Manhattan Real Estate Market Forecast 2025

Posted by Wei Min Tan on May 30, 2025

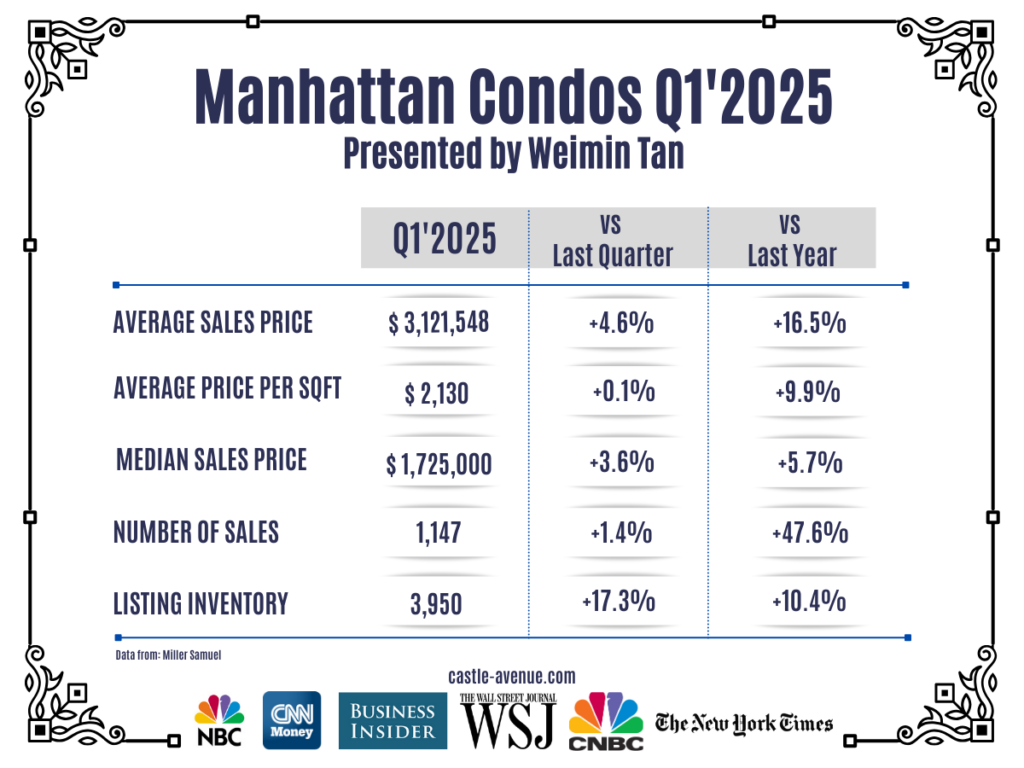

The Manhattan real estate market forecast 2025 points to better times after going sideways since 2017. Price per sqft at $2,130 is now almost at the level of 2017. The main drivers of the Manhattan real estate market this year will be deal flow in banking and finance, foreign investors, mortgage rates and supply.

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

Manhattan Real Estate 2025 Market Indicators:

Banking and finance: The new Trump administration plans to deregulate the finance industry. This means it will be easier to do investment banking and private equity deals. Since Manhattan’s real estate market is heavily influenced by the finance industry, this should help the property market. Why? Because high income earners buy Manhattan property, and there has always been a positive correlation between Wall Street bonuses and Manhattan sales activity.

Foreign Investors: We are starting to see foreign investors flow back into the Manhattan market after the election. Confidence towards the U.S., whether in AI, real estate, technology or economy, is back. At the national level, Trump recently unveiled Stargate, a $500 billion AI infrastructure investment involving Softbank, Oracle and OpenAI. At the local Manhattan property level, I have been getting a lot more calls from foreign investors who have been on the sidelines but have decided to make the move, especially after seeing the stock market’s performance post election.

Mortgage Rates: The Federal Reserve‘s ongoing efforts to combat inflation have led to a series of interest rate hikes. While the Fed decreased rates last year, mortgage rates remain persistently high. The 30-year mortgage is still at 6.5 percent. This has turned a lot of potential buyers into renters. About 60 percent of Manhattan real estate buyers are all-cash. High mortgage rates are not good for the market as it turns away buyers needing financing.

Supply Levels: While there has been slight increases in inventory compared to the historically low levels seen in recent years, supply remains constrained. Sellers holding onto low mortgage rates are reluctant to sell as they will be faced with much higher mortgage rates when they buy the new property. As result, buyers have limited property choices.

Deal Example: 305 E 51 St, Halcyon. Buyer client reserved property at pre-construction stage. Completed 2 years later and rented out with strong cashflow to owner since then. Property is close to the United Nations, Citigroup Center, Blackstone, Blackrock, Chase Bank.

Wei Min’s article: Transaction Costs Manhattan Condominium

Deal example: Represented multiple buyers at 130 William, FiDi’s new development with very low carrying costs and full amenities. Proximity to the Fulton Street subway station and high quality finishes make this a good buy.

Luxury Market Trends

The luxury market in Manhattan, defined as the top 10 percent of sales, is expected to remain a significant segment in 2025. Strong demand from ultra-high-net-worth individuals and families is anticipated to continue to drive activity in this segment as they seek asset diversification and legacy preservation. Key trends within the luxury market include:

Increased demand for unique and bespoke features: Luxury buyers are seeking properties with unique architectural features, high-end finishes, amazing views and state-of-the-art amenities.

Focus on privacy and exclusivity: There is a growing demand for properties that offer a high degree of privacy and exclusivity, such as penthouse apartments with private terraces and whole-floor apartments.

The current average price for a luxury condo is $10.3 million, or 36.9 percent higher than a year ago. Price per sqft for a luxury condo is $3,173, or 16 percent higher than a year ago. Listing inventory, referring to supply available, decreased compared to prior quarter and prior year.

We expect the 2025 Manhattan real estate market to finally come back and look forward to representing our global clients this year in identifying and negotiating the best properties.

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale