Manhattan property market trends

Posted by Wei Min Tan on November 6, 2023

Manhattan is one of the most desirable property markets in the world, and for good reason. Manhattan is the financial capital of the world, the East Coast’s Silicon Valley and home to world-class culture and entertainment. But what’s the state of the Manhattan property market now as we are in the last quarter of 2023?

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

Overall condo and coop property trends

The overall theme in the current Manhattan property market is 20-year high mortgage rates and limited supply. Closed sales volume at 717 in October 2023 was 30.4 percent lower than a year ago. Contracts signed was higher for October 2023, with 793 contracts signed, up 9.2 percent from last year. The average price per square foot for a Manhattan property (average of condo and coop) was $1,363, 5.3 percent lower compared to last year.

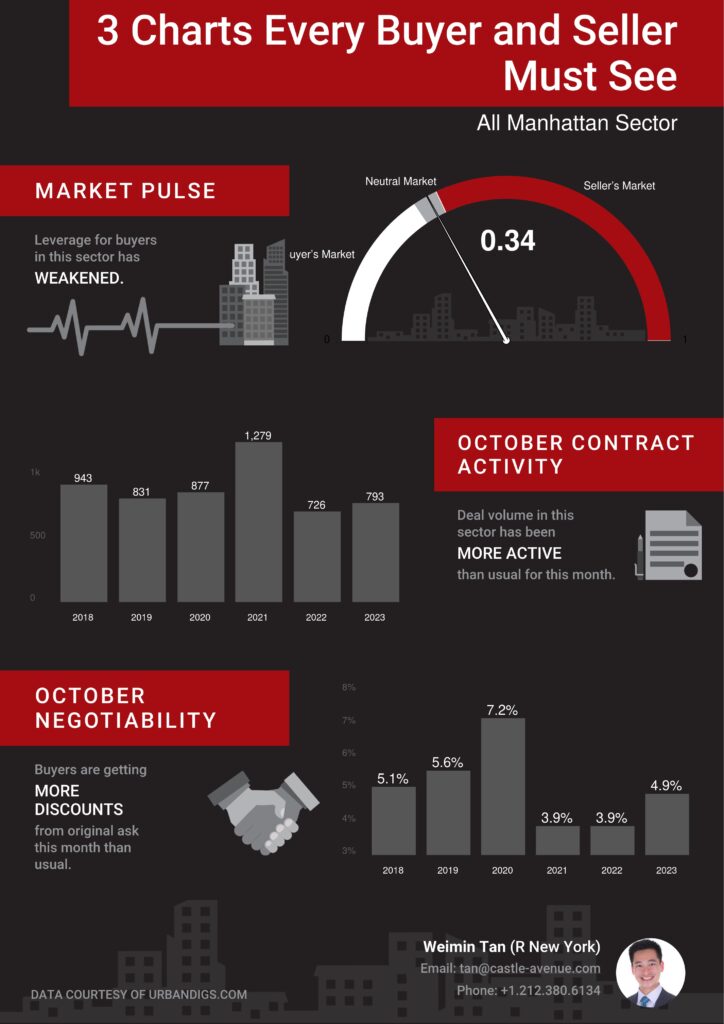

3 Charts Every Buyer and Seller Must See

Buyer leverage in the Manhattan property market weakened in October 2023 and it’s now a neutral market with the Market Pulse at 0.34. In terms of price negotiability, buyers are getting more discounts from original ask this month than last year, with a median discount of 4.9 percent in October 2023, up from 3.9 percent in October 2022. This is a sign that sellers are willing to negotiate on price in order to sell their property. Peak negotiability was during Covid 2020 when it was at 7.4 percent.

Manhattan Property Trends for Supply, Demand, New Listings, Contracts Signed

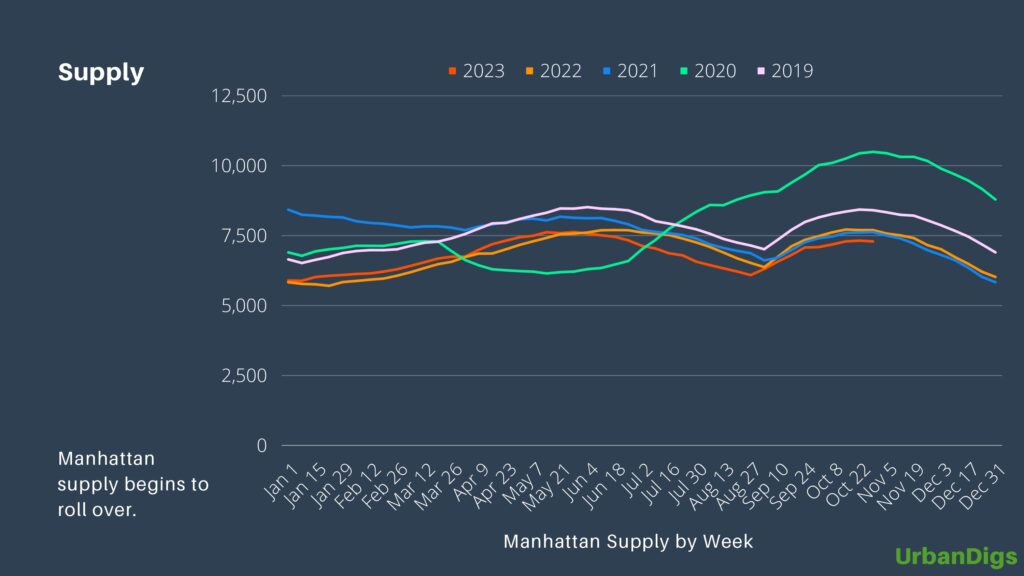

Property supply ticks up over 7,000 units (red line) but still short of historical supply levels. Sellers are wary that if they sell, the mortgage expense on the new property they buy will be too high. As such, many sellers are staying put at their current property.

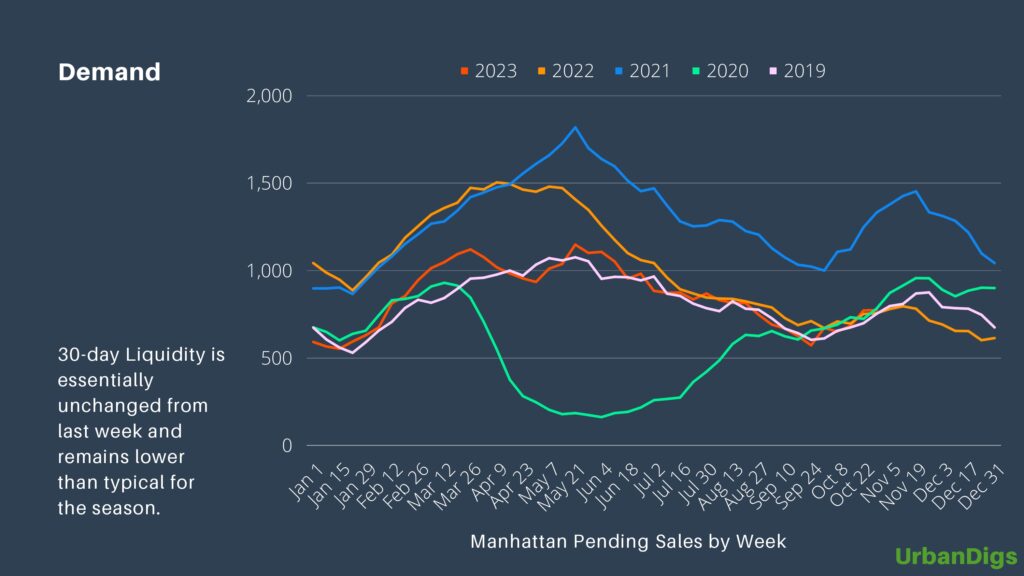

Property demand continues the downward trend and is even lower than during Covid 2020.

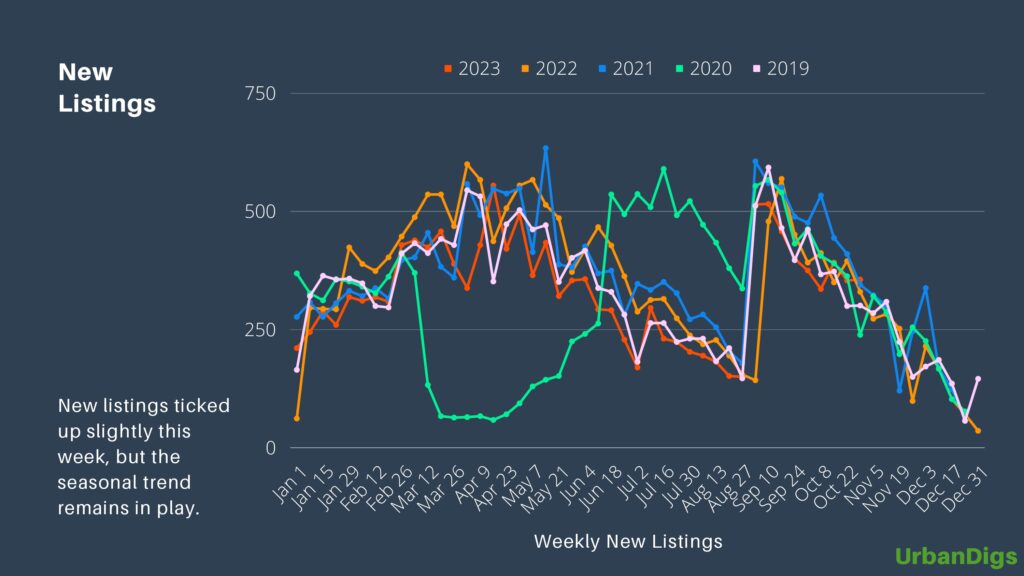

New listings remain on par with the past few years

Contracts signed thus far in 2023 is lower than in 2021 and 2022, understandably because the last two years experienced record sales levels. Surprisingly, cumulative contracts signed is higher than pre-pandemic 2019.

Condos vs. coops

The two main types of property in Manhattan are condos and coops. Condos are individually owned, while coops are owned by a corporation and residents own shares in the corporation.

The condo market in Manhattan is performing slightly better than the coop market. In October 2023, the median sale price for condos was $1.493 million, down 3.8 percent from the previous year. The median sale price for coops was $805,138, down 1.5 percent from the previous year.

Neighborhoods to watch

In addition to the neighborhoods of Upper West Side and Upper East Side, which are close to Central Park, Tribeca, known for low-rise buildings and restaurants, and SoHo, the fashion neighborhood, there are a few up-and-coming neighborhoods in Manhattan that are worth watching in 2023.

Hudson Square is home to Google’s second campus and is experiencing a surge of development, with new restaurants, shops, and developments opening. Lower East Side is another up-and-coming neighborhood, with a vibrant nightlife, new restaurants, and a development called Essex Crossings, which features a Target, Trader Joe’s, and AMC movie theater.

Looking ahead

The Manhattan property market is expected to remain relatively stable in the coming months. Currently more than 60 percent of buyers are all-cash. The factors to watch that will impact the market are mortgage rates and market supply.

Buyers should carefully consider their financial situation and long-term goals before purchasing a property in Manhattan. Sellers should be prepared to price their homes competitively as the market is 2023 is very different from the seller’s market environment of 2021/2022.

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale