Manhattan property discount to asking price

Posted by Wei Min Tan on August 24, 2021

Manhattan property discount to asking price is one of the most common questions we get asked by clients globally. How much can we negotiate off the shown price, how much is the Covid discount, how negotiable are prices? All reasonable and relevant questions.

In some markets, sellers ask for the sky and buyers offer half. They eventually meet over months of negotiation. But in Manhattan, closed transactions and their prices are public data. Hence, sellers list their property at market price, or slightly higher. Sellers would not ask 20 percent higher than market because then buyers would not come to view, and the property languishes in the market. The longer a property is on the market (as denoted by the Days on Market metric), the less desirable it becomes.

Contact: tan@castle-avenue.com

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

Interested in working with Wei Min?

Click here to get in touch!

Manhattan’s discount to asking price

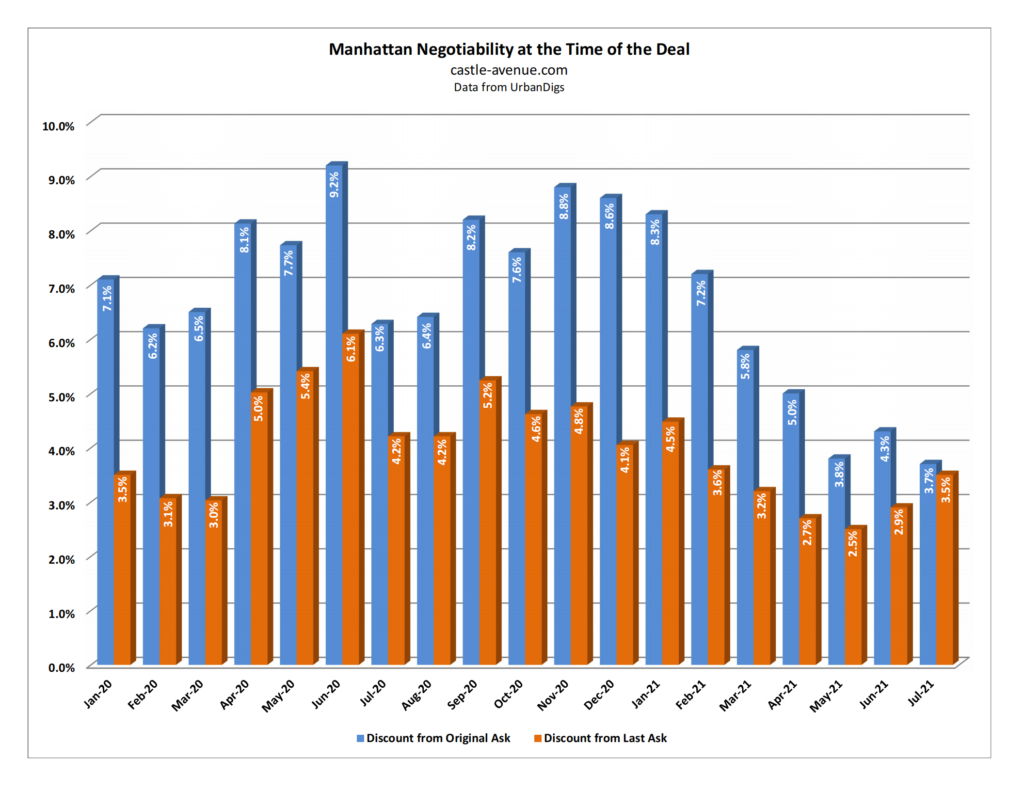

According to UrbanDigs, Manhattan’s discount to original asking price from Covid peaked in June 2020 at 9.2 percent. Discount to last asking price (after sellers reduced pricing as a result of not getting bidders) was 6.1 percent.

The most recent discount to original asking price (July 2021) was 3.7 percent, while the discount to the last asking price was 3.5 percent. This shows it is a seller’s market and there is minimal price reduction before property is sold.

This demonstrates how tight and accurate pricing is in Manhattan. Why? It’s because pricing data is public information. There is no guessing or testing out the market with a ridiculously high price. Asking way above market does not work here because buyers know what market prices are. Serious buyers would not waste time going to view a property that is overpriced. And serious sellers would not waste time asking unreasonable prices either.

Deal example: Our client’s prewar condo in the West Village which has high ceilings and dramatic sky views. Rented out in one week despite the slow rental market.

Where is the Covid discount?

Short answer – there is no longer a Covid discount. Manhattan is now a seller’s market which is driven by low mortgage rates, pent up demand from buyers who were supposed to buy last year in 2020 and optimism from the Covid vaccines. The bottom of the Covid market was from May to July 2020.

Good news is that buyers no longer have to search for a bottom or guess how long the slowdown will last. Buyers don’t have to wonder about the future viability of a big city like Manhattan and whether people will be moving to the suburbs.

Companies are calling people back to the office and as a result, even the rental market is back. A bull market typically lasts 7 years and we are now at the beginning of the next bull market.

Deal example: 111 Murray was being built and was going to be the newest new development super tower in Tribeca. Represented foreign client on the apartment below. Key driver for our decision was the location, opposite Goldman Sachs headquarters (the green glass building). We waited 2 years and upon completion, prices went up 20 percent.

Weimin’s article, Buying new property in New York

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale

Article updated Aug 24, 2021

Follow On Instagram

CNBC interview on U.S. property price to income ratio

Choosing the right investment condo

The key to negotiation – be nice to the other party