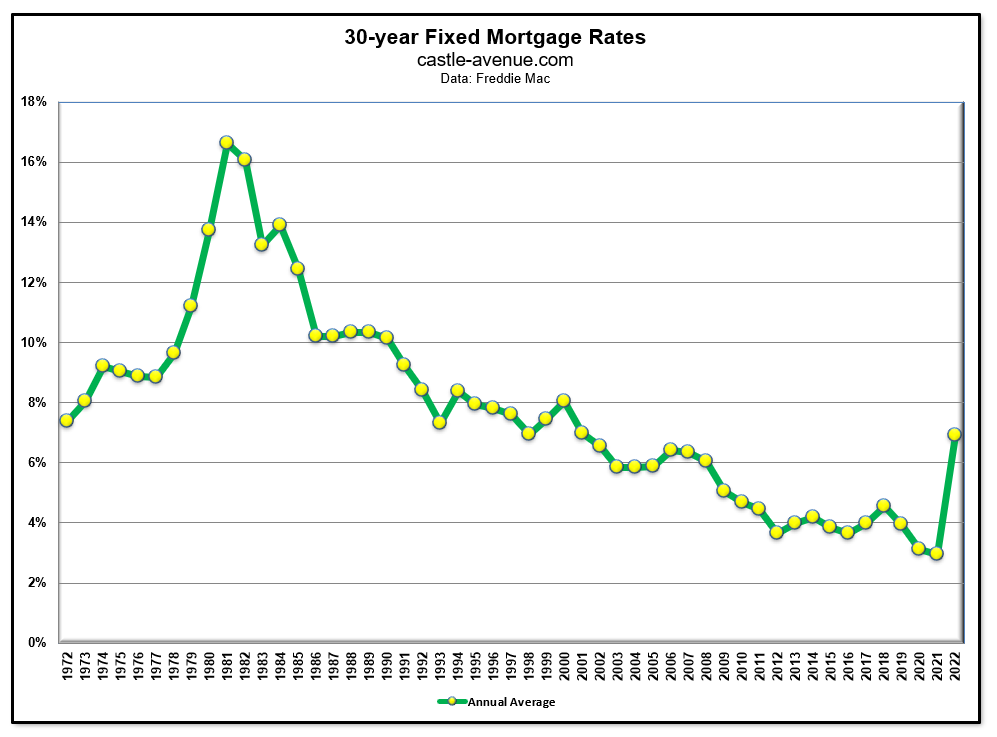

Key point #1: Sales down because of spike in mortgage rates

Despite multiple 0.75 percentage point rate hikes by the Federal Reserve, overall inflation in September remains high at 8.2 percent. More importantly, September’s core inflation, which excludes volatile food and energy prices, was up 6.6 percent, the fastest pace of increase since August 1982. As such, the market expects the Federal Reserve to increase interest rates again by 0.75 percentage points at the next Fed meeting.

Commensurately, mortgage rates have been going up. The 30-year mortgage reached 7 percent, compared to 3 percent a year ago (refer chart above). This has decreased Manhattan’s property sale volume drastically. Q3’2022 sales volume was down 24 percent compared to last year because of mortgage rates.

Read Wei Min’s article: How inflation impacts Manhattan property

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

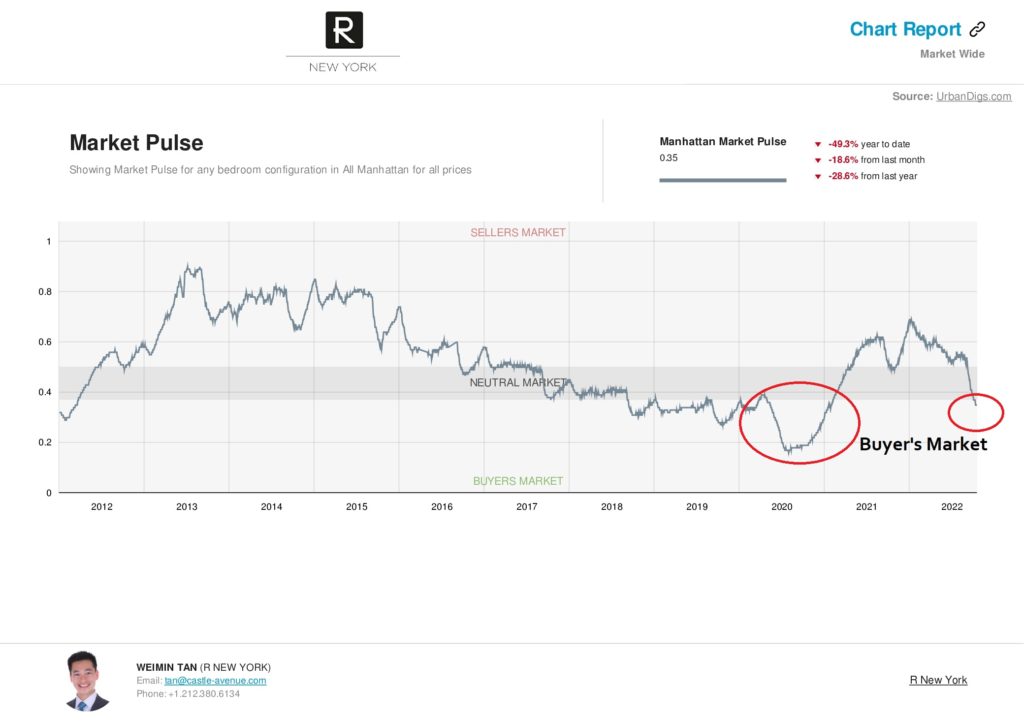

Key point #2: Buyer’s market favoring all-cash buyers

We are officially in a buyer’s market. The last buyer’s market was right after Covid reopening in 2020. About 50 percent of Manhattan buyers require mortgage financing, and this segment has turned away from buying. Understandably because monthly mortgage payment has increased dramatically. Cash buyers currently have significant leverage in negotiating a good deal.

Meanwhile, discount to asking price is increasing because of the market slowdown. The chart below from Urbandigs shows that as of the most recent July data, the percentage of sales with over 10 percent discount (the red line) is increasing, while sales with under 2 percent discount (the blue line) is decreasing. Sellers are more negotiable now given that the buyers that require mortgage financing disappeared.

Read Wei Min’s article: Manhattan, New York Property Historical Price Trends

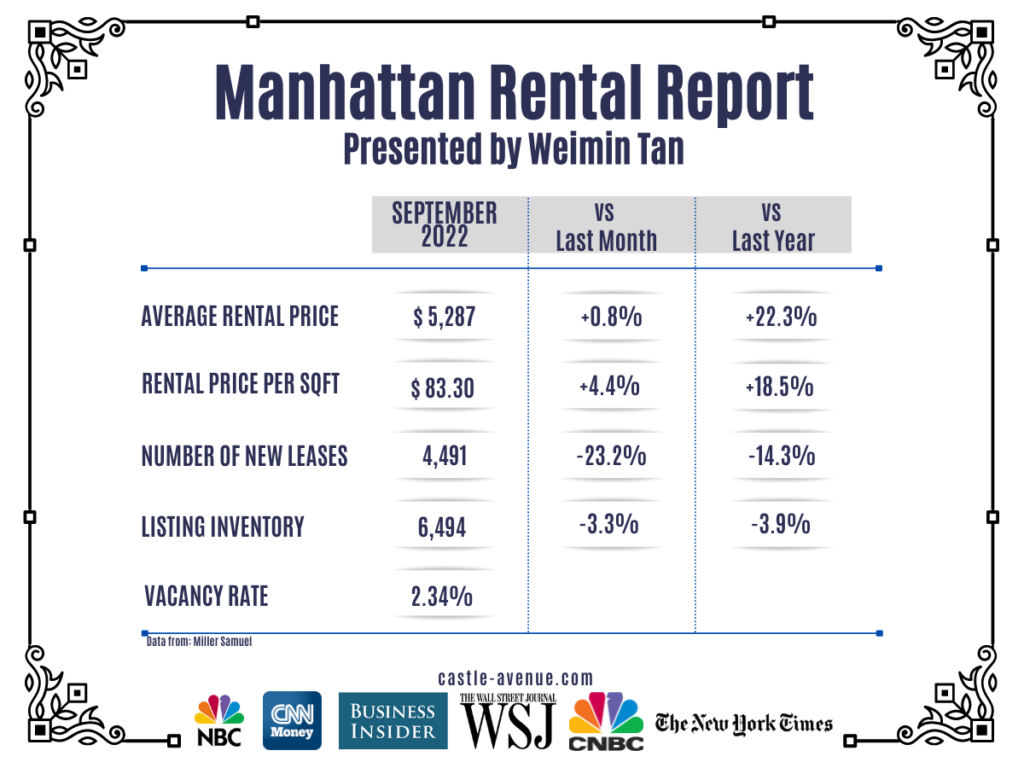

Key point #3: Rents keep breaking records

Table below shows September average rent at $5,287, or 22.3 percent higher than a year ago. This is because of (i) inflation and (ii) demand coming from potential buyers who decided to continue renting given the high mortgage rates.

Back in June 2022, the average Manhattan rent hit $5,000 for the first time and this was all over the news. Since then, rents continued to go up and each month broke the prior month’s record. For cash buyers who intend to rent out the condo, now is perhaps the best time to get into the market.

Read Wei Min’s article: Buying property in New York to rent out

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale