Foreigner Buying Property in New York, 8 Questions That Matter

Posted by Wei Min Tan on March 1, 2024

1. Can a foreigner buy property in New York?

Yes, absolutely! Foreigners from all over the world buy property in Manhattan, New York as part of their asset diversification strategy. We have clients from Singapore, Hong Kong, London, New Zealand, Denmark, Dubai, Taiwan, Israel, China, Indonesia, Thailand, California and of course, New York.

Manhattan and London are deemed the world’s most global cities, at the rating of Alpha++, by the GaWC. Foreigners buy in New York because they want stable price appreciation. Manhattan is a landlocked island so supply of property is very limited. That is a reason behind the stable appreciation in Manhattan. Investing in Manhattan property, profiting and repeating is the foundation of many real estate dynasties in New York.

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

2. What type of property can a foreigner buy in New York?

Property in Manhattan are divided into Cooperatives, Condominiums and Townhouses.

A Cooperative is an apartment building where each apartment owner owns shares in the building. A Coop owner has a proprietary lease from the Coop building which technically means the Coop owner is actually an indefinite tenant of the Coop building. A Coop is not the recommended building type for foreign buyers because board approval is required to buy or sell, there are limitations in renting out and a Coop board can reject a transaction without providing reason. Coop buyers are almost always local New Yorkers buying for self use.

The recommended building type for foreign buyers is a Condominium. A Condominium is also an apartment building, but each apartment owner owns real estate title for the specific apartment. This means the Condo owner can buy or sell without needing board approval, rent out whenever he wants and make renovations as desired. Since a Condominium is more flexible, the appreciation of a Condominium is higher than that of a Coop.

Foreigners can also buy townhouses, which are landed property. Some townhouses even have air rights, the right to build higher and add value. There are no board rules when one owns a townhouse. However, the entry price point is a lot higher. A townhouse in Manhattan starts at around $7 million.

Deal Example: Halcyon in Midtown East, represented multiple clients at the $1.7 million to $5 million price point. We picked this new property project at pre-construction stage and property completed in 2 years. Rented at premium rents since. Close to United Nations, Citigroup Center, Blackstone, Blackrock.

3. What are property prices in New York?

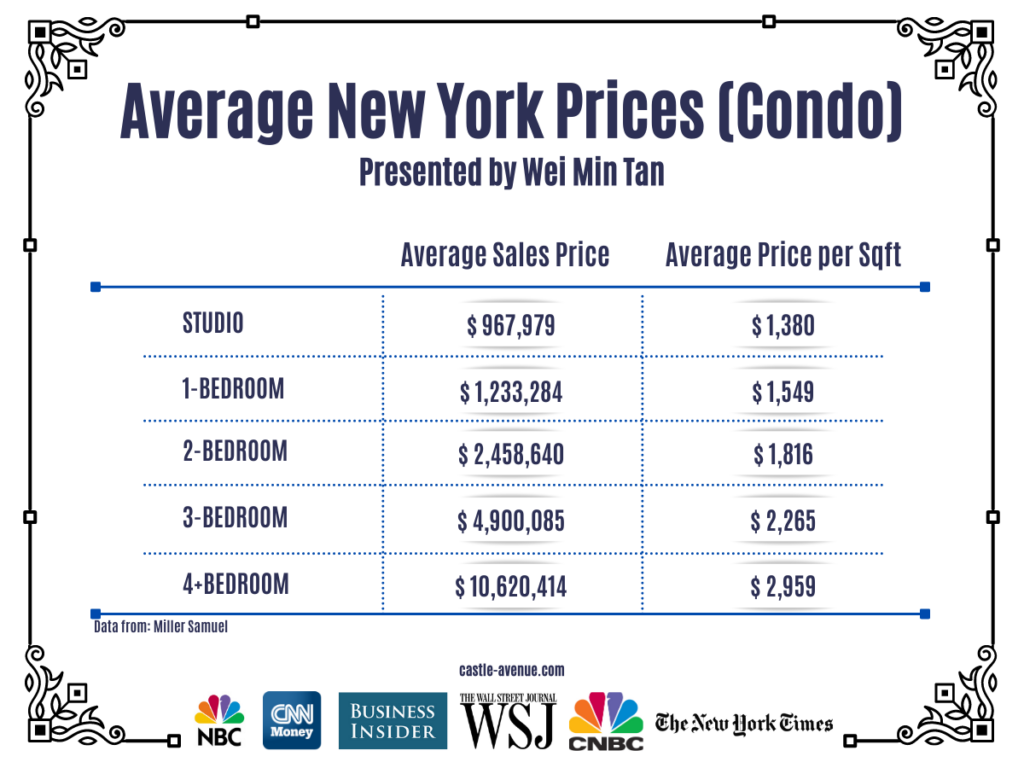

The average price per square foot of a Manhattan condominium is about $2,000. This is skewed by the higher priced new developments. The price per square foot for Resale property is between $1,200 to $2,000. New developments are in the $2,000 to $3,000 per square foot range.

Studios (no bedroom) range from $500,000 to $1 .2 million. One bedrooms range from $800,000 to $2.5 million. Two bedrooms range from $1.8 million to $4.5 million. Three bedrooms start from around $3 million and goes up from there. Most foreigners invest in studio to three-bedroom sizes. Having a three bedroom in Manhattan means owning a large apartment. Post Covid pandemic, we successfully guided our clients in targeting the rental demand for larger apartments by investing in 3 bedroom condos. Four+ bedroom condos in Manhattan, with average price of $10.6 million, is like having a mansion.

Deal Example: Investor client’s prewar West Village condo with high ceilings, amazing open views and prewar charm. These wow factors got the apartment rented in one week! Weimin’s article, Investing in West Village.

4. What are costs associated with a foreigner buying property in New York

The costs for a foreigner are the same as for a local U.S. citizen. There is no extra stamp duty or taxes levied on foreign buyers. The only incremental cost to a foreigner is if the foreigner chooses to set up a more complex entity structure to hold the property. However, locals may do the same so there is really no extra expenses targeted at foreigners.

Costs for a foreigner at purchase:

To keep it simple, transaction costs at purchase is about 2 to 5 percent of property price for an all-cash purchase, higher if buying new development.

If there is a mortgage involved, the costs are about 6 to 10 percent of the mortgage loan. Notice I changed it from a function of property price in the above example to now a function of loan in this example. Reason is that, with a mortgage, there is a mortgage tax of 2 percent of loan. Hence if we convert everything to a function of the loan, it works out to about 6 to 10 percent of loan.

Deal Example: Greenwich Club in FiDi. Building is one block south of the World Trade Center, hence benefiting from demand coming from employees working at the WTC. The WTC comprises 4 buildings and the Perelman Performing Arts Center is in development. The area has transformed since buyer client bought the apartment. Dual West/South exposures and double height, 17 feet, ceilings. Always rented with premium rents due to the dramatic views and high ceilings.

Costs for a foreigner at sale:

At the sale, the transaction costs are about 5 to 8 percent of the property price. These are the same for foreigners and U.S. citizens. The key components are broker fee, transfer taxes and attorney fees.

Transaction costs when buying and selling New York property

5. Property rental yield in New York

The gross rental yield is about 5 percent of property price. For example, for a $1 million property, expect to collect $50,000 a year in rent. There are two main carrying costs when owning a condo and these are common charges and property taxes. After these two expenses, the net property rental yield for a condominium in Manhattan is between 2 to 3 percent. This is indeed low. The reason investors buy in Manhattan is for the long term appreciation and price stability.

Chart: Manhattan condominium historical price trend

6. How should a foreigner own property in New York

It all depends. Foreigners can own the property under their own name or through a company (or layers of companies). With the company structure, ownership can be through a New York Limited Liability Company or, at a more complex level, having a foreign corporation own a New York LLC which owns the New York property.

There are pros and cons of each and it depends on whether there is a mortgage involved, whether there is a tax treaty between the United States and the foreigner’s country, risk tolerance, expense tolerance, appetite for administrative work annually etc. We will coordinate a meeting with a tax attorney to explore all the options.

Deal Example: 40 Mercer Street in Soho. This is an ultra luxury property where prices and rental are much above average. In an up market, ultra luxury usually outperforms while in a down market, prices decline more than average.

7. Taxes when a foreigner sells his New York property

The capital gains tax for a foreigner is the same as for a local, around 25 percent of gains. It depends on ownership structure, income level and a list of other considerations.

At the sale, a foreigner is subject to a 15 percent withholding tax called FIRPTA (Foreign Investment in Real Property Tax). This withholding is the U.S. government’s way to ensure foreigners report and pay taxes annually. If the foreigner has been reporting taxes annually, he can request an exemption certificate from FIRPTA. Nevertheless, if there is FIRPTA withholding, it is refundable after the U.S. government confirms that taxes due have been paid. FIRPTA is a withholding tax that is refundable. It is not an incremental tax charged to foreigners.

Legal and tax tips when buying Manhattan, New York property

8. How does the estate tax impact foreigners?

The estate tax is the tax payable when an owner dies. For foreigners, there is very little estate tax exemption. This means should the foreign property owner die, the estate tax due is up to 50 percent of property value. This is the largest exposure for a foreigner owning U.S. property. There are ways to deal with this estate tax exposure and an experienced attorney will be able to advise.

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale

Article updated March 1, 2024

Follow On Instagram

Related Articles:

Foreign Buyer Guide to Investing in New York Property