Terrace demands a premium – one bedroom at 99 John

Posted by Wei Min Tan on August 18, 2020

Terraced apartments in Manhattan, New York demand a premium. They are highly desirable because of the outdoor oasis a terrace provides and because there are so few apartments with a terrace.

This article is about how we represented an investor client in buying and then reselling a terraced apartment at 99 John Street in Financial District. 99 John is a 1933 Art Deco prewar building designed by Shreve, Lamb and Harmon, the architects who built the Empire State Building. We purchased the condo when it was being converted to residential condominium in 2008. The apartment interiors – kitchen, bathroom, floors were redone. The elevator cabs were updated. We then represented our client in reselling the apartment five years later in 2013.

Contact: tan@castle-avenue.com

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

Interested in working with Wei Min?

Click here to get in touch!

Client’s 500 sqft terrace with outdoor furniture and plants

What is a terrace

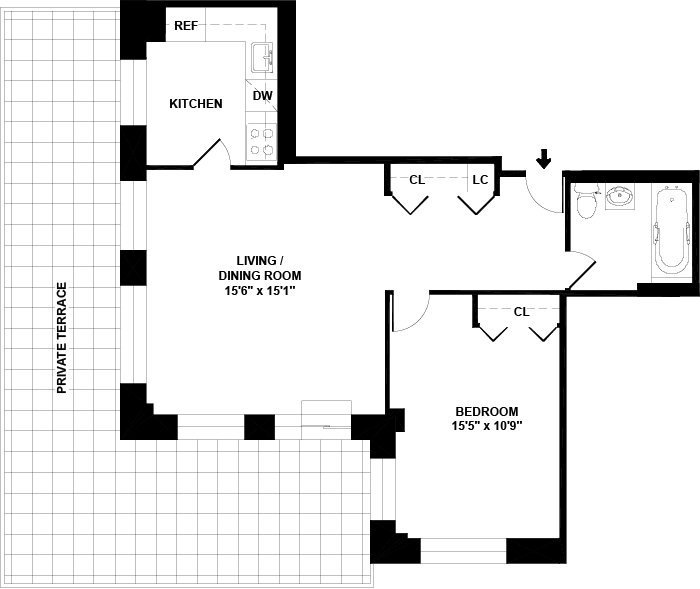

Buyer client selected a one bedroom apartment with a 500 sqft terrace. A terrace is outdoor space that sits above the apartment below. This happens when a building has setbacks, tapering of the building like a wedding cake as building height increases. The reason for setbacks is to allow light onto the streets below.

A terrace differs from a balcony, which is merely an extended platform of concrete. Hence, a terrace is a rare and valuable asset in Manhattan real estate. Usually terraces come with larger 3 or 4 bedroom apartments. Having a 500 sqft terrace with a one bedroom is very rare.

Price and location

We purchased the property during the condo conversion in 2008 at $839,999. Property was resold in 2013 at $1.28 million. Driver of the transaction was the terrace.

The building was located in Financial District, a value area with upside potentials driven by the World Trade Center, Fulton Street subway station, South Street Seaport.

Photos of the apartment

Views to the north, south, east and west.

Living room with windows looking out to the terrace. Faces west and south.

Bedroom

Kitchen has a window looking out to the terrace on the left

Read more: New property projects in Manhattan, how we pick winners

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale

Article updated Aug 18, 2020

Follow On Instagram

Related Articles: