November 2022 Manhattan Property Market Update

Posted by Wei Min Tan on November 17, 2022

November 2022 Manhattan Property Market Update

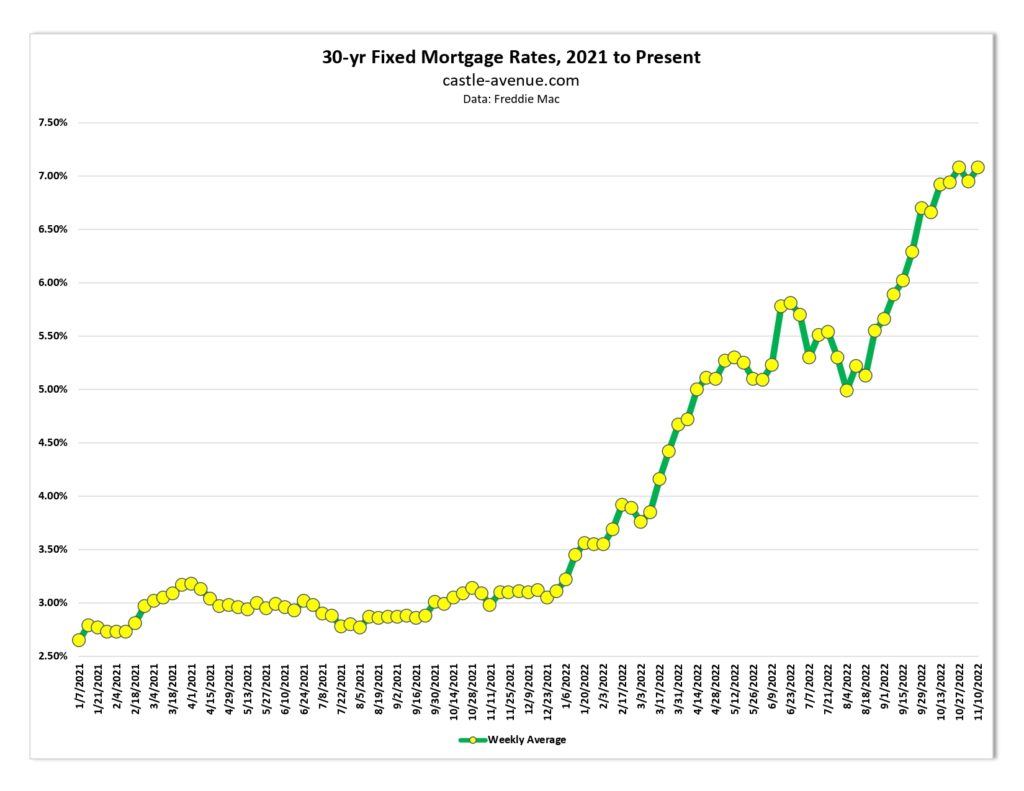

Increase in the 30-year mortgage rate from beginning of 2021 until now.

Key point #1: Sales remain low because of mortgage rates

The Federal Reserve increased interest rates by 0.75 percentage point for the fourth time this year. October’s inflation rate slowed to 7.7 percent, down from 8.2 percent in September. The stock market welcomed the news, but we are still expecting another rate increase in December, this time by 0.50 percentage point.

In line with interest rate increases, mortgage rates are at a 20-year-high. The average 30-year mortgage is now more than 7 percent. This translates into drastically fewer buyers because 50 percent of Manhattan buyers require a mortgage. New contracts signed in October 2022 was 60 percent lower than a year ago.

Read Wei Min’s article: How inflation impacts Manhattan property

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

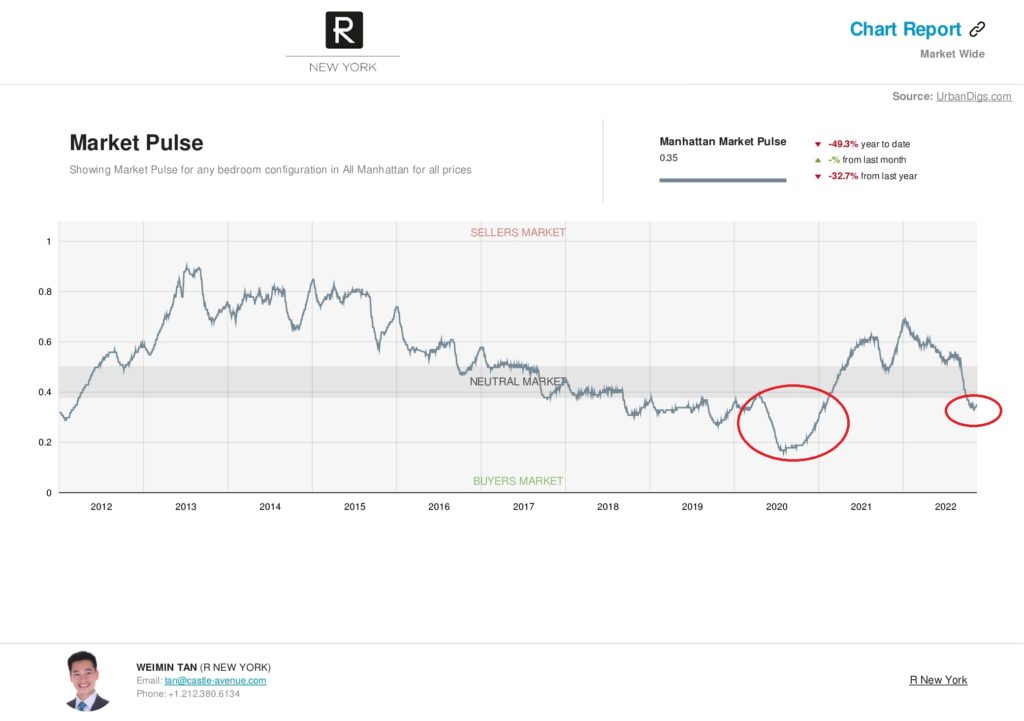

Key point #2: Buyer’s Market

We are in a buyer’s market. The last buyer’s market was right after Covid reopening in the second half of 2020. About 50 percent of Manhattan buyers require mortgage financing, and this segment has turned away from buying. Understandably because monthly mortgage payment has increased dramatically.

Cash buyers currently have significant leverage in negotiating a good deal. I expect Manhattan prices to decrease between 5 to 10 percent from Q2’2022. For new property, developers are offering price and term concessions again.

Read Wei Min’s article: Top 5 Mistakes To Avoid When Investing In New York Property

We’re in a Buyer’s Market, indicated by the red circles, the prior Buyer’s Market was in 2020.

Key point #3: Slowing rental market

The rental market started slowing down after several months of double-digit price increases. Driven by high inflation which led to rental price increases, many renters are opting to just renew their current leases, to avoid fees associated with moving (broker fee, board package, moving fees).

In addition, we are now in the slowest rental season because of Christmas and winter. We are seeing more landlords of condos paying broker fees. The last time this happened was during the Covid pandemic.

Read Wei Min’s article: Average Manhattan, New York Apartment Prices

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale