Future of Real Estate

Posted by Wei Min Tan on December 21, 2020

The future of real estate as result of Covid-19 can be summed up as (1) an acceleration of technology, (2) cities will always be needed because humans are social creatures. Real estate, this human endeavor from the beginning of civilization, is pushed aggressively into adopting technology. Will cities die because people don’t want to be living closely anymore? Absolutely not. In the context of history, the Plague of Justinian, Black Death, Spanish Flu each killed 50 million people during a time when the earth’s population was much much less. Covid thus far killed 1.7 million globally. Cities didn’t go away then and they will not now either.

Contact: tan@castle-avenue.com

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

Interested in working with Wei Min?

Click here to get in touch!

This storm of so many bad things

In a New York Magazine article which was later published in curbed.com, the current crisis is said to incorporate parts of every drawback New York has faced. Similar to Hurricane Sandy, Covid is a natural disaster. Like the Great Financial Crisis of 2008, Covid triggered a rise in unemployment and poverty. Like 9/11, it is an incident of mass casualties.

The NYC government, similar to the 1970s, faces a fiscal crisis with tax revenue forecast to plunge. Our nation has never been as bipolar as now, given the drastically opposing views of the Biden vs Trump presidential election. Previously inactive voters came out, voted and created the highest voter count ever in history. Meanwhile, our nation is experiencing a huge economic downturn costing millions of Americans their jobs, closing down 25 percent of retailers.

In my 26 years in America, there has never been such a culmination of events.

Global Forecast for 2021

Real estate is very local and to forecast one global outlook is unrealistic. Each country, driven by its own supply/demand fundamentals, will have a different outlook. Prime global forecast from Knight Frank’s analysts looks at three broad groups to emerge in 2021.

First, London, Sydney, Paris, Berlin and Madrid, markets where prices are expected to recover, backed by low interest rates, suppressed demand, tax incentives or strong market fundamentals. An increase is expected in New York, mainly because inventory is absorbed by pent up demand. As a broker, I am getting calls from all over the world from savvy investors wanting to get into Manhattan amid this opportunistic time.

Second, markets where the pandemic is having little effect. For example, Buenos Aires, Shanghai and Lisbon. The Buenos Aires market has always been slow even before Covid, while the Shanghai market has already resumed its pace of pre-pandemic levels. Infrastructure projects in Lisbon is strong and prices are expected to reflect that even post Covid.

Third, markets like Auckland, Vancouver, Geneva, Los Angeles and Miami saw a rise in activity in 2020 as people upgraded to larger properties. For these markets, 2021 price growth is expected to be slower than 2020 but still stay in positive territory.

View from client’s investment condo in West Village, signed during Covid lockdown. We got amazing terms that would not have been possible in a normal market.

U.S. real estate is red hot!

Despite all uncertainties brought by the pandemic, the U.S. real estate market became a hotspot. This is driven by (i) low interest rates, and (ii) demand chasing limited supply. According to cnbc.com, existing home sales in October 2020 rose to the highest level since February 2006 with an increase of 4.3 percent compared to prior month, equivalent to a 26.6 percent year-over-year increase.

U.S. housing inventory was at 1.4 million, down 19.8 percent compared to prior year. This represents a 2.5 month supply, a record low. Median home price rose to a record $313K, an increase of 15.5 percent compared to a year ago. As of Dec 16, mortgage rates set the 15th record low for 2020. Yes, you read it right – it was record low after record low, 15 times this year. Refinance activity went up 105 percent and new purchases increased 26 percent.

This is a pandemic, folks! And we are having a real estate boom?

Manhattan

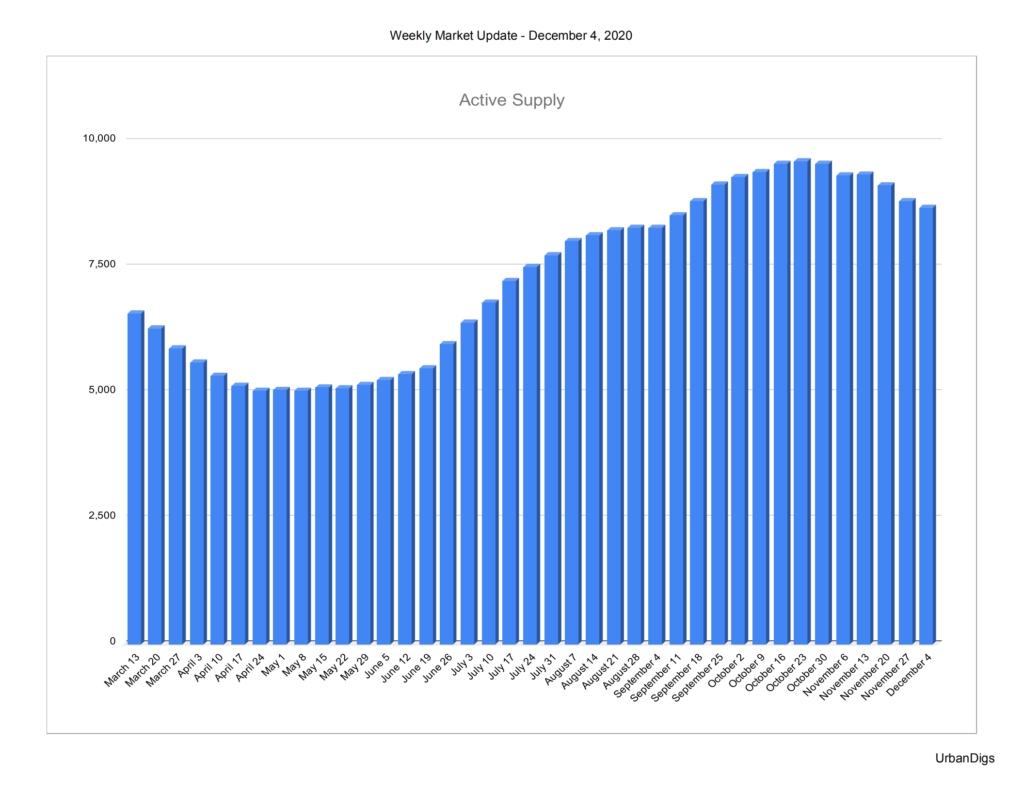

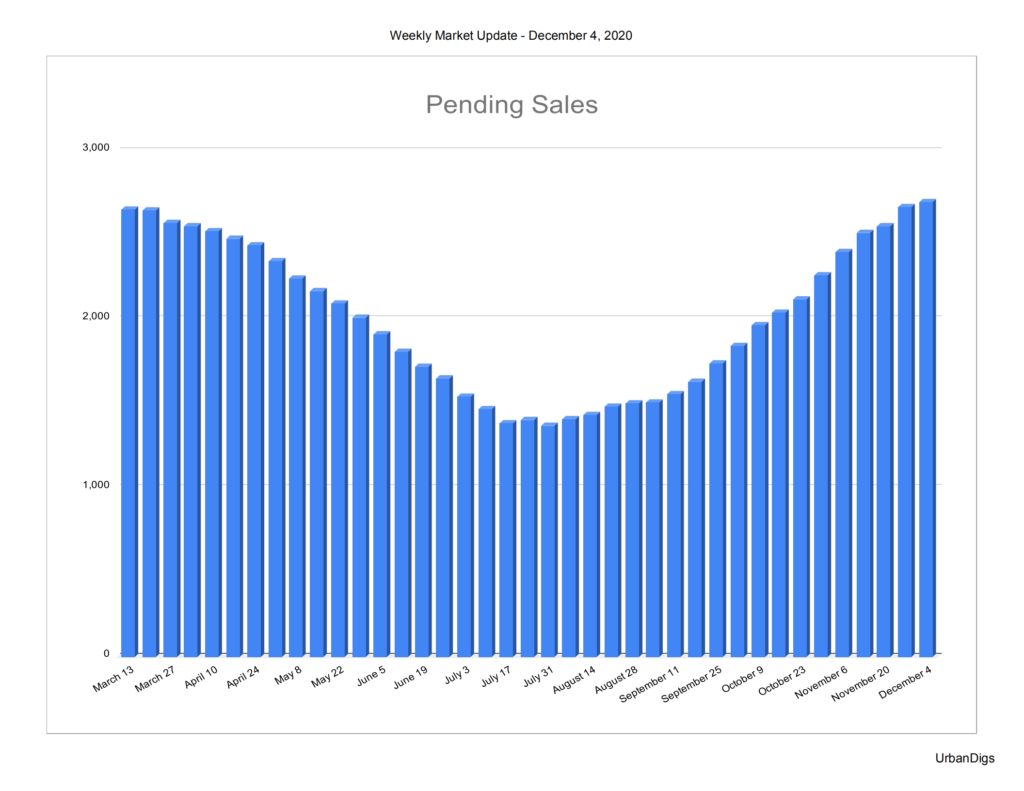

While the rest of the U.S. is having a red hot real estate market, Manhattan has been slow but picking up. Supply has stabilized while pending sales, referring to listings in contract, has been increasing weekly since July. In representing buyer clients, I have been lucky to win certain deals and lost a few as well. One three-bedroom at 101 Warren with outdoor space was sitting on the market for months and months. All of a sudden they had multiples offers, my client being one. Unbelievable. And this is at the $3 million+ price point.

For those still looking to catch the bottom, it’s over. The bottom was in July as the pending sales graph below shows. Contracts signed is correlated to price. This means the more contracts are signed, the less negotiability as more people are chasing the same property. Buyers have the strongest advantage when they are the only bidder. Not when there are 3 other bidders. Because guess what, when a seller’s agent tells you there are 3 other offers and you should come up with your best, what would you do? You would try to not lowball and offer a price higher than if the seller’s broker tells you there is no other offer and to PLEASE PLEASE present something. Right?

Technology and real estate transactions

As a broker, I am seeing first hand the technological innovations that came forward between March 2020 and now. We are now doing closings virtually. Now we are are not sitting 6-7 people in a room for 3 hours to do a closing. It’s remote! This means brokers don’t even have to be there, because there is no “there” to be at.

Listing agreements are being signed via Docusign or Digisign, digital apps where signing is done with a few clicks. This as opposed to the old way which is printing out a document, signing, scanning, and emailing back. Now it literally takes 10 seconds, not counting the time to read. Checks are wired, no more physical checks written.

There is a lot more video viewings and buyers save time from watching a video (which takes 2 minutes). This as opposed to going to a property which takes at least 1 hour when counting the travel time etc. If a buyer really likes the place, then we do an actual viewing.

Client’s condo in FiDi with double height ceilings. We changed tenants during Covid but it was rented immediately because of the high ceilings, views and location. This despite FiDi having the slowest rental market ever.

Weimin’s article, How to buy property in Manhattan.

Embracing tech in buildings

Stefanos Chen of New York Times outlined innovation points emerging in the post-Covid property market. This ranges from robotic furniture to apps built to minimize touching and limit spread of germs.

Reimagining furniture has been happening for a while now, for example, the Murphy bed. Given the existing work from home policies in place, space-saving, multi-purpose and multi-functional designs are in vogue. Ori, a robotic furniture company, recently launched the pocket office which converts from office to living room to save space. Buildings are focusing on better air circulation, higher MERV-13 air filtration standards and systems to sanitize surfaces and eliminate viruses.

Gyms and amenity spaces are being reserved online and apps are built to limit number of people in the space. As a fitness enthusiast, I have avoided using our amenity space and opt to workout on our roof deck. Anyway, that’s besides the point….

Some of the technology innovations will last and set the new standard. Others, such as fancy convertible furniture, cater to a niche market. Real estate is a very traditional industry and used to be driven by pen and paper. Now it’s being driven by apps, virtual this and remote that.

Covid pushed us ahead 5 years in terms of embracing technology.

Weimin’s article, New York property trends

Death of cities?

Are cities dying because people want to escape density, have more space and live further from other humans? Absolutely not. Humans are social animals and we need physical, in-person interaction with other humans as a basic need. Not online through Zoom. This CNN video by Fareed Zakaria gives examples of past pandemics.

Florence experienced the Renaissance era after the Bubonic Plague killed half its population. Philadelphia lost 10 percent of its population to Yellow Fever, and Thomas Jefferson then predicted the death of cities. Didn’t happen.

Zakaria cites that density is not the driver of the spread of Covid. In NYC, the most densely populated borough, Manhattan, has the lowest cases of infections. Within the U.S., the highest infection rates are in areas with the lowest densities. Globally, Singapore, Taiwan and Hong Kong have the highest densities but lowest infection rates. It is the management and leadership of a city that matters, not the density.

Summary

I have people from all over the world wanting to know if they can get 30 to 40 percent off Manhattan prices in this pandemic. These calls have gotten less and less, thankfully. The pricing discount has been between 7 to 11 percent. Not 30 percent or more unless you have $10 million to spend.

In Manhattan, the current inventory is by sellers who need to sell. A new round of supply will emerge in Spring 2021 and those pricings will be higher.

The good news is that Manhattan will be back to normal, now that we have the vaccine. Better technology and eventual return of the renters (as work-from-home ends) will make this market even stronger. Yes, there was and still is a discount to be had. I wish it were 30 percent, since I am a buyer and buyer’s broker.

Weimin’s article, Is now a good time to buy Manhattan real estate?

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale

Follow On Instagram