May 2022 Manhattan Property Market Update

Posted by Wei Min Tan on May 18, 2022

The key points for the May 2022 Manhattan Property Market Update are recession concerns, strong buyer demand and rents going up/high cap rates.

May 2022 Manhattan Property Market Update

Recession Concerns

The first point is recession concerns. The job market is very hot, while consumer spending is high. Oil prices are also high because of the war in Ukraine. In addition, supply chain problems mean that goods are taking longer to arrive and that’s another reason driving prices up.

In March, the inflation rate was at 8.5 percent which was the highest in 40 years. To combat high inflation and rein in the economy, the Federal Reserve is increasing interest rates. The concern is that higher interest rates is going to pull back the economy and cause a recession.

Conversely, some are saying that a recession wouldn’t be likely because for a recession to happen, there has to be job losses. With the way the labor market is going right now, it is less likely to have job losses because companies are hiring aggressively and there are not enough employees to fill available jobs.

Read Weimin’s article: How recessions impact Manhattan property

Strong Buyer Demand

In the sale market, supply is low and it is still a seller’s market. Buyers who are trying to lock in the still historically low interest rates are having a tough time finding available property.

Rents Going Up/High Cap Rates

The rental market is the hottest it has ever been. Rents are even higher than pre-pandemic levels. That is resulting in high cap rates, the rental yield for landlords. It is a good time to be a landlord right now, especially if the landlord bought the property several years ago when prices were lower. For our clients’ apartments, we have been increasing rents by anywhere from 20 to 50 percent.

Read Weimin’s article: Is now a good time to invest in Manhattan, New York residential property?

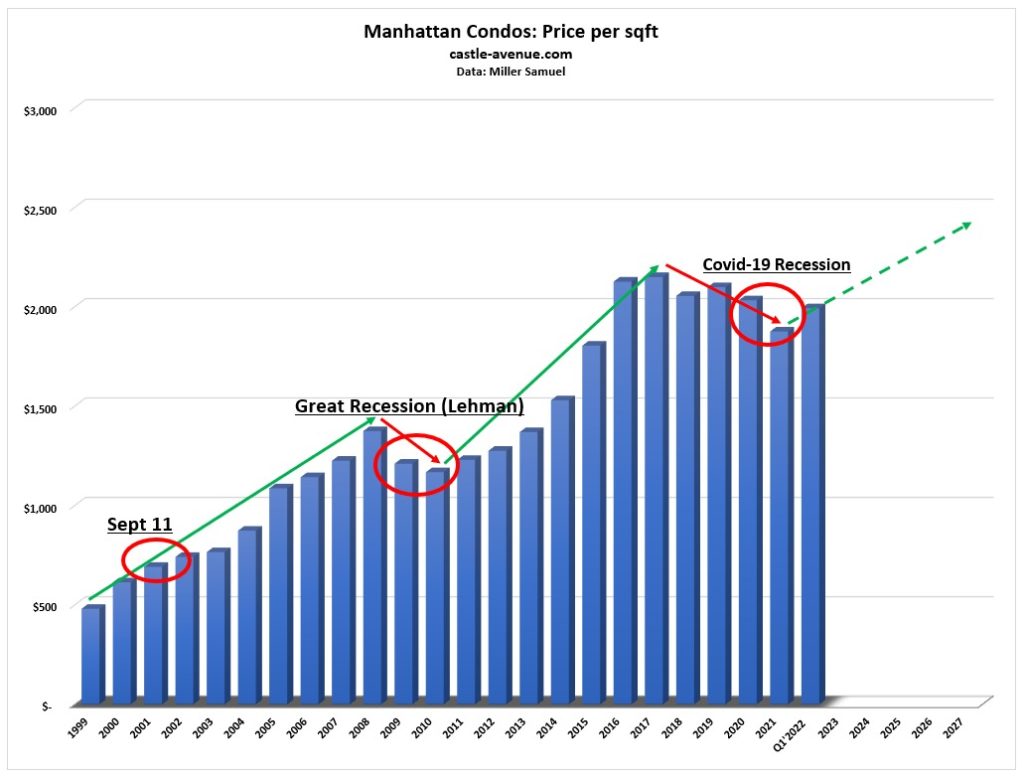

Manhattan property (condo) performance during the three prior recessions

September 11, 2001 — The price per square foot didn’t drop at all. The market stalled for about four weeks but after that, it was very robust. Then prices went up until 2008 when the subprime crisis happened and Lehman collapsed.

Lehman Collapse — The subprime crisis’ impact on Manhattan was delayed by one year. It hit the rest of the U.S. in 2008 but only hit Manhattan in 2009 and stretched out to 2010. Manhattan price per square foot was down by about 15 percent when the rest of the U.S. was down by about 35 percent. After Lehman, prices continued to go up until the prior peak of 2017 when it was around $2,200 per square foot. The market slowed down from 2017 to 2019. Sales activity in the beginning of 2020 was very strong and we thought it was going to recover but then Covid hit.

Covid-19 Recession — The market closed for three months, March to June of 2020. Q1’2021 was the lowest in terms of price per square foot because it reflected deals from late 2020. From the beginning of 2021 until the end of 2021, and stretching into 2022, prices have been going up. Prices in Q1’2022 continued increasing but it is still lower than the 2017 level.

Looking at historical trend, prices go up for several years, comes down for about 2 years during a recession. Then prices go back up for several years. This is why we are predicting prices to go up for the next 6-7 years.

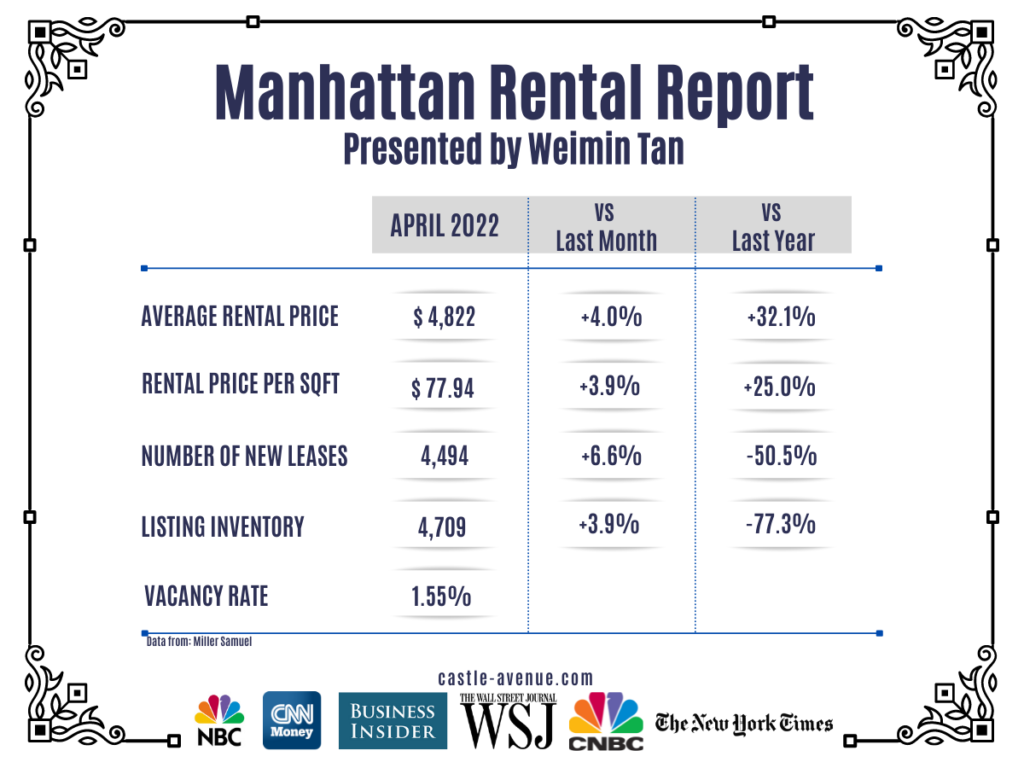

Manhattan Rental Report

According to the latest rental report from Miller Samuel, rents have been increasing and inventory has been decreasing. The average rental price and rental price per square foot went up by 32 percent and 25 percent vs a year ago. The number of new leases was higher than last month but lower than a year ago. Listing inventory was at 4,709, 77 percent lower than a year ago. Peak inventory was in late 2020 when it was about 15,000 units. The vacancy rate as of April 2022 was 1.55 percent. One year ago, it was more than 11 percent.

This shows what a strong rental market we are in right now.

Read Weimin’s article: 2022 Cost of Manhattan, New York Flats

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale