Manhattan freehold condo, high rental return, close to MRT

Posted by Wei Min Tan on June 3, 2021

Manhattan freehold condo with high rental return and close to MRT, United Nations, Citigroup Center, Blackstone, Blackrock headquarters. Analysis of the key drivers behind the purchase decision.

Property overview

Address: 959 First Avenue, Apt 23E, New York, NY 10022 (Condominium)

Price: $1,830,000

Common charges: $1,400

Property taxes: $160

Rental return: At rent of $6,000 per month, rental return of 2.9 percent. A strong rental return by Manhattan standards.

Size: 907 square feet / 84.3 square meters

Contact: tan@castle-avenue.com

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

Interested in working with Wei Min?

Click here to get in touch!

Quality interiors

Whether for self use or for renting out, wow factor is important. Apt 23E’s wall of windows from living room to bedroom (facing East) provides ample light and has water views as well. The large casement windows are elegant and pleasing.

23E is a large 907 sqft luxury One Bedroom condo on the 23rd floor with East River views. Wall-of-Windows from living room to bedroom. 421A tax abatement in place. Apartment features High Ceilings, Large Casement Windows, Hardwood Floors, Open Kitchen with Gaggenau appliances and island, Wash/Dryer, Bathroom with Calacatta marble walls.

Developer and building facilities

The Sutton, developed by Toll Brothers, is a Full Service building with Concierge, Fitness Center, Residents’ Lounge, Children’s Playroom, Garden. Toll Brothers is one of the U.S.’s major developers. Big U.S. developers do not have a stronghold in the Manhattan market, which is dominated by smaller niche developers.

Freehold Condo in CBD

Apt 23E is a freehold condominium in Midtown East, Manhattan, New York’s Central Business District (CBD). Close to United Nations, Citigroup Center, Blackstone, Blackrock. Restaurants in the area include Ethos, Deux Amis, The Smith, Hillstone.

Apt 23E’s high ceilings. Casement windows are a wow factor attracting top quality renters

Rental Return

Investor buyers can rent out at $6,000 per month. After deducting common charges and property taxes, this luxury condo provides an all cash rental return of 2.9 percent.

2.9 percent is very high by Manhattan standards where the average rental return is less than 2.5 percent for unfurnished rentals. Unfurnished is the normal rental situation and represents 95 percent of the rental market. This is because tenants will have their own furniture.

Rental return will be higher if rented furnished. Keep in mind that furnished rentals are a very small segment of the market. Renters who want furnished condos are usually short term (less than 1 year). Most condo buildings do not allow short term rentals.

Weimin’s commentary on, Negotiations, Be Nice.

MRT stations

Close to E/M/6 MRT subway train lines.

Living room and view of kitchen with island.

Kitchen with top end appliances from Gaggenau

Bathroom with marble tiles

Bedroom, notice the windows which extended from living room to bedroom

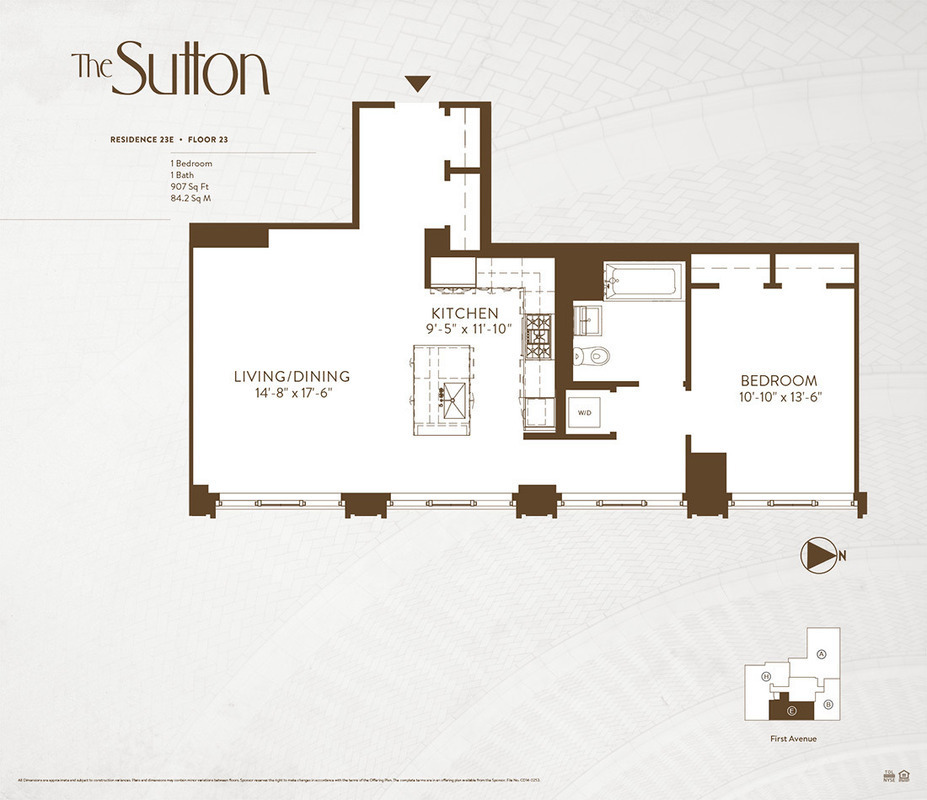

Floorplan of 959 First Avenue, Apt 23E

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale

Follow On Instagram

Related Articles: