How to buy property in Manhattan, New York

Posted by Wei Min Tan on April 30, 2025

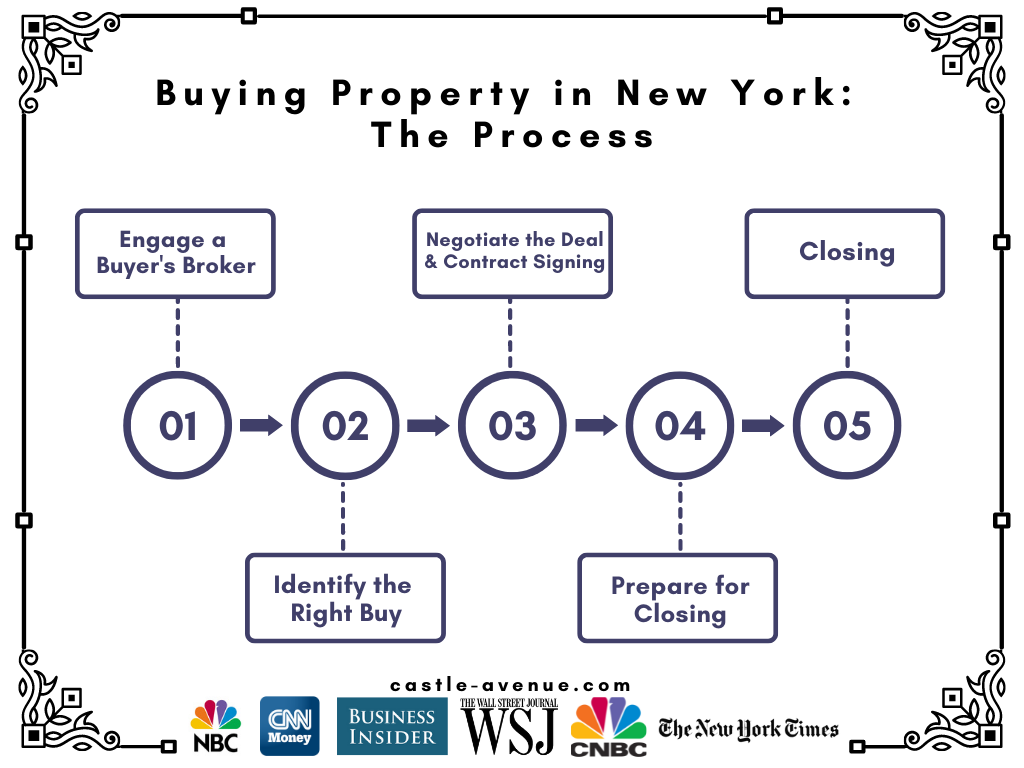

How to buy property in Manhattan, New York in 5 easy steps. It starts with engaging a buyer’s broker, then identifying the right buy, negotiating the deal and contract signing, preparing for closing, and finally closing.

Step 1: Engaging a buyer’s broker

In New York, there are usually two brokers to a transaction – the seller’s broker and the buyer’s broker. The seller’s broker is the one who lists the property for sale and has his/her photo beside the listing you may view on websites like streeteasy.com, zillow.com etc. The seller’s broker’s role is to maximize price for the seller by getting the most traffic to view the property and generating the most interest from the public.

Meanwhile, the buyer’s broker represents the interest of the buyer and guides the buyer through the buying process. This includes recommending the right property, negotiating price and terms and bringing the process through to closing. I am usually the buyer’s broker and will explain the upsides and downsides of each property, why something is a good buy and another is not.

The best way to select a buyer’s broker is to interview a few and see who is the best fit. Having a buyer’s broker is crucial as he’s your objective advisor. Who else is going to tell you the downsides of a property?

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

Deal example: Client’s condo in Midtown East. Booked at pre-construction stage, waited 2 years for completion after which it was always rented. Close to United Nations, Citigroup Center, Blackstone.

Step 2: Identify the right buy

Having identified the buyer’s broker, the buyer and broker would identify metrics to evaluate the properties, view the properties and shortlist finalists based on objectives. For example, buying a vacation apartment facing Central Park has very different criteria than buying an investment apartment in Manhattan to rent out.

The buyer’s broker should know the entire market in order to recommend the right buys based on the buyer client’s objectives. For example, if the client wants an apartment with a terrace, the buyer’s broker should know the difference between the types of outdoor spaces in Manhattan.

Weimin’s article, Buying and then reselling a Manhattan Art Deco prewar condo with a 500 sqft terrace

Step 3: Negotiating the deal and contract signing

The buyer’s broker would evaluate offer price based on closed comparable properties. An offer is presented and seller typically provides a counter offer. This may go on for a few rounds. When both parties finally agree on price and terms, there is an accepted offer. However, having an accepted offer is still not binding. The seller’s broker then prepares a deal sheet and the seller’s lawyer drafts the sale contract and sends to buyer’s lawyer.

The lawyers review, negotiate legal fine points and when the contract is finalized, the buyer signs and provides the contract deposit. Then it gets delivered to seller to countersign. It is at this point that both parties are bound by the contract. Before which either party could still back out of the deal.

Step 4: Preparing for closing

This step involves submitting a formal mortgage application to the buyer’s bank to initiate the mortgage process. The bank appraises the property and the underwriter performs the necessary bank steps to eventually issue a mortgage commitment letter. With a cash purchase, this step is avoided since there is no mortgage.

Concurrently, the buyer’s broker and buyer prepare and submit the board package. With a condo, this step is merely administrative. Condos always approve the transaction because rejecting means the condo board has to buy up the property from the seller with the same terms. But with a Coop, it’s different. A Coop board can reject a transaction without consequence. After the board package is submitted, all parties wait for board approval.

Weimin’s article, Manhattan property market trends

Deal example: Client’s waterview apartment with terrace in Financial District. High ceilings, prewar condo, dual exposures to south and west. FiDi is a value buy with upside potential driven by WTC.

Step 5: Closing

After the bank provides a clear-to-close and the board has approved, all parties will agree on a day of closing. Closing is usually about 60 days from contract date if there is a mortgage involved. If no mortgage, then closing can be as soon as 30 days from contract date. Closing is the point after which the buyer becomes the official owner of the property.

The above is the process for a resale transaction. With a new development, closing is usually 1-2 years from when the contract was first signed because the buyer needs to wait for completion of the property project.

Weimin’s article, Buying new vs resale condo in Manhattan

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale

Follow On Instagram

Article updated Apr 30, 2025

Related articles