Average Manhattan, New York Apartment Prices

Posted by Wei Min Tan on May 12, 2025

Average Manhattan apartment prices are based on whether the apartment is a condo or coop. Price per square foot of a condo is higher than for a coop because: a condo owner gets real estate title, does not require board approval and can rent out the apartment as desired without limitation.

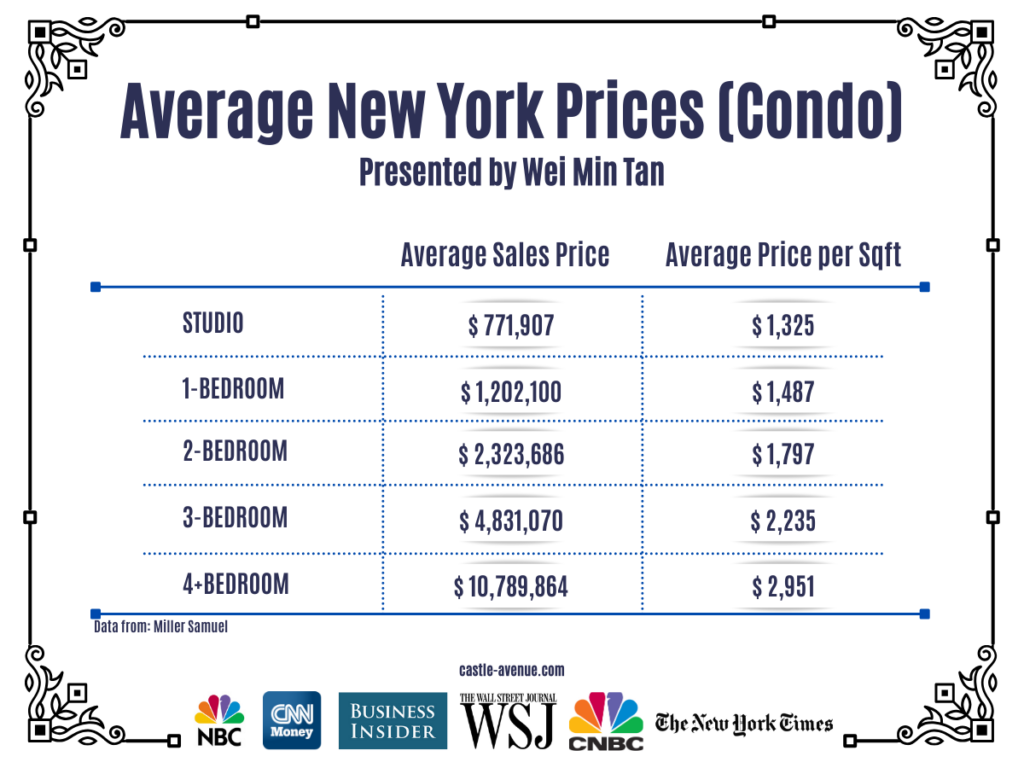

Average Manhattan, New York Apartment Prices (Condo)

The average sale price for a condo ranges from $771,907 for a studio apartment to $10,789,864 for 4+ bedroom apartments. Meanwhile, the average price per square foot ranges from $1,325 for a studio to $2,951 for 4+ bedroom apartments.

As apartments get larger, the price per square foot increases. Why? Generally, it’s because the larger apartments are on higher floors and have better views. Therefore, larger apartments get higher price per square foot.

Client’s large 3-bedroom apartment located opposite Goldman Sachs (the green building). We targeted tenants wanting more space post Covid, rented out in 1 week.

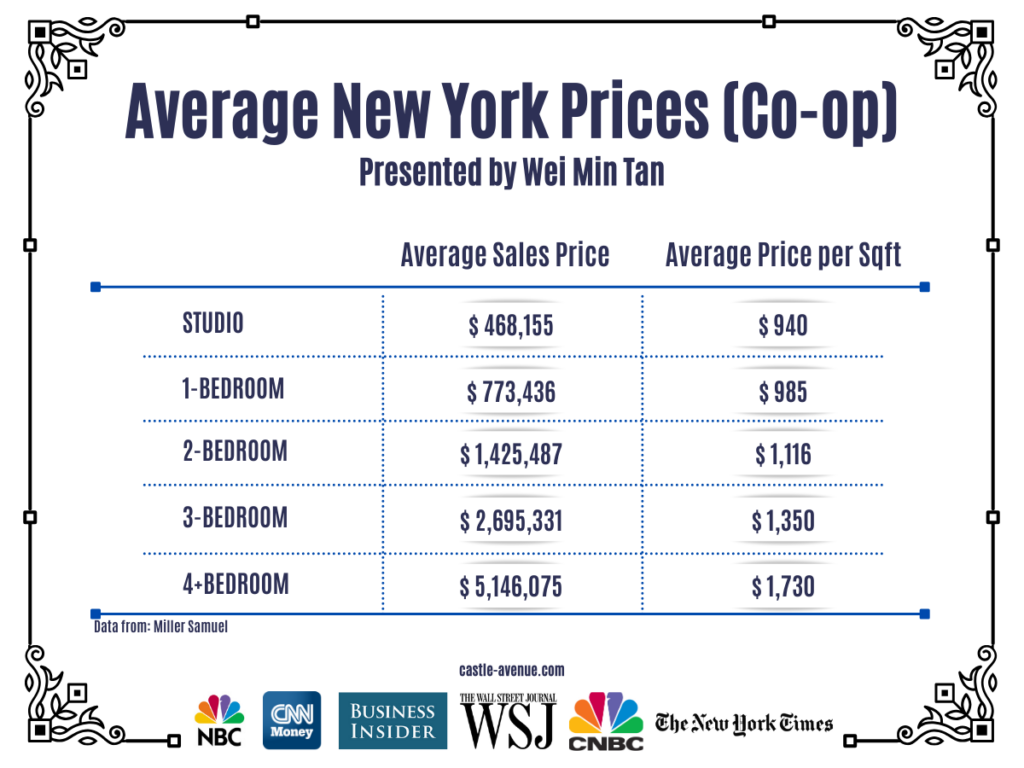

Average Manhattan, New York Apartment Prices (Co-Op)

The average price per square foot for a co-op is roughly 50 percent lower than that of a condo. Average sale price for a co-op ranges from $468,155 for a studio to $5,146,075 for a 4+ bedroom apartment. The average price per square foot ranges from $940 to $1,730.

The trend is similar with condos and co-ops; as size of apartment increases, the average price per square foot increases as well.

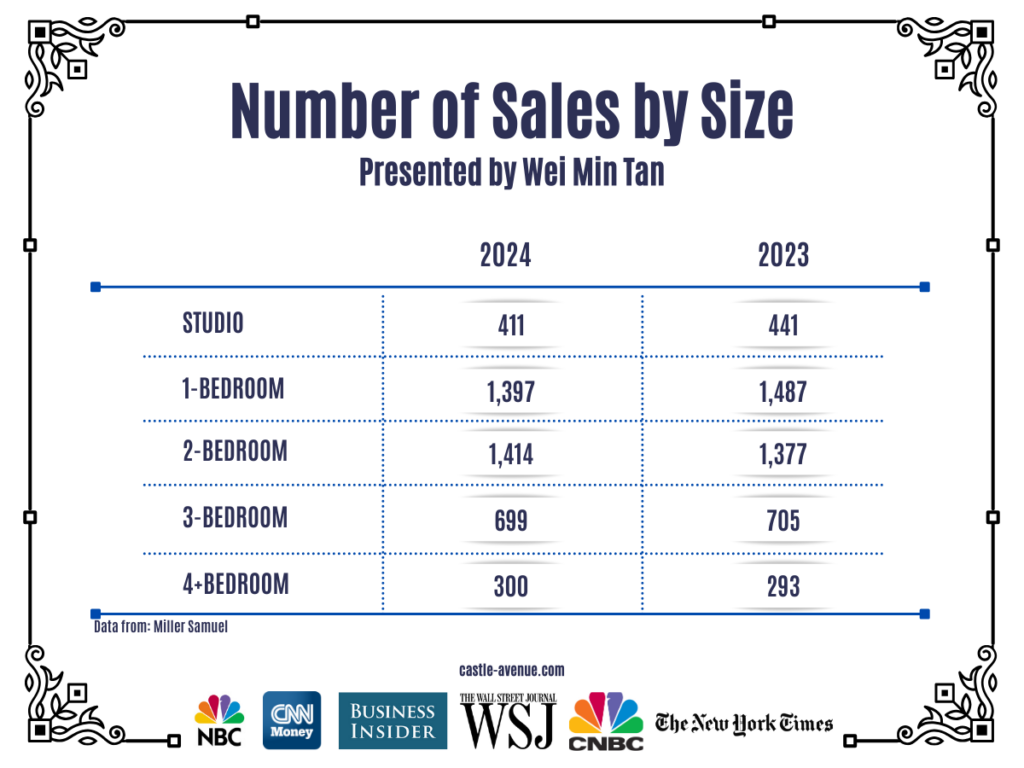

Number of Sales by Size

The table above shows that majority of transactions are in the 1 and 2 bedroom sizes. Large apartments, defined as 4+ bedrooms, represent the smallest segment.

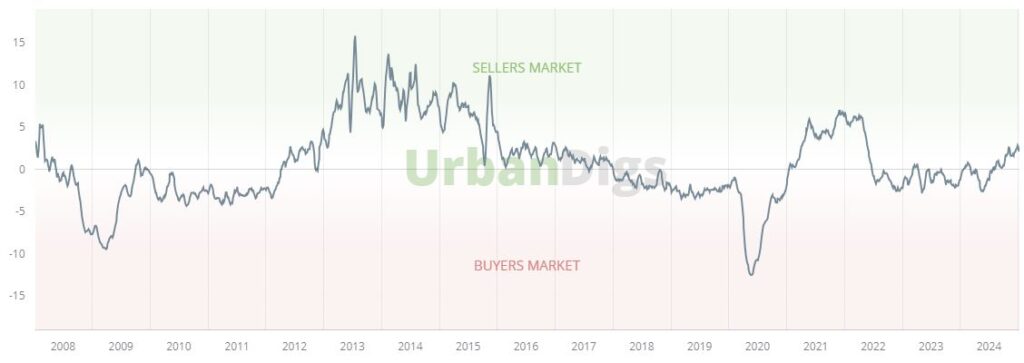

The bottom of the market during the Covid period was in July of 2020. The market recovery started in 2021 and we had record high sales volume. Sales volume in 2021 was higher than in 2007 driven by pent up demand, low mortgage rates and overall optimism as the vaccines came out. From mid 2022 to present, sales volume has been low because of high mortgage rates.

We’re now in a Seller’s Market

The current market is characterized by low transaction volume and low supply inventory. Buyers have limited options to choose from as sellers are holding out on selling because of high mortgage rates (if they need a mortgage to buy a new property).

Desirable apartments in high demand buildings are snapped up within a week while less desirable ones can linger on the market for a long time. We have even participated in bidding wars where the deal price is higher than asking price. Hence, the degree of negotiability depends on the property and demand.

Weimin’s article, Is now a good time to invest in Manhattan property?

Deal example: Client’s Manhattan apartment close to World Trade Center bought a few years ago. Multiple offers at eventual sale.

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale

Follow On Instagram

Related Articles

Manhattan Condo Historical Price Trend