Co-op versus Condo in Manhattan

Posted by Wei Min Tan on March 15, 2022

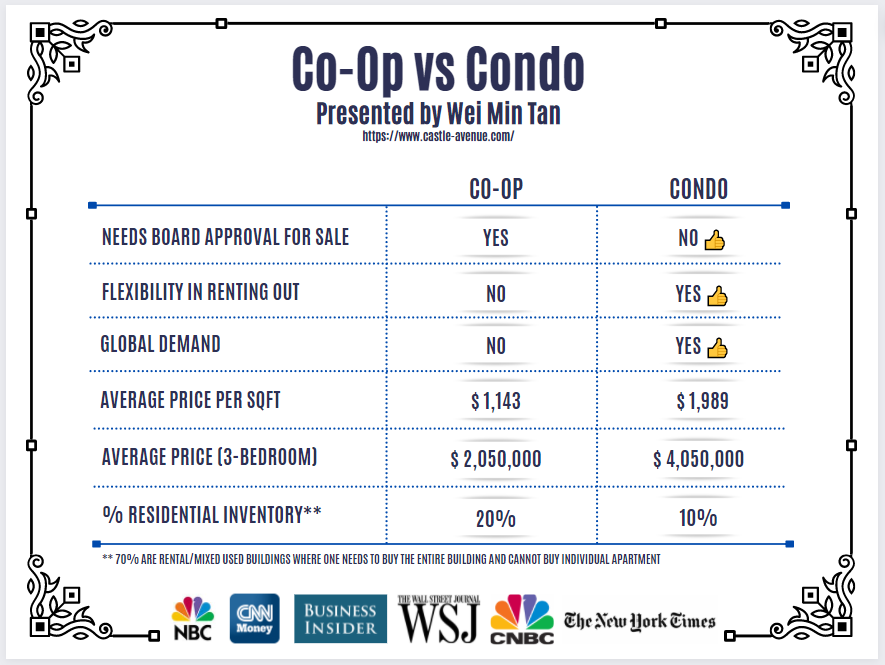

This analysis is a comparison between a co-op versus condo in Manhattan property.

A condo or condominium is similar to how condominiums are in the rest of the world. It is where someone owns an apartment and has title to the apartment within the building.

A co-op, specific to New York City real estate, is a property legal structure whereby the owner of the apartment owns shares in the building. What does that mean? It means that the person who owns a co-op apartment does not own a real estate title, but instead, the co-op owner has a proprietary lease. A proprietary lease is a lease that allows the owner of a co-op to live in the apartment indefinitely. As such, a co-op “owner” is not technically an owner of the apartment.

Condo ownership structure only started in the 1960s, before which residential apartments were all Co-ops. This explains why a pre-war condo is rare because most of the pre-war inventory are Co-ops.

Key differences between a co-op and a condo

Board Approval

Co-op transactions need board approval. If a buyer and seller have agreed to a price, the co-op board may reject the transaction without reason and without consequence to the board.

With a condo, the board approves 99% of the time because rejecting entails exercising a right of first refusal which means the board would have to buy the property from the seller with the same terms that has been agreed upon between the seller and buyer of the apartment. The only way a condo board would be able to do that is to use the building’s reserve funds to buy up the apartment. This is why it is extremely rare for a condo board to exercise the right to first refusal to prevent a sale.

Flexibility in Renting Out

With a co-op, usually there’s a stipulation that says that the owner can rent out the apartment two out of every five years. But with a condo, there’s no such restriction. The condo owner can rent out the apartment whenever he/she wants. Investors always choose condos because of the flexibility in renting out.

Global Demand

This refers to demand from foreigners investing in New York City real estate. Global buyers will almost always choose a condo because they are investing in New York City real estate for either appreciation potential or rental income. To do that, buying a condo is a better choice.

With a co-op, usually the co-op board requires buyers to have the co-op as a primary residence. Sometimes, a co-op board may allow the buyer to use the co-op as a pied-a-terre or vacation home. But most of the time, the co-op owner would need to use the apartment as a primary residence.

Average Price per Sqft

A condo is about 74 percent more expensive than a co-op based on the Q4’2021 data shown in the table. The price per sqft for a co-op based on Q4’2021 was $1,143 while that of a condo was $1,989. It’s because with a condo, one owns a real estate title, there’s no need for board approval to buy or sell, there’s flexibility in renting out and there’s global demand.

Average Price (3-bedroom)

The price for a condo is also a lot more expensive. The average price for a 3-bedroom condo apartment is $4.05 million while the average price for a co-op is $2.05 million.

% Residential Inventory

In terms of supply, co-ops make up 20 percent of residential inventory while condos make up 10 percent. The other 70 percent are multifamily or mixed-use buildings where one cannot buy an individual apartment but would have to buy the whole building.

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale

Follow On Instagram

Related Articles

March 2022 Manhattan Property Market Update