September 2022 Manhattan Property Market Update

Posted by Wei Min Tan on September 14, 2022

Key points for the September 2022 Manhattan Property Market Update:

- Inflation at 8.3% and mortgage rates continue to increase

- Buyer’s market

- Record high rental market

Key point #1: Inflation and mortgage rates

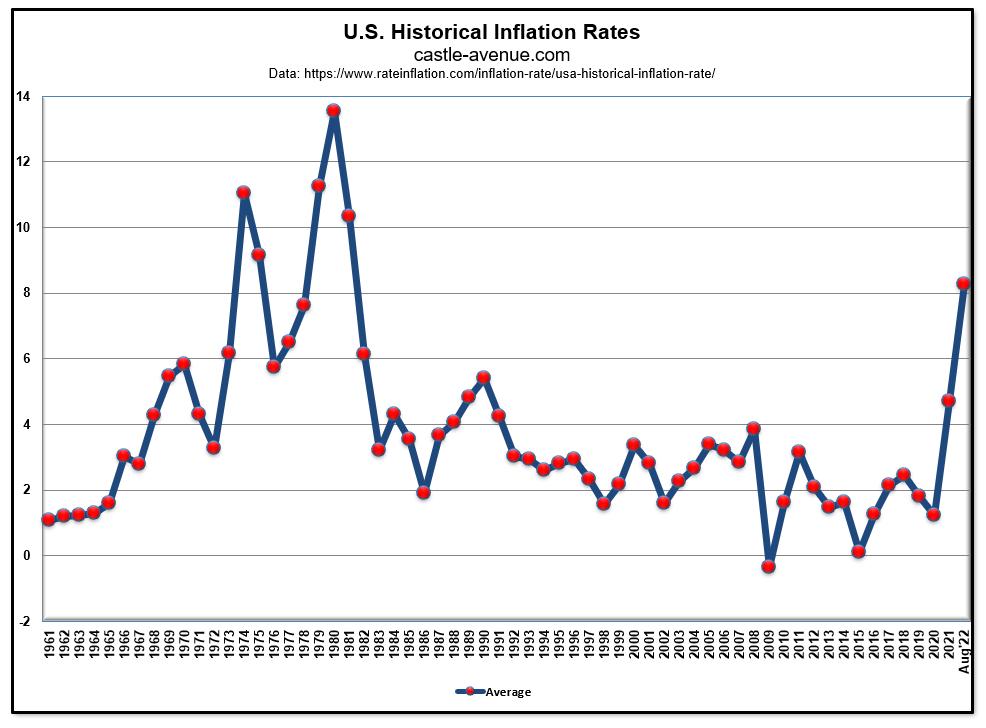

Inflation reached 8.3 percent in August 2022. This is slightly lower compared to the 8.5 percent in July and 9.3 percent in June. But core inflation, which excludes food and energy, was at 6.3 percent in August, higher than the 5.9 percent in both June and July. We are experiencing the highest inflation levels in 40 years. The only time it was higher was in the turbulent 1980s.

Graph above shows U.S. inflation rate has been within the 4 percent range for many years. After the pandemic, driven by pent up consumer spending and a robust job market, inflation rate started increasing. The Russian invasion of Ukraine affected supply of energy while supply chain disruptions in China further spurred inflation globally.

The priority of the Federal Reserve for the past year has been to tame down inflation, slow down the economy and prevent a recession. To do this, the Fed has been increasing interest rates. The federal funds rate increased from 0.09 percent in September 2021 to 2.33 percent in August 2022. At the next Fed meeting, rates are expected to increase by another 0.75 percentage points.

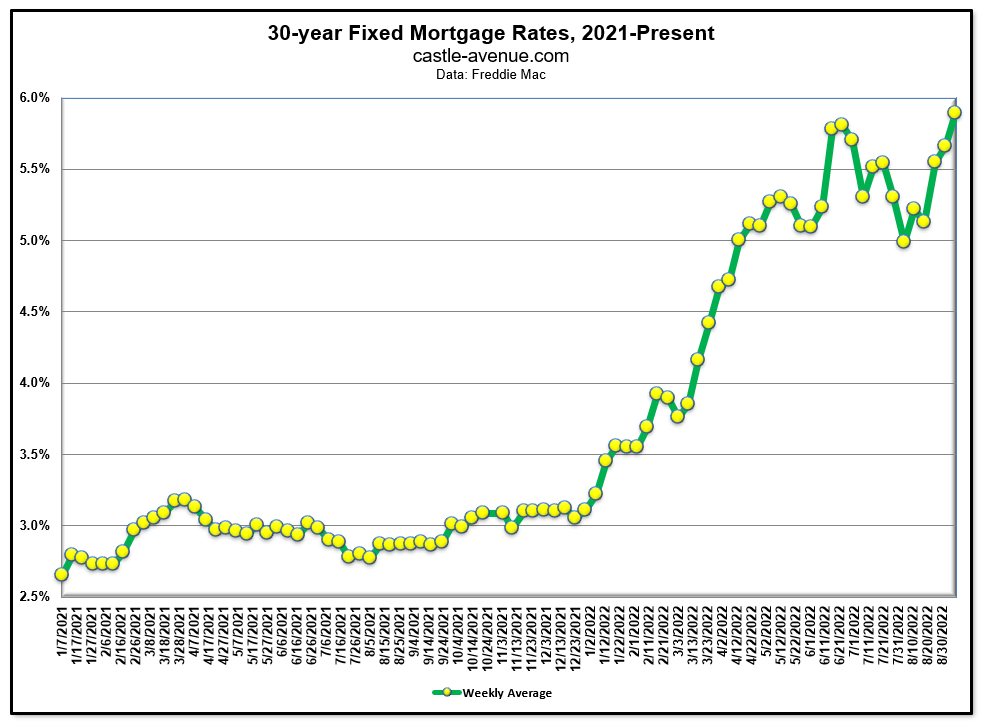

Commensurately with increasing interest rates, the 30-year fixed mortgage rate increased from 2.65 percent in January 2021 to 5.89 percent in the first week of September 2022 (graph below). The doubling of mortgage rates makes it a lot more expensive for the 50 percent of Manhattan buyers who need mortgage financing. This resulted in the Manhattan sale market slowing down.

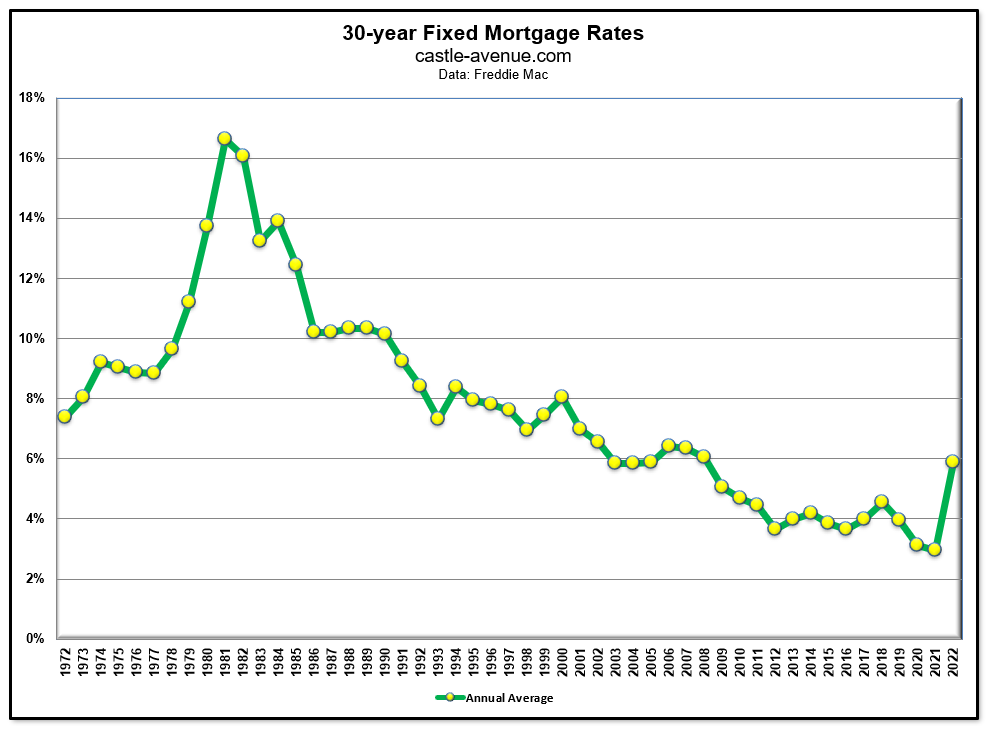

Looking at the 30-year mortgage in a historical context, it’s still considered low. But the market’s movement is based on the current relative situation (eg compared to a year ago) and not compared to 20 or 30 years ago.

Read Wei Min’s article: Historical trend of 30-year fixed mortgage rate

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

Key point #2: Buyer’s market

Plenty of buyers who need financing suddenly found that if they buy, the monthly payment has shot up compared to a year ago. These buyers have become renters which is dampening the sale market. The advantage now goes to all-cash buyers who are able to negotiate good deals from the slowdown.

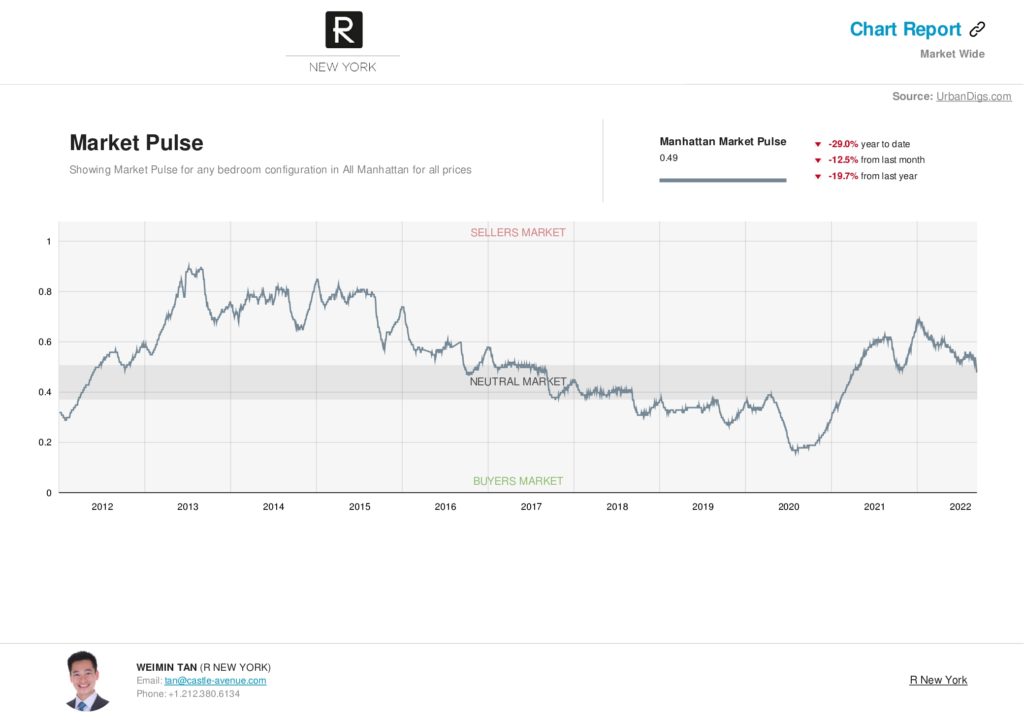

Above is the market pulse chart, provided by Urbandigs, a data analytics firm in Manhattan. It shows whether we are in a seller’s market, a neutral market or a buyer’s market. We were in a buyer’s market in 2020, then it became a seller’s market in 2021. Currently, it shows that we are in a neutral market. Actually I consider this a buyer’s market. The graphs only dips to the bottom band during a recession or extraordinary event like Covid. For Manhattan, anytime it’s in the neutral band signals that buyers have the advantage.

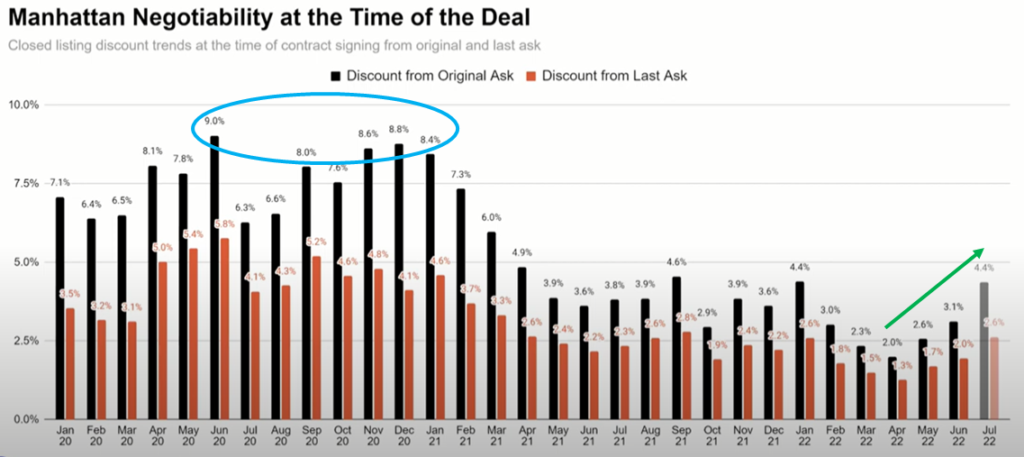

The chart above shows the discount relative to the original asking price and last asking price. The highest negotiability was in Covid 2020 (blue circle), when the discount from original ask was around 8 to 9 percent. In 2021, the Manhattan market surged amid pent up demand. Number of transactions hit the highest level since tracking began 30+ years ago. Negotiability in 2021 reduced to between 3 to 4 percent.

From March 2022 until now (green arrow), the discount has been increasing and in July 2022, it was at 4.4 percent. This also shows that we are in a buyer’s market.

Read Wei Min’s article: Is now a good time to invest in Manhattan, New York residential property?

Key point #3: Record high rental market

We are having a record high rental market. There are two reasons. First is that shelter is the largest component of the inflation index. With 40-year high inflation, rents are bound to increase. Second is that many potential buyers, because of the doubling in mortgage rates, converted to being renters. This increases the rental demand for the limited inventory available which allows landlords to increase rents.

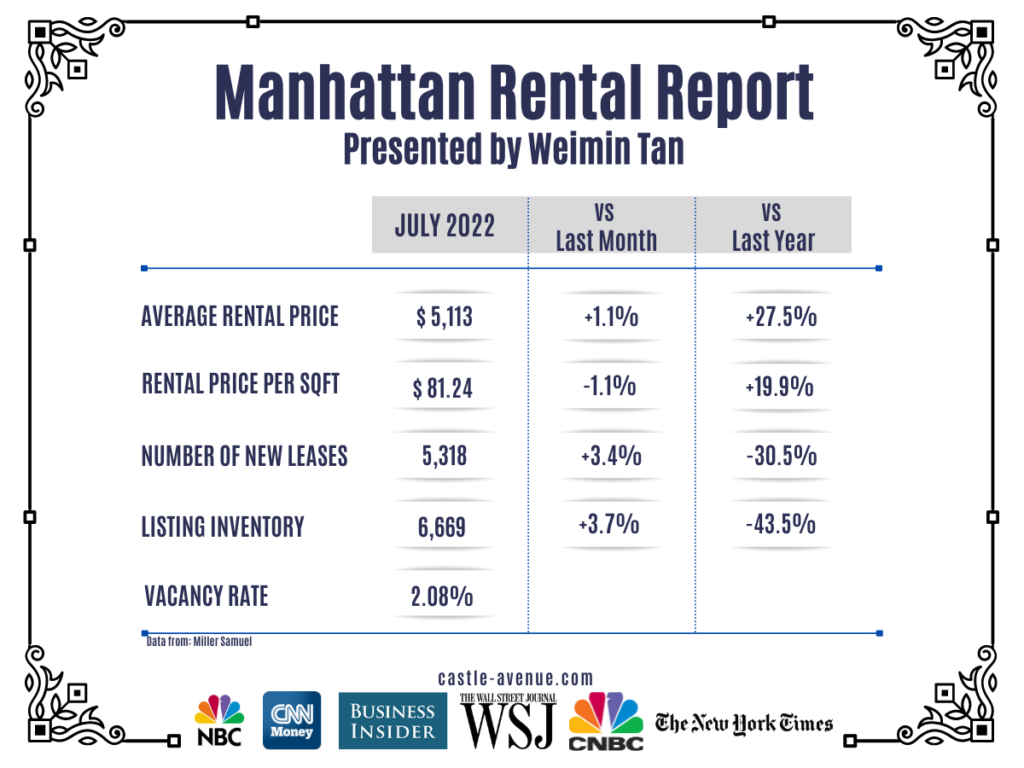

According to the latest rental report from Miller Samuel, the average rental price in July 2022 was at $5,113, or 27.5 percent higher compared to a year ago. Rental price per square foot increased by 19.9 percent while listing inventory decreased by 43.5 percent. All these show Manhattan rents are in record territory.

From a landlord’s perspective, higher rent results in higher rental return. For landlords who locked in low mortgage rates already, the current rental market is very favorable because the largest expense item, mortgage, is already locked in. We have been increasing rents on our landlord clients’ investment condos by 30 to even 50 percent. Hence the numbers in the table above are very real.

Read Wei Min’s article: How to select a Manhattan condo

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale