New York Property Trends

Posted by Wei Min Tan on May 25, 2021

The Manhattan, New York property market trends from 1997 to current 2021 can be divided into six periods:

(i) Up market from 1997 to 2008,

(ii) Down market due to Great Financial Crisis 2009 to 2010,

(iii) Up market 2011 to 2017, the sweet years,

(iv) Down market 2017 to 2019,

(v) Down market due to COVID-19 pandemic 2020.

(vi) Manhattan recovery post Covid 2021

I have been a Manhattan real estate agent representing investor clients from around the world since 2009 and throughout all these ups and downs, the most striking trend is this – Manhattan always recovers. During each of the down markets, there is fear, panic, uncertainties. Experienced property owners know that each downturn is not permanent and will end. Each upturn will also run its course and will end. An experienced property owner does not sell in panic, but instead expect each cycle to come and go.

Contact: tan@castle-avenue.com

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

Interested in working with Wei Min?

Click here to get in touch!

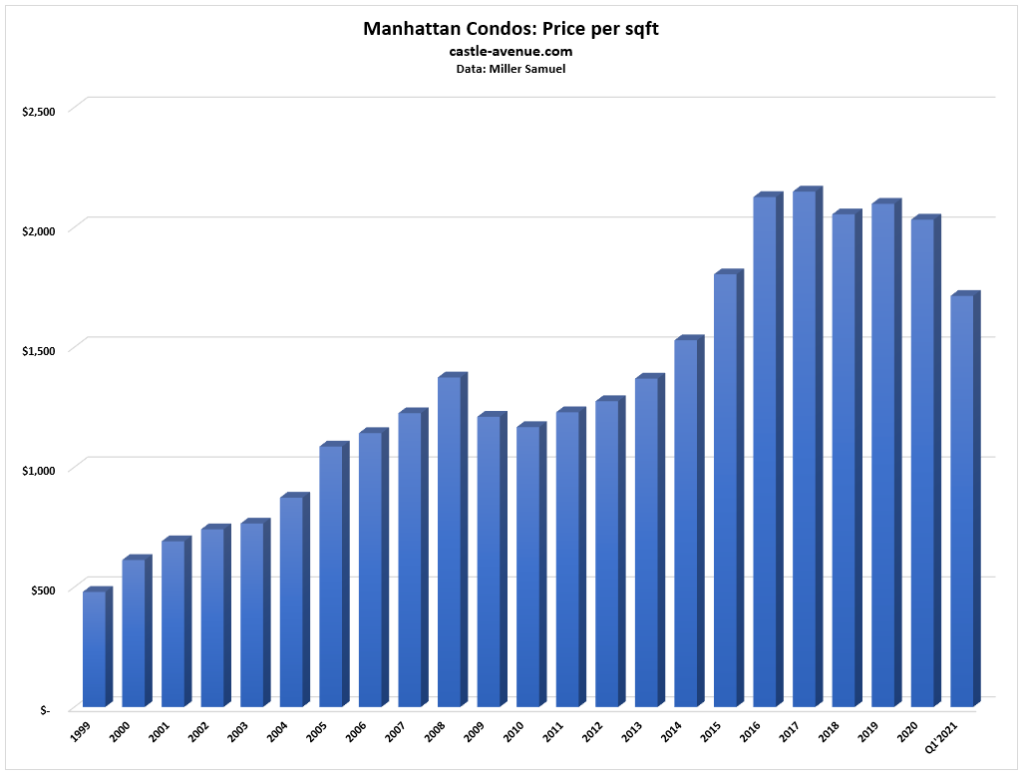

Up market from 1997 to 2008

Back in 1997, the average price per sqft of a condominium and cooperative apartment was $328. Yes, $328 per sqft, which in today’s terms is an absolute bargain. Why didn’t I buy 5 apartments at that time??? Well, back then $328 per sqft was not cheap. $328 per sqft in 1997 dollars was a lot more than $328 today. $328 was also a record high in 1997. The 9/11 attack in 2001 paused the Manhattan market for 5 weeks, after which activity resumed. Prices increased from $328 per sqft in 1997 to $1,251 per sqft in 2008. That was a pleasant up cycle – the U.S. housing bubble, which peaked in the US in 2006 and in Manhattan in 2008, played a role as well.

I clearly remember my first Manhattan apartment which I bought in 2005, at $600 per sqft. My friend said I was crazy because he had bought at $180 per sqft (before 1997).

This cycle lasted 11 years and like everything else, ended, in 2008/2009.

Down market due to Great Financial Crisis 2009 to 2010

The Great Financial Crisis happened in 2007/2008 but it didn’t really affect Manhattan property until 2009, after Lehman Brothers filed for bankruptcy in late 2008. When the rest of the U.S. was experiencing massive foreclosures, we in Manhattan saw prices continue to increase in 2007 and 2008. But when Lehman, the fourth largest investment bank at the time, collapsed due to exposure to subprime mortgages, the financial crisis finally hit Manhattan real estate.

Manhattan in 2008 was still a very financial services driven economy. A lot of highly paid finance people lost their jobs. The property market in 2009 went down 14 percent on price per sqft, from $1,251 in 2008 to $1,073 in 2009. 14 percent may seem like a lot but bear in mind the rest of the U.S. was down by between 35 to 50 percent. Reason was that Manhattan was less exposed to subprime mortgages and to heavily leveraged buyers. The strict Cooperative (Coop) boards are credited for this, ie Coop boards can reject buyers they deem not financially strong.

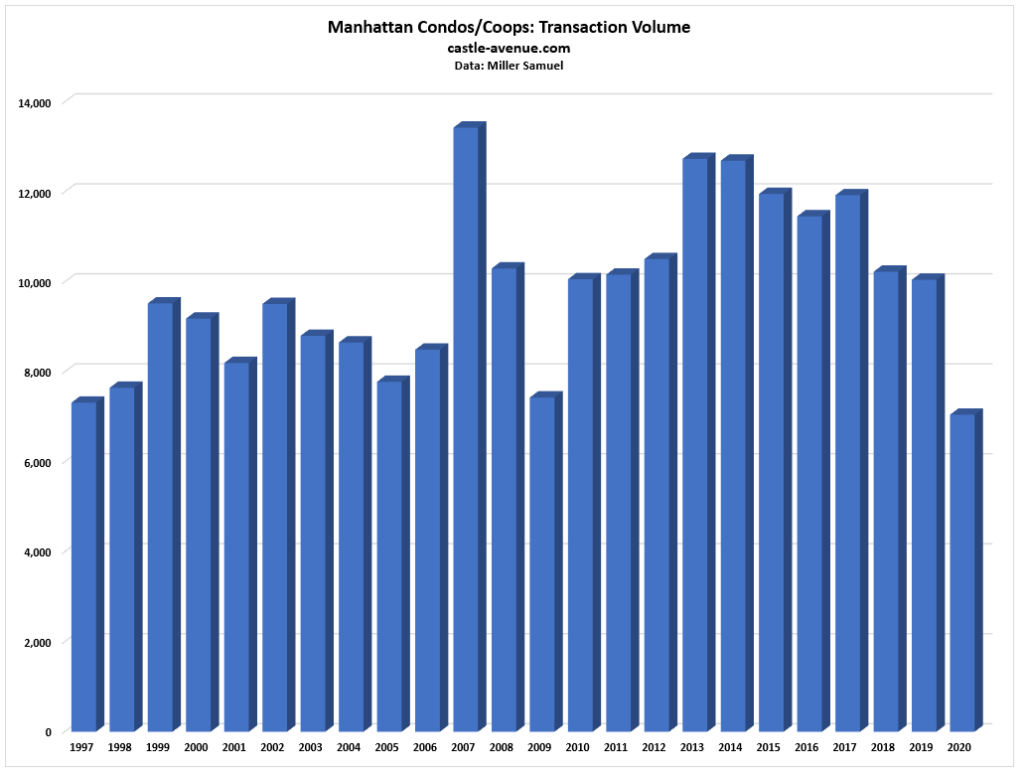

2009 was the lowest in number of transactions, at 7,400. For context, 2007 had 13,400 transactions. In 2010, price per sqft went down another 1 percent to $1,060.

Deal example: Buyer client invested in the below apartment which has a 500 sqft terrace. We got a good deal as it was during the Great Financial Crisis. Apartment was sold a few years later at a nice profit.

Up market 2011 to 2017 – the sweet times

The down market of the previous cycle was short lived. While 2009 had 7,400 transactions, 2010 saw number of transactions rose to 10,000 as investors and pent up demand came back into the market. The world is always watching Manhattan. When there is downturn, savvy investors from all over the world come in. This while a lot of people are being afraid, feeling uncertain etc. The experienced global investors are not fazed by market downturns.

Year 2011 saw prices start to recover again and was up 3 percent to $1,087 per sqft. Number of transactions held roughly the same at 10,000 transactions, similar to 2010.

From 2011 to 2017, the New York economy was strong, property market was sailing smoothly. I represented a lot of international buyers wanting to diversify and invest in Manhattan. In 2017, price per sqft was at $1,775, a 63 percent increase compared to 2011, the first year of the post Great Financial Crisis recovery.

Deal example: 111 Murray was being built and was going to be the newest new development super tower in Tribeca. Represented foreign client on the apartment below. Key driver for our decision was the location, opposite Goldman Sachs headquarters (the green glass building). We waited 2 years and upon completion, prices went up 20 percent.

Weimin’s article, Buying new property in New York

Down market 2017 to 2019

The 2017 slowdown started with the market’s reaction to decreased mortgage tax deductibility on primary residence property. Consequently, mansion tax increased and developers built more and more $5 million+ high-end apartments which resulted in a lot of new inventory. Ultimately, it’s a reaction to the sweet upcycle of 2011 to 2017. Reasons will differ but whatever goes up for 6-7 years must come down for a few years, this is the nature of markets.

Average price per sqft of a Condo and Coop in 2018 was down 4 percent to $1,707 and in 2019 another 3 percent to $1,657. Number of transactions fell from 12,700 in 2013 to 10,000 in 2019.

Weimin’s article, What is a luxury apartment in Manhattan

Down market due to COVID-19 pandemic 2020

Between Jan 1 to March 15, 2020, it appeared that the Manhattan market may be on a recovery as evidenced by the jump in sales volume. Condominium sales volume was up 19 percent in Q1. But then in mid March, COVID-19 hit New York City at unprecedented levels and NYC became the global epicenter of COVID. The real estate industry was locked down between mid March to end June 2020.

Due to the lockdown, Q2’2020 experienced a dramatic drop in sales volume. As Q4’2020 market data came out, all metrics showed improvement to Q3 but are still lower than pre-Covid levels.

The three key points from Q4’2020 data are:

(i) Sales volume was up 39 percent compared to Q3, showing recovery, but still lower than pre-Covid levels.

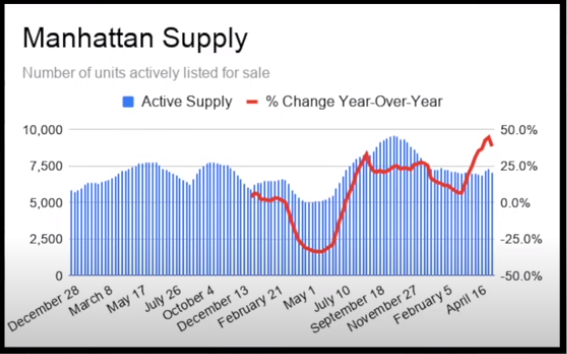

(ii) Listing inventory was down 11 percent vs Q3, but still higher than pre-Covid.

(iii) Months of supply at 13 months was a marked improvement from the 20 months of supply in Q3

Outside of Manhattan, the U.S. housing market as a whole is doing very well due to limited supply and record low mortgage rates. Even the suburbs close to New York City, in New Jersey and Long Island, are experiencing a very hot market. Properties are sold in 2 days! Only Manhattan and other large urban areas are suffering as people move out of the city.

Deal example: We negotiated the below condo in West Village during the COVID lockdown in May 2020. Obtained very favorable terms. The apartment has since been rented out at a high rental rate.

Weimin’s article, Investing in West Village.

Manhattan Recovers

The Manhattan market has been picking up since November 2020 and demand has been exceedingly strong. This is driven by:

(i) record low mortgage rates

(ii) pent up demand from 2020

(iii) optimism from the Covid vaccines

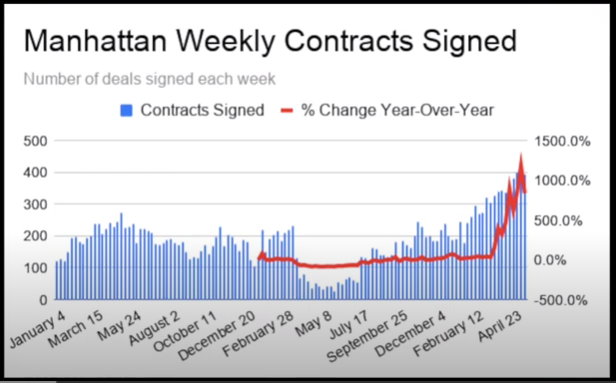

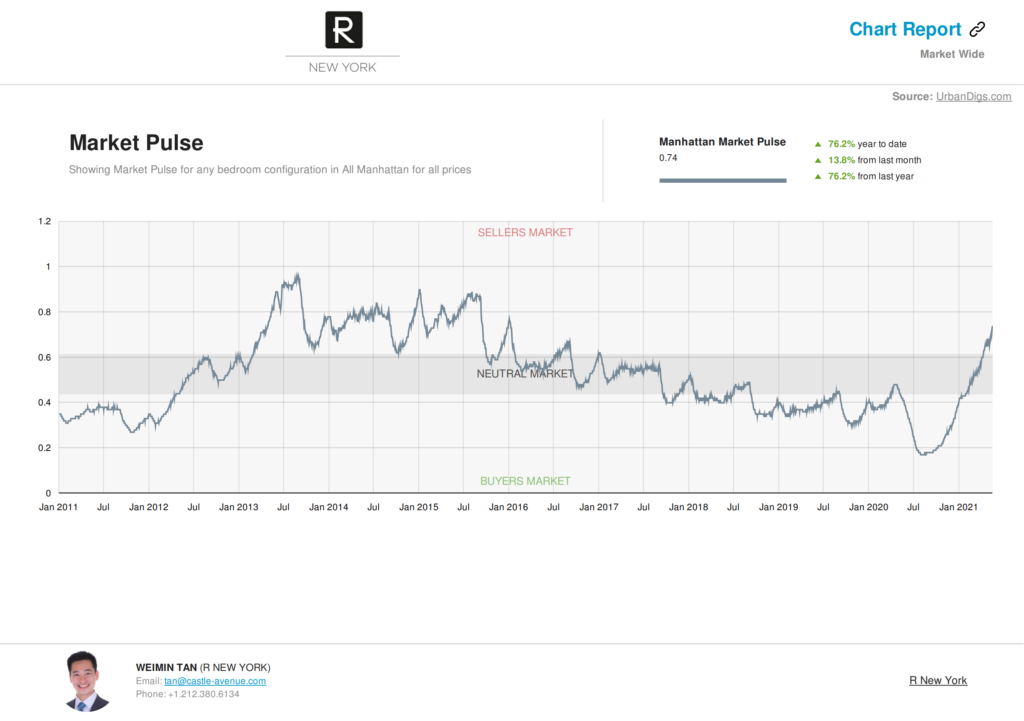

We are currently in a seller’s market and shortage of supply is an issue. Pending sales, which reflects contracts in pipeline waiting to close, have been increasing every week since the bottom of the Covid market which was from May to July 2020. Weekly contracts signed is in record territory with more than 300 contracts signed per week.

The rental market has also been picking up as companies are calling employees back into the office a few days a week. The rental market experienced price declines of 25 percent from Covid. Now inventory is being absorbed and rents are going back up.

Supply has been decreasing but now slowly edging back up.

Below: Weekly contracts signed in record territory, exceeding 300 contracts per week.

Below: Market Pulse shows we are in a seller’s market

As I write this, I am representing a buyer in bidding on a $3 million apartment in Tribeca. There is another competing buyer who is all-cash. In the past 4 weeks, I have been in several situations where we are bidding for the same property with other buyers. The market is certainly back as buyers have decided they have waited long enough and are taking advantage of crazy low mortgage rates. As a buyer’s broker, this is not necessarily a good thing, as it would be harder to get good deals for my buyer clients. But we’ll see…

Weimin’s article, Parents buying condo for child attending Columbia / NYU, what to analyze

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale

Follow On Instagram

CNBC interview on U.S. property price to income ratio

Choosing the right investment condo