How inflation impacts Manhattan property

Posted by Wei Min Tan on October 11, 2022

The Manhattan property market suffered from Covid in 2020 and became a buyer’s market. In 2021, Manhattan rebounded and sales volume in 2021 was the highest ever recorded. Now in 2022, we are again in a buyer’s market because of inflation. Inflation led to the Federal Reserve increasing interest rates, which led to more than doubling of mortgage rates.

Read Wei Min’s article: Mortgage rates softens Manhattan property market

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

Sales volume down 24 percent

Currently, the national average 30-year mortgage is 7 percent. A year ago, it was around 3 percent. A lot of potential buyers who need a mortgage became renters because the monthly payment with a mortgage increased substantially. Roughly 50 percent of the Manhattan buyer pool use financing, while the other 50 percent are cash buyers. Suddenly, half of the buyers are gone – because of 7 percent mortgage rates.

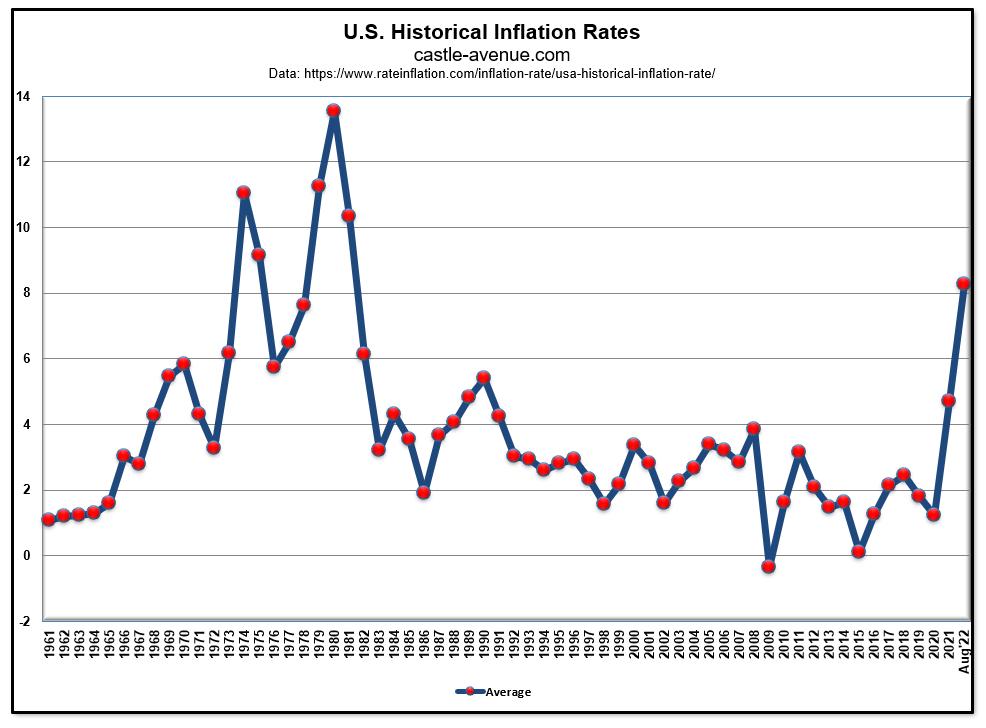

Inflation is at 40-year high which led to higher borrowing costs overall. Mortgage rates is now at 7 percent, compared to 3 percent a year ago.

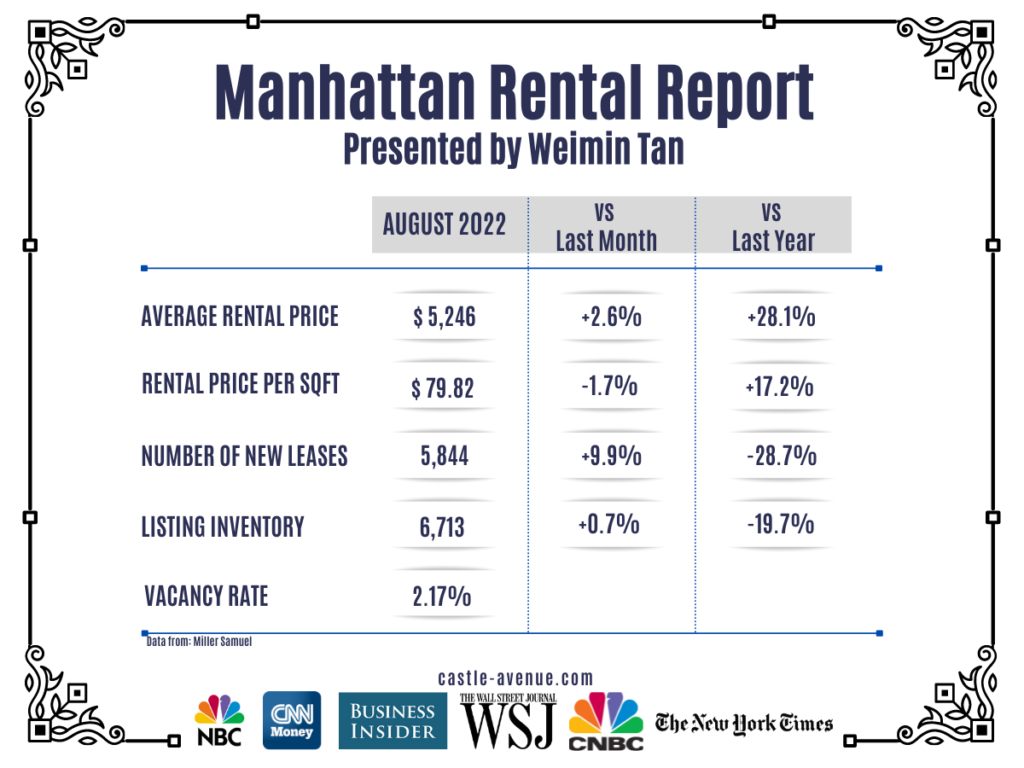

Rents up 28 percent

Meanwhile, inflation is causing rents to increase. In August 2022, the average rent in Manhattan was $5,246 or 28 percent higher than a year ago. The increase in rents is driven by inflation and rental demand coming from people who originally wanted to buy.

Read Weimin’s article: New York Apartment Prices Q3, 2022

Deal example: Investor client’s two-bedroom condo looking out to new Google downtown campus. Rents have increased substantially.

What is the opportunity

Price per sqft in Q3’2022 was $2,080, down 2.4 percent compared to prior quarter but up 10.6 percent compared to a year ago. I expect prices in Manhattan to drop 5 percent because of inflation/mortgage rates. During Covid, Manhattan prices came down 9 percent, and during the Lehman collapse in 2008, prices were down about 10 percent as well. It takes a major recession for prices to drop with Manhattan condos. One reason is the supply of condos is only 10 percent of residential inventory. Very little supply, but demand is global.

The opportunity goes to the all-cash buyer, who will be able to negotiate on both price and terms. With new developments, developers are negotiating again (which they don’t do in a normal market). Since rents are at an all-time high, investors will benefit from higher rental yields. There is negotiability in price and big upside with rental income.

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale