Manhattan Real Estate Market Forecast 2024

Posted by Wei Min Tan on June 11, 2024

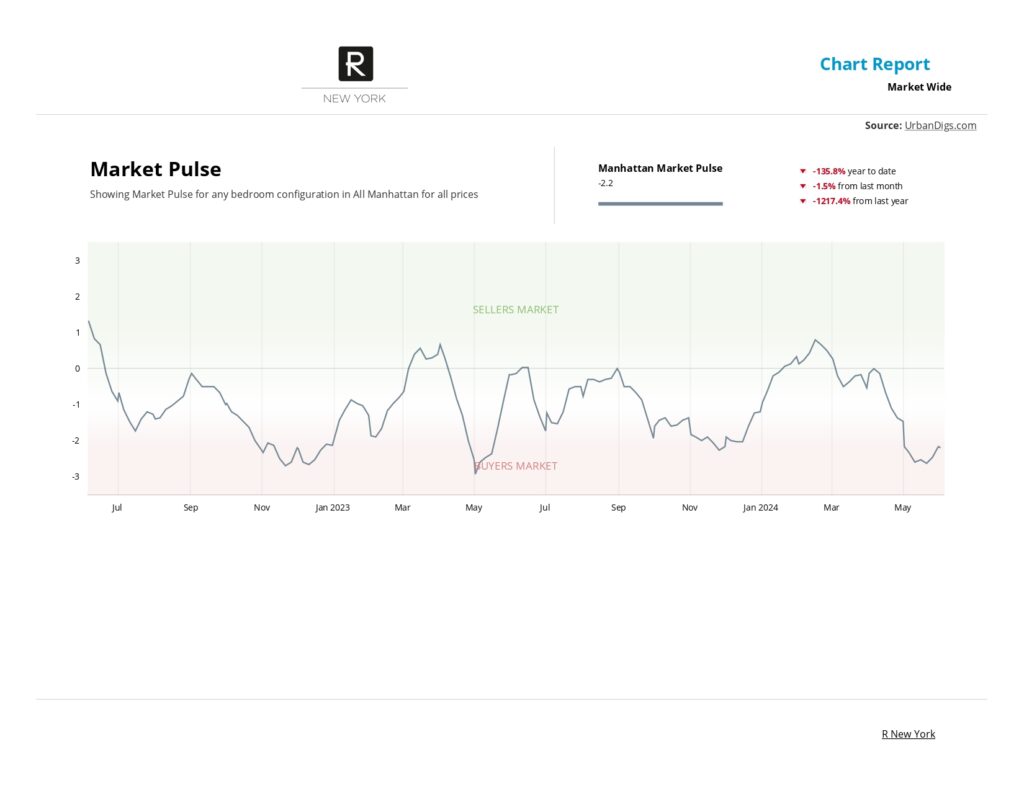

Manhattan Real Estate Market Forecast: Continued Buying Opportunity in 2024? The Manhattan real estate market, a microcosm of New York City’s dynamism, experienced a rollercoaster ride in 2023. Soaring interest rates dampened buyer enthusiasm, leading to a significant drop in sales volume compared to the record highs of 2021. We’re now in the second quarter of 2024. The anticipated pickup of the Spring season didn’t really happen, and I see continued buying opportunities.

Read Wei Min’s article: Manhattan Condo Historical Price Trend

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

Manhattan Real Estate’s Market Indicators:

Interest Rates: A key factor influencing buying demand, mortgage rates are expected to stabilize in the latter half of 2024, making financing a home purchase more manageable. The Federal Reserve’s monetary policy decisions will be crucial in this regard. For now, buyers needing financing are sidelined and 70 percent of buyers are all cash.

Inventory Levels: Inventory in Manhattan started 2024 at its lowest point in eight years. While a positive sign for sellers, a gradual increase in listings is happening, offering buyers more options.

Sales Activity: Sales activity is moving sideways, the expected pickup of the Spring season didn’t really happen. Contracts signed are currently even below 2023 levels.

Job Market: New York City’s job market remains a bright spot. Continued job growth, particularly in high-paying sectors like finance and technology, will fuel demand for housing, especially in Manhattan. The latest unemployment rate for the city is a metric to watch, as it reflects economic health.

Inflation: Inflation, though a national concern, is projected to ease further in 2024. From a real estate perspective, the hope is for mortgage rates to decrease as well. For context, inflation reached 9.1 percent in June 2022, a 40-year-high. In December 2022, it was at 6.5 percent, and in April 2024, it came down to 3.4 percent.

.

Deal Example: 305 E 51 St, Halcyon. Buyer client reserved property at pre-construction stage. Completed 2 years later and rented out with strong cashflow to owner since then. Property is close to the United Nations, Citigroup Center, Blackstone, Blackrock, Chase Bank.

Read Wei Min’s article: Engaging property agent in Manhattan, New York

How much Manhattan residential condos cost now

Back in 1999, price per sqft was $480. The prior annual peak was in 2017 at $2,149. The below are key data points on a Manhattan condominium in Q1, 2024, the latest datapoint.

Average price $2.68m (-7.2% vs prior year)

Price per square foot $1,939 (-8.5%)

Median price $1.63m (-0.8%)

Transactions 777 (-20.6%)

Months of supply 13.8 months (+25.5%)

Read Wei Min’s article: Is now a good time to invest in Manhattan, New York residential property?

Navigating the Market in 2024:

For buyers, the current market presents an opportunity to secure a property with potentially more negotiating power compared to the seller-dominated market of 2021. The market pulse shows it’s a buyer’s market (graph below). All cash buyers have the strongest position as buyers needing financing are sidelined because of mortgage rates.

Sellers, on the other hand, might need to adjust pricing strategies to align with the changing market conditions. A focus on highlighting unique property features and capitalizing on the still-limited inventory could be beneficial.

Deal example: Represented multiple investor clients in reserving Tribeca Green at initial pricing. This was Manhattan’s hottest new development.

Read Wei Min’s article: Benefits and Downside Risks of Buying Manhattan Property

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale