New York Property Market Outlook

Posted by Wei Min Tan on May 17, 2025

Manhattan, New York remains a top choice for global investors seeking a safe and stable property market. This appeal stems from factors like limited supply, high global demand and consistent value appreciation.

Even with lower rental yields compared to other locations, the New York property market offers diversification and a hedge against inflation, political uncertainty, and global economic disruptions. This New York property market outlook explores the trends impacting the prized Manhattan market.

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

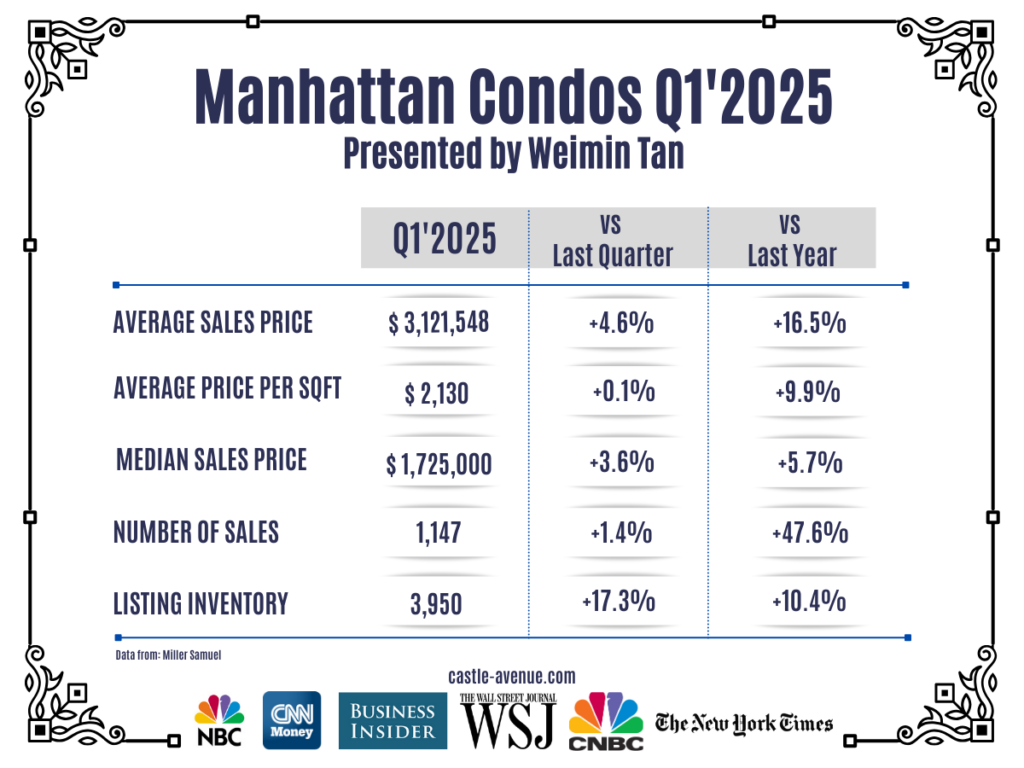

New York’s Overall Condo Market

The latest Q1’2025 data from Miller Samuel shows that the average price per square foot for a Manhattan condo is now $2,130. This represents a 9.9 percent increase compared to the prior year. The number of sales was at 1,147, a 47.6 percent increase year-over-year. Additionally, the median sales price increased to $1.725 million, an increase of 5.7 percent from a year ago.

Wei Min’s article: Manhattan Condo Historical Price Trend

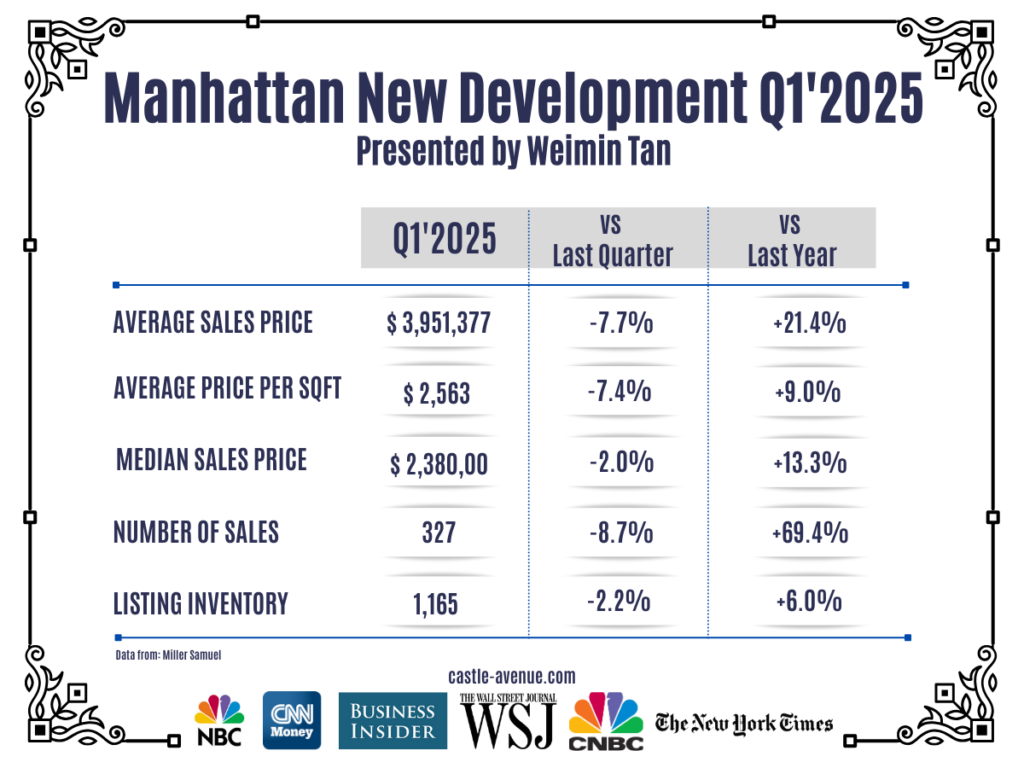

New York’s New Developments

New developments, brand-new properties purchased directly from the developer, had an average sales price of $3.95 million, a 21.4 percent increase from the previous year. The number of sales was 327, a 69.4 percent increase from a year ago.

Deal example: 40 Mercer in Soho. Ultra luxury apartment building commanding premium rents, in Soho. In this deal, we also took over with tenant in place, which meant no vacancy period having to look for a tenant.

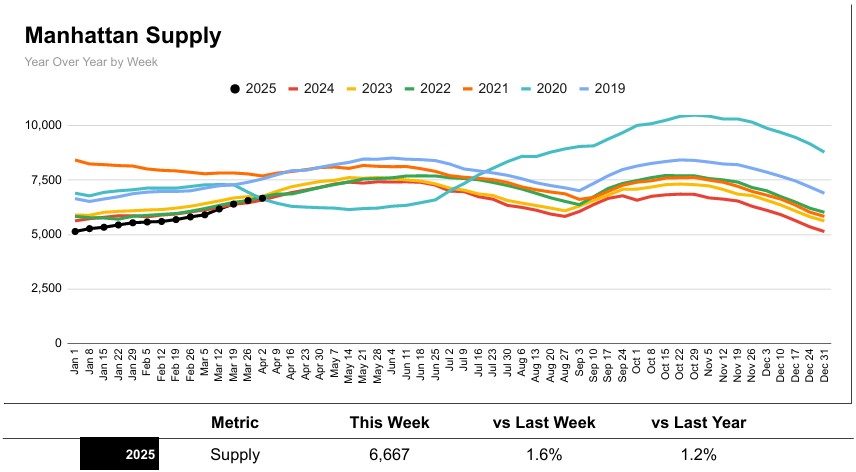

Low Property Supply

Supply has been increasing, but the market is still facing a supply shortage. The challenge for the market is that while supply has been increasing, it’s still not enough as it’s still below the 2019 and 2021 levels.

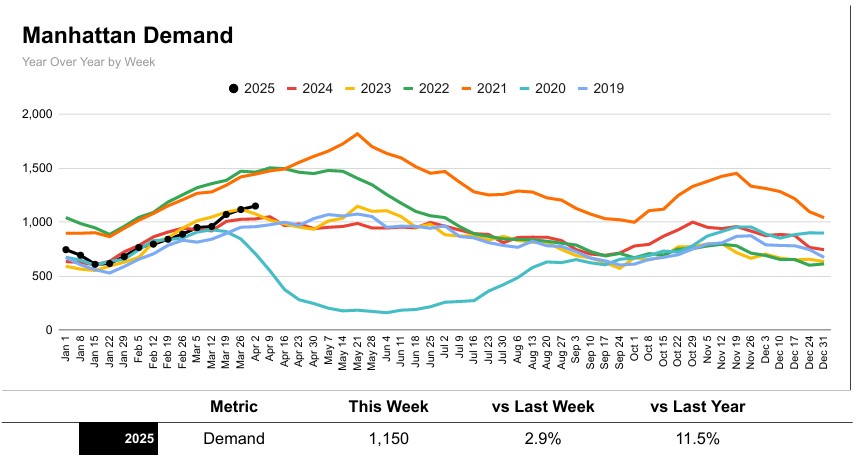

Demand

Demand has started picking up since the low in the beginning of the year.

Wei Min’s article: Transaction Costs Manhattan Condominium

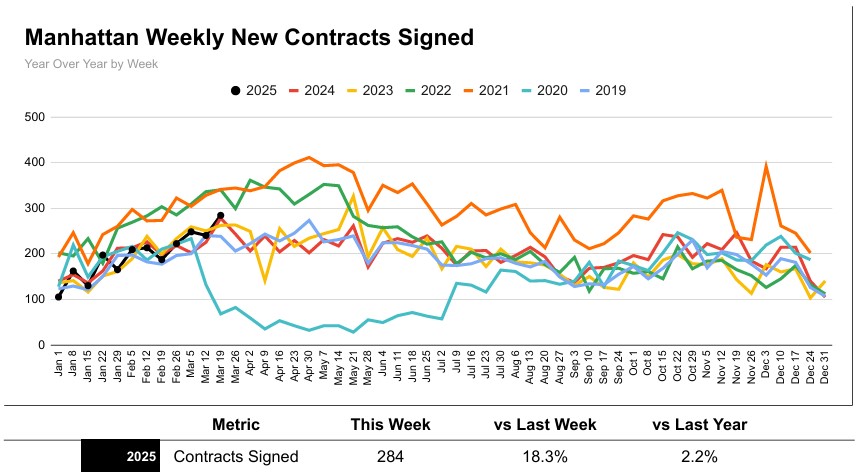

Property Contracts Signed

New contracts signed have been rising since beginning of the year as well. It is now above 2019 levels but still below 2021 and 2022, both of which were record years for Manhattan as people moved back into the city and during which interest rates were still low.

Deal example: Represented multiple buyers at 130 William, FiDi’s new development with very low carrying costs and full amenities. Proximity to the Fulton Street subway station and high quality finishes make this a good buy.

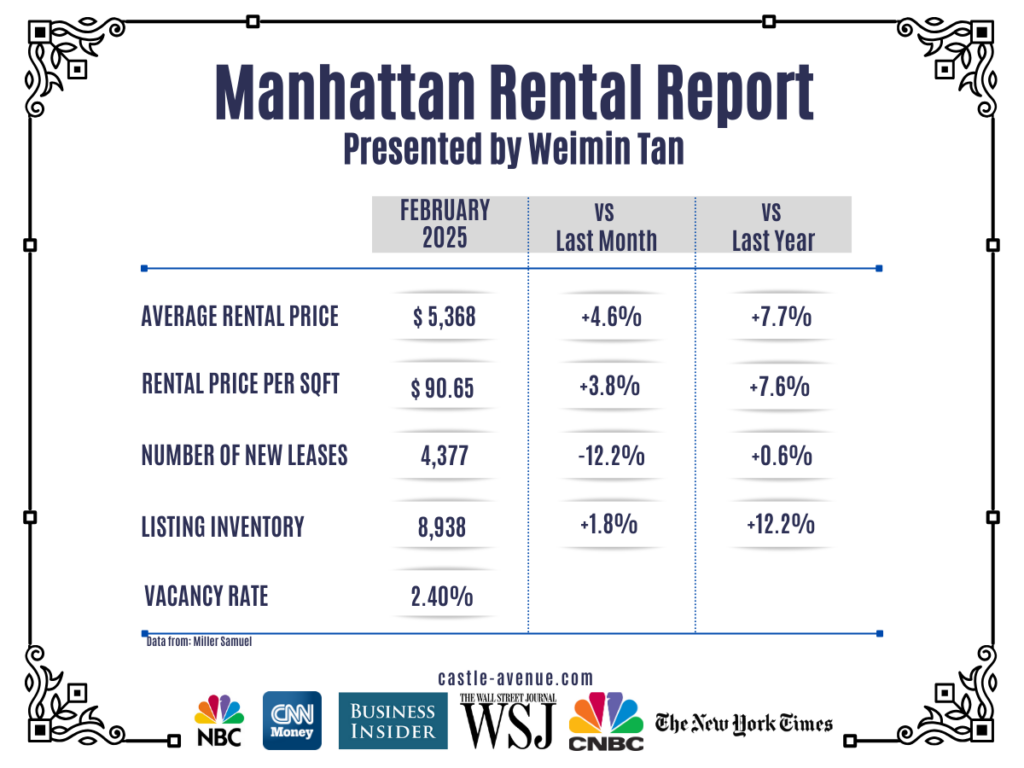

Rental Market

Rental price per sqft are at record highs, with demand outpacing supply. In February 2025, rent per sqft was at $90.65, up 7.6 percent from a year ago. The number of new leases increased by 0.6 percent from the previous year, reaching 4,377. Manhattan’s residential vacancy rate is the lowest in the U.S., at 2.40 percent.

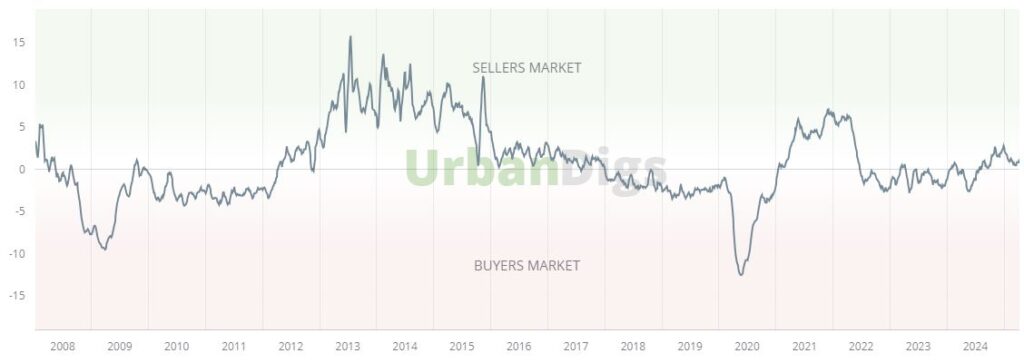

Market Pulse

While demand is picking up, the shortage of supply makes this a seller’s market, as indicated in the chart below.

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale