Mortgage rates softens Manhattan property market

Posted by Wei Min Tan on September 27, 2022

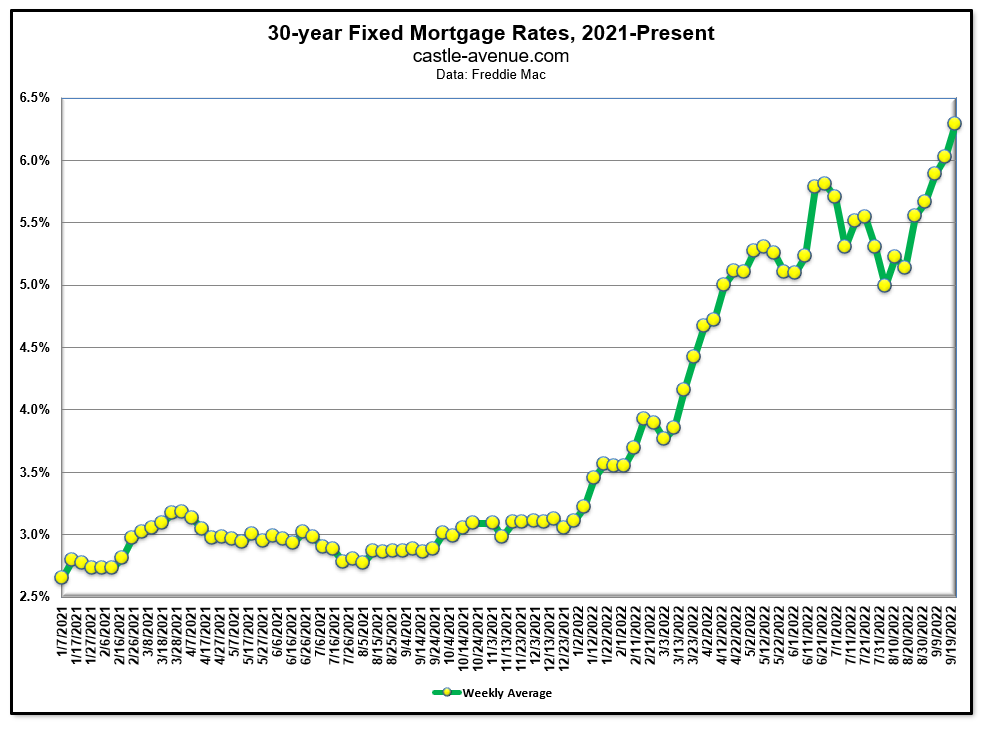

The Manhattan property market has slowed significantly due to increasing mortgage rates. Today’s Wall Street Journal shows the 30-year mortgage rate at 6.67 percent. For context, the 30-year rate was at 3.01 percent a year ago in September 2021.

Read Wei Min’s article: Is now a good time to invest in Manhattan, New York residential property?

The increase in mortgage rates is related to the 40-year high inflation that the U.S. is experiencing. To tame inflation and avoid a recession, the Federal Reserve increased the federal funds rate by 0.75 percentage points at each of the last three FOMC meetings. This increases overall borrowing costs. In August, inflation was at 8.3 percent, down from 9.1 percent in June and 8.5 percent in July.

How is this impacting Manhattan property?

Chart data: Jan 1, 2021 through Sept 19, 2022

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

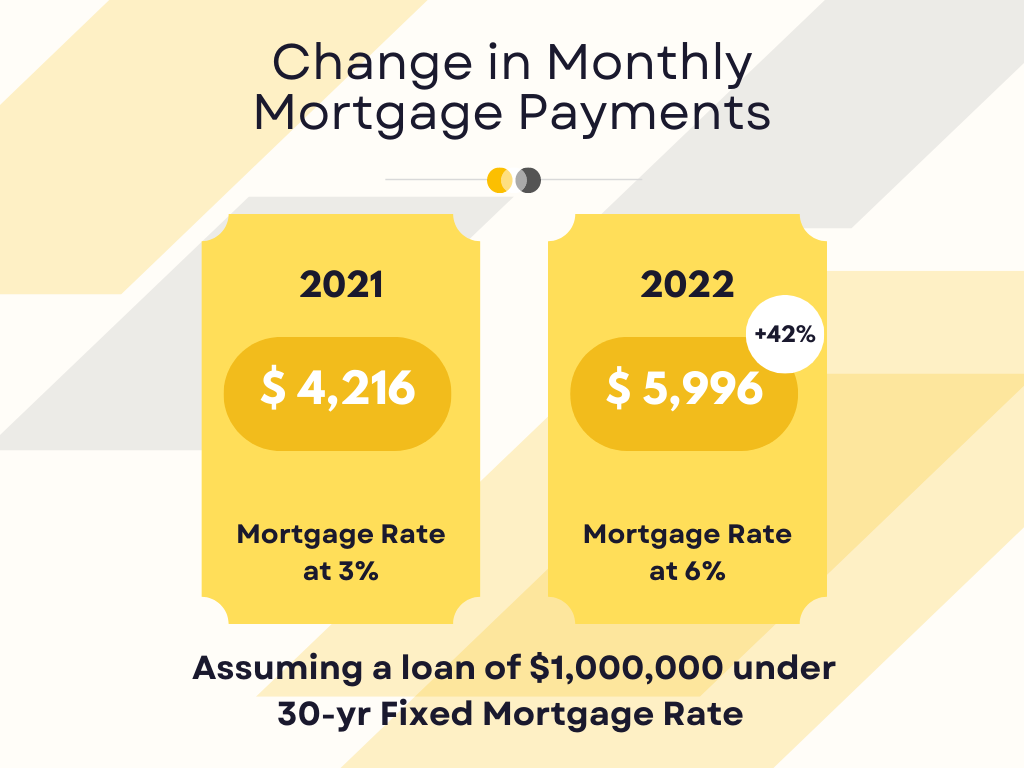

Buying becomes more expensive for buyers needing mortgage financing

About 50 percent of Manhattan real estate buyers need mortgage financing. The doubling of mortgage rates from a year ago means that monthly mortgage payment is now a lot higher. For example, at a 3 percent mortgage rate, the monthly principal and interest payment on a $1 million loan is $4,216. At a 6 percent mortgage rate, the monthly payment is $5,996, or 42 percent higher.

Read Wei Min’s article: Investing in NYC Real Estate

Buyers became renters

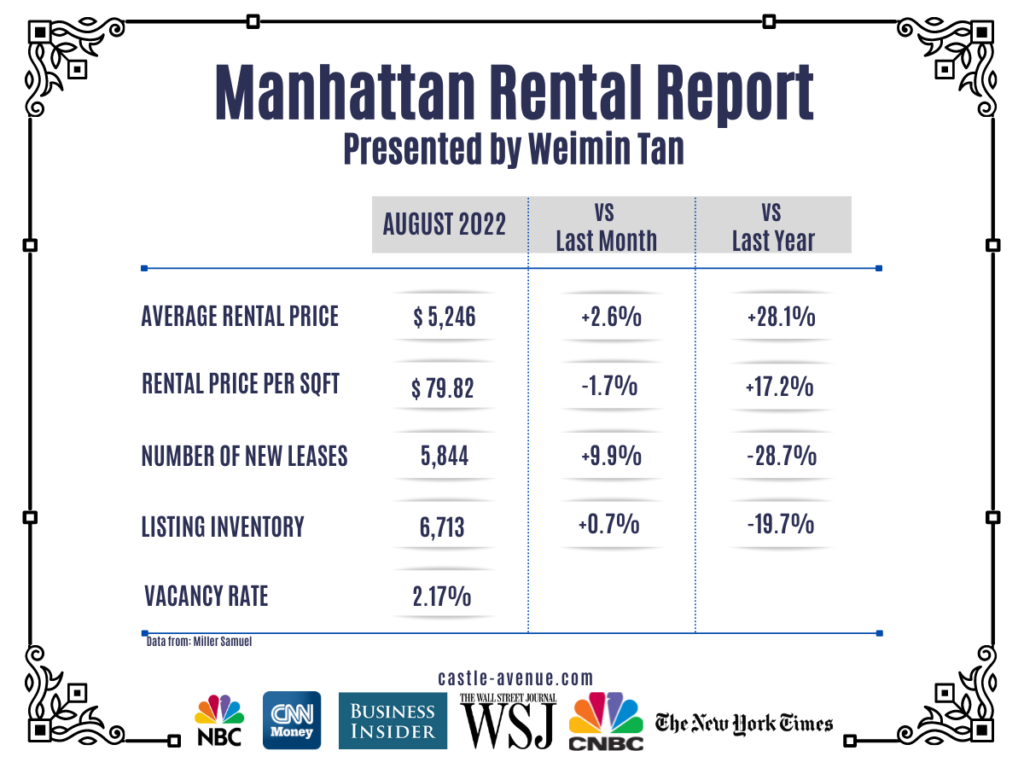

This has converted a lot of would-be buyers into renters. In the process, increasing demand for rental inventory in an inflationary environment where rents are already at all-time highs.

Rental prices hit historical highs

Inflation, increased demand from buyers who became renters and limited inventory are all driving up rental prices to record levels. In August 2022, the average Manhattan rent was $5,246, or 28.1 percent higher than a year ago. Listing inventory was at 6,713, a 19.7 percent drop compared to the same period last year.

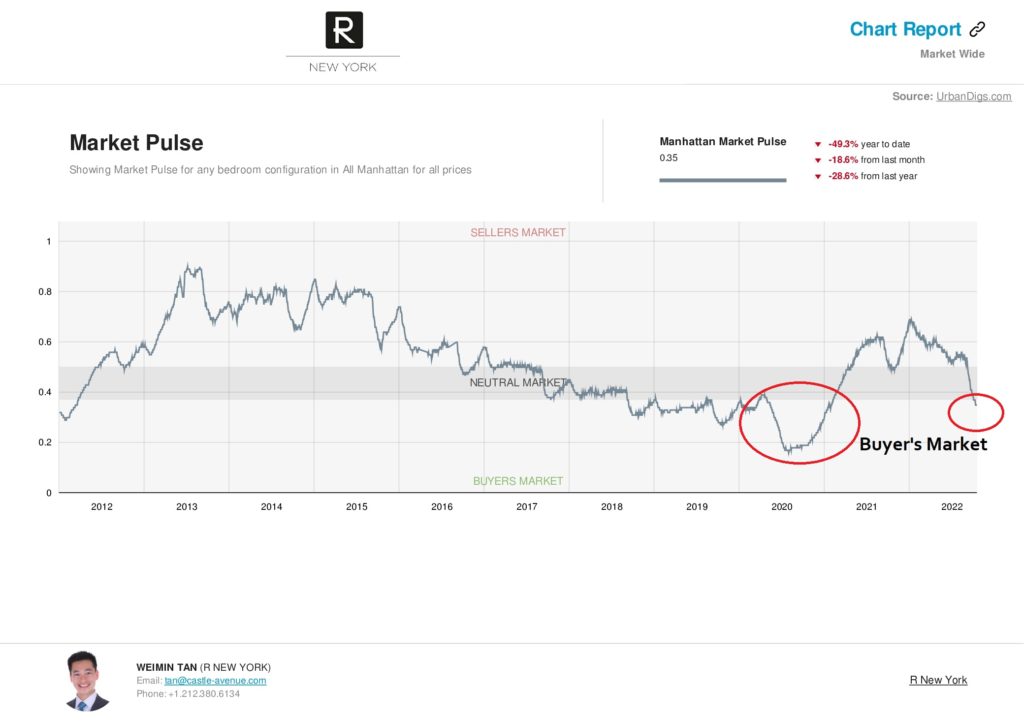

Buyer’s Market

As a result, the Manhattan real estate market is now favoring buyers – a Buyer’s Market. The advantage goes to the all-cash buyer who does not need mortgage financing and hence protected from the high mortgage rates. The cash buyer is in a strong position to negotiate both price and terms. What a change a year has made. Last year, in 2021, it was a total seller’s market with the highest sales volume ever recorded. Now the market softened so much that we’re in a buyer’s market.

Read Wei Min’s article: September 2022 Manhattan Property Market Update

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale