December 2022 Manhattan Property Market Update

Posted by Wei Min Tan on December 15, 2022

December 2022 Manhattan Property Market Update

1) Interest rate uncertainty continues

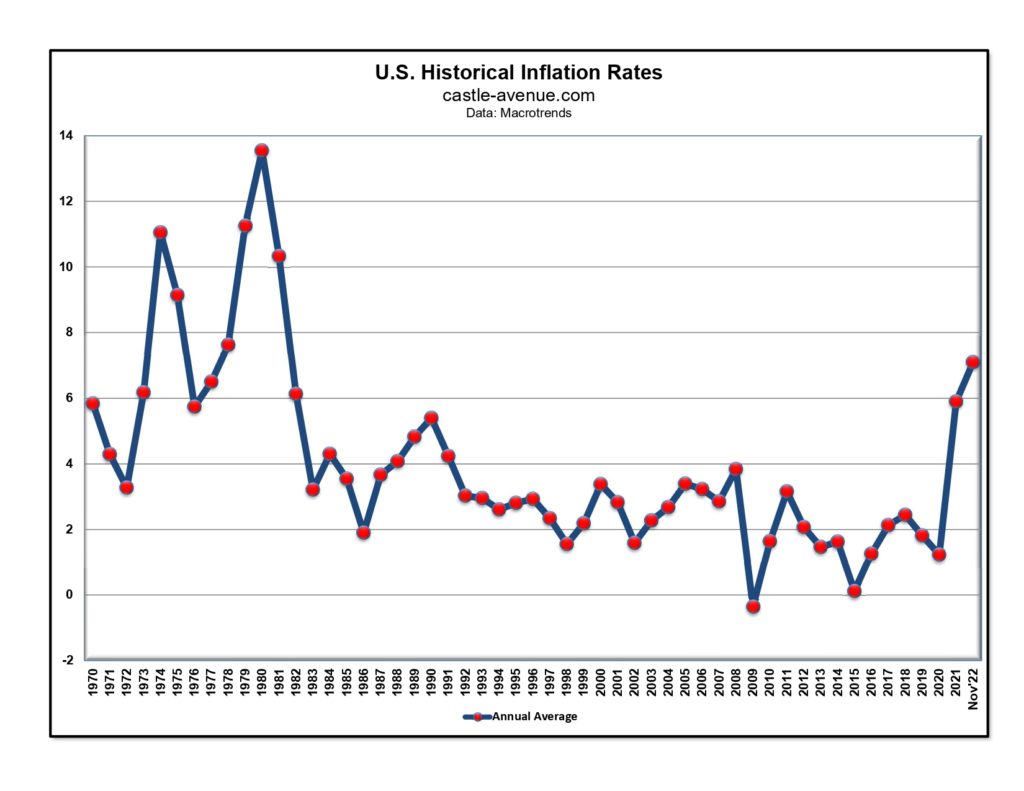

The Manhattan real estate market is on hold as the market watches the Federal Reserve’s tightening policies to fight 40-year high inflation (graph above). The Fed increased rates 0.75 percentage point four times this year and by another 0.5 percentage point in the most recent December meeting. This increased borrowing costs overall, and mortgage rates doubled compared to a year ago. Good news is that in November, inflation finally slowed to 7.1 percent, down from 7.7 percent in October and 8.2 percent in September.

Read Wei Min’s article: Manhattan property investment performance

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

The Fed’s tightening policy is expected to continue, albeit at a slower pace. All this in an attempt to bring inflation down to 2 percent while avoiding a recession.

Buyers who could no longer afford to buy with the current 7 percent mortgage rate are now renting instead. Those who are still looking to buy with a mortgage are waiting for the Fed’s tightening policies to end in hopes that mortgage rates will decrease. Meanwhile, there is limited inventory as sellers are not listing their property, understanding the current market wouldn’t get them the best price. Cash buyers have a wait-and-see outlook. As a result, the sale market is quiet and slow.

2) Rental market slows

As rents increased more than 20 percent compared to a year ago, renters who have not found a new place are now opting to stay put and renew their leases. Because the rate increase with a renewal is less than getting a new place with higher rent and having to pay the fees associated with moving. In addition, we are now in the slowest rental season of the year – Christmas and winter.

Read Wei Min’s article: Investing in Manhattan condo to rent out

The slowdown happened about 2 months ago. We are now seeing more concessions. Landlords are paying broker fees as apartments are sitting on the market longer. In November, rental prices were 19 percent higher than a year ago, but down 3.4 percent compared to October. Number of new leases in November were down 39 percent compared to October.

3) What’s the opportunity?

The present moment is a buying opportunity for all-cash buyers. Unlike buyers needing financing, cash buyers are not exposed to the current mortgage rates, which doubled vs a year ago. Nor are they concerned that if they buy now, mortgage rates may go down after the Fed’s tightening policies end and inflation is in check.

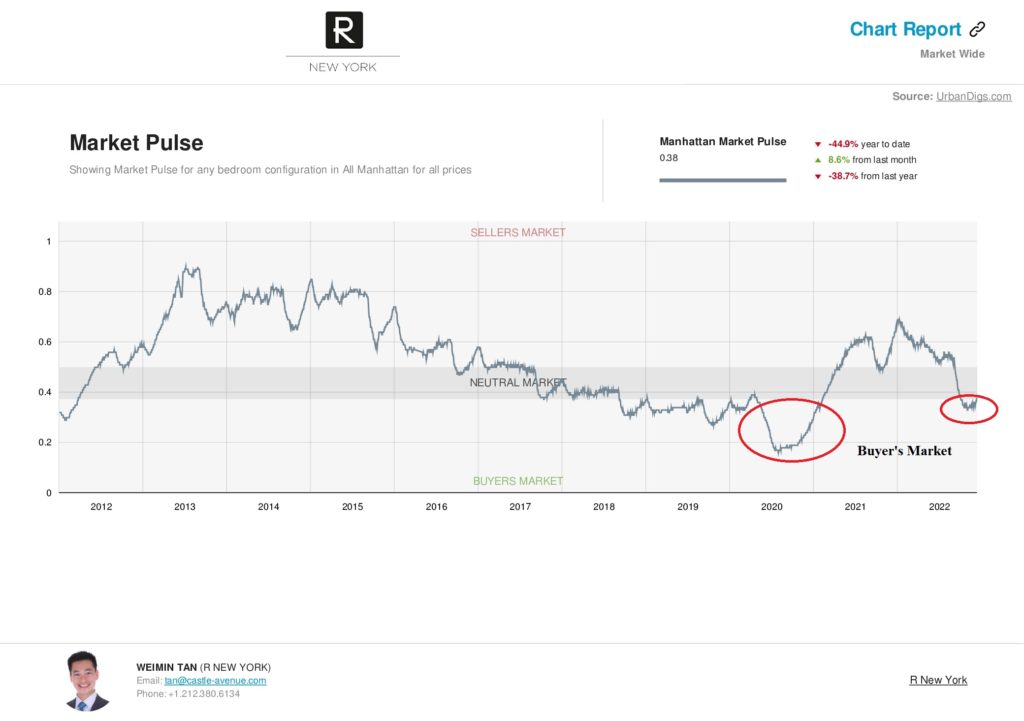

In new developments, developers are offering term and price concessions. The sale volume is low, so it’s easier to negotiate compared to 2021 when it was a total seller’s market. This turnaround has been the fastest in my experience. In 2020, it was a buyer’s market because of Covid. In 2021, the market rebounded, and we had the highest sale volume ever recorded. Now we are in a buyer’s market again.

In the overall U.S. real estate market, prices were up 40 percent post Covid. That explains why many economists are expecting a price correction of up to 20 percent. However, in Manhattan, prices are still around the pre-Covid level, definitely didn’t increase by 40 percent! In 2019, average price per sqft for a condo was $2,098. The bottom of Covid saw prices go down to $1,750 per sqft. The latest Q3’2022 data has prices at $2,080 per sqft.

I expect prices to decrease around 5 percent because of interest rates, but not more than that. Manhattan prices are stable because sellers have more financial flexibility. They’d rather hold or take a condo off market than to sell at a loss.

Read Wei Min’s article: Property investment in New York

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale