March 2023 Manhattan Property Market Update – Weimin Tan

Posted by Wei Min Tan on March 21, 2023

The collapse of SVB, the most significant banking crisis since Lehman in 2008, is causing concern over the stability of midsize banks, possible tightening of lending standards and whether the Manhattan property market will be affected. It’s too soon to tell, but I haven’t seen an impact yet. Real estate traffic the past 2 weeks has been strong – a lot of viewers at open houses given the Spring season, contracts signed and to the relief of buyers, more inventory is coming out.

Read Wei Min’s article: Investing in Manhattan real estate using 1031 Exchange strategy

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

SVB Collapse

While there was an initial expectation that the collapse would result in decreased mortgage rates, this has not yet materialized. Amid the financial market’s volatility, investors have been flocking to the safety of treasuries, which has led to a decrease in the 10-year treasury yield over the last 2 weeks. However, this has not translated into decreased mortgage rates. As background, mortgage rates track the 10-year Treasury yield. As the 10-year’s yield decreases, mortgage rates are expected to decrease as well.

10-year Treasury yield

First Republic is the current bank under scrutiny due to concerns about its deposits. The majority of First Republic’s deposits (around 65 percent) are not FDIC insured. This leads to concerns that there may be a bank run, which could create a situation similar to the collapse of SVB. A consortium of banks led by JP Morgan Chase is providing a $30 billion capital infusion into First Republic, yet FRC’s stock price continues to decline (by 47 percent on Monday alone).

First Republic is a major player in mortgage lending. However, it remains to be seen how this will impact the Manhattan property market. Even if First Republic decreases mortgage lending activities, buyers still have all the other banks to choose from including JP Morgan Chase, Citibank, Wells Fargo etc.

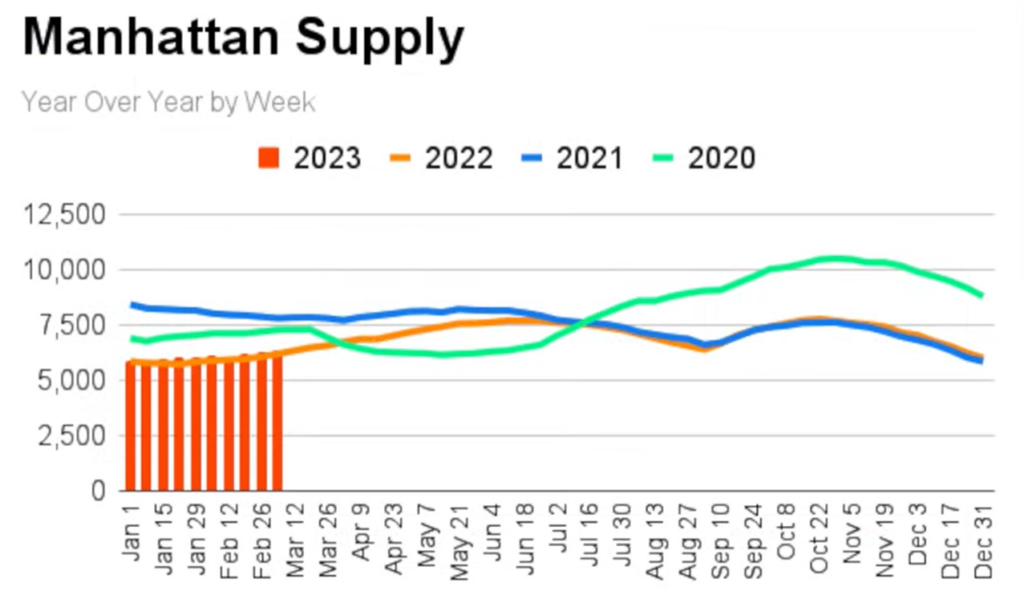

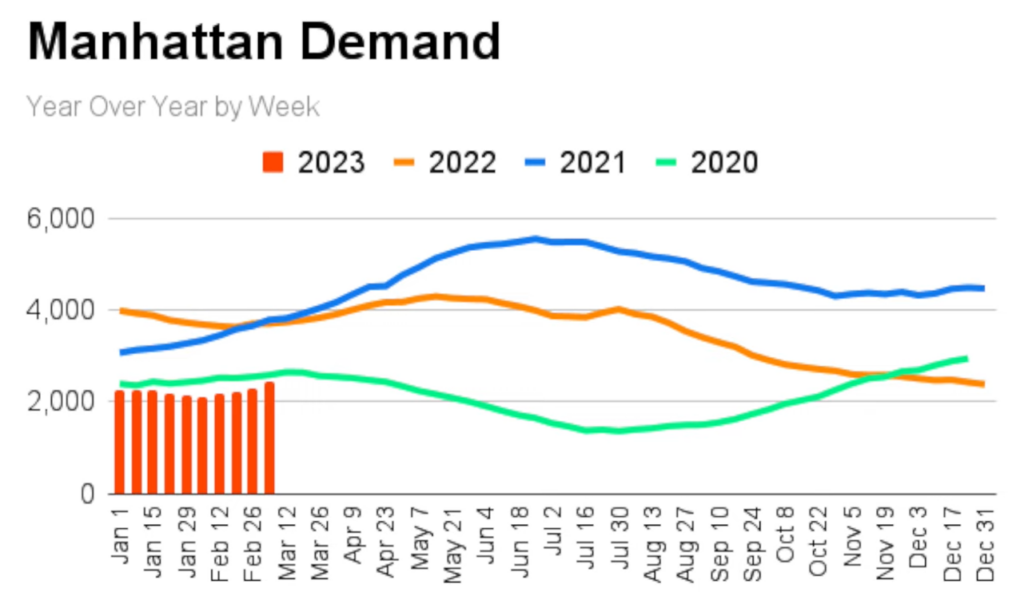

Supply and Demand Increasing Slightly

As we approach Spring, there has been an increase in supply as sellers list their properties for sale. Demand for properties has also been increasing, with good traffic at open houses and accepted offers.

Read Wei Min’s article: Tribeca luxury condo with high rental return close to World Trade Center, Goldman Sachs

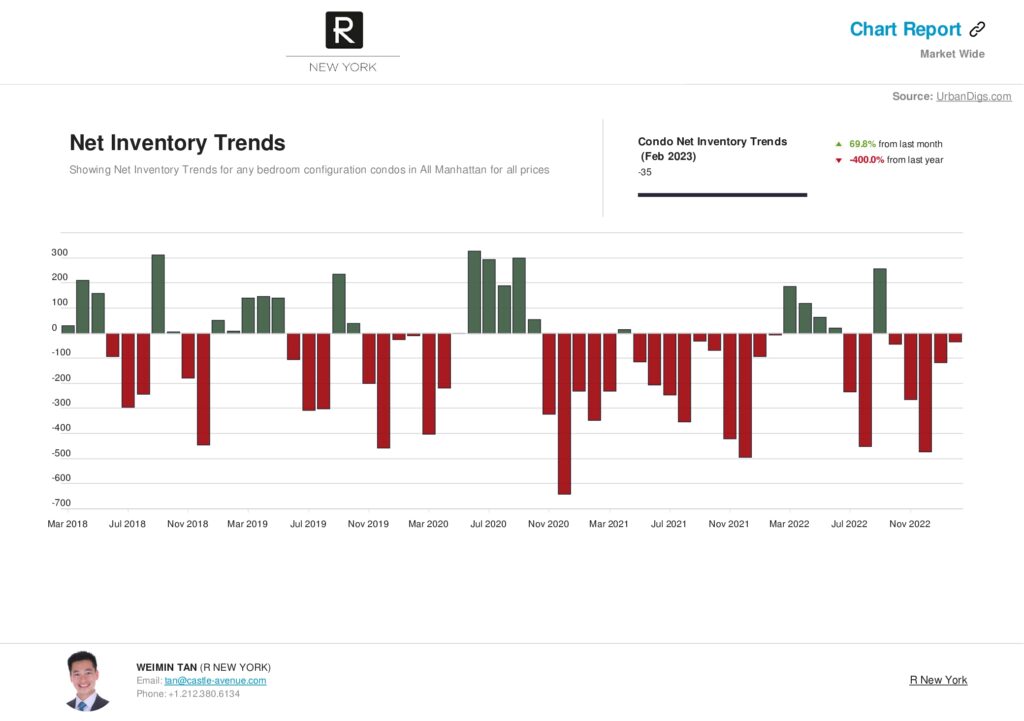

Net Inventory

Net inventory for condominiums is approaching flat after being negative for six months. This is a positive development for the real estate market in Manhattan. The increase in mortgage rates from mid 2021 until late 2022 led to a significant slowdown in sales volume. The mortgage rate increase was more than double, and this led to 50 percent of Manhattan buyers (those who need financing) being removed from the market.

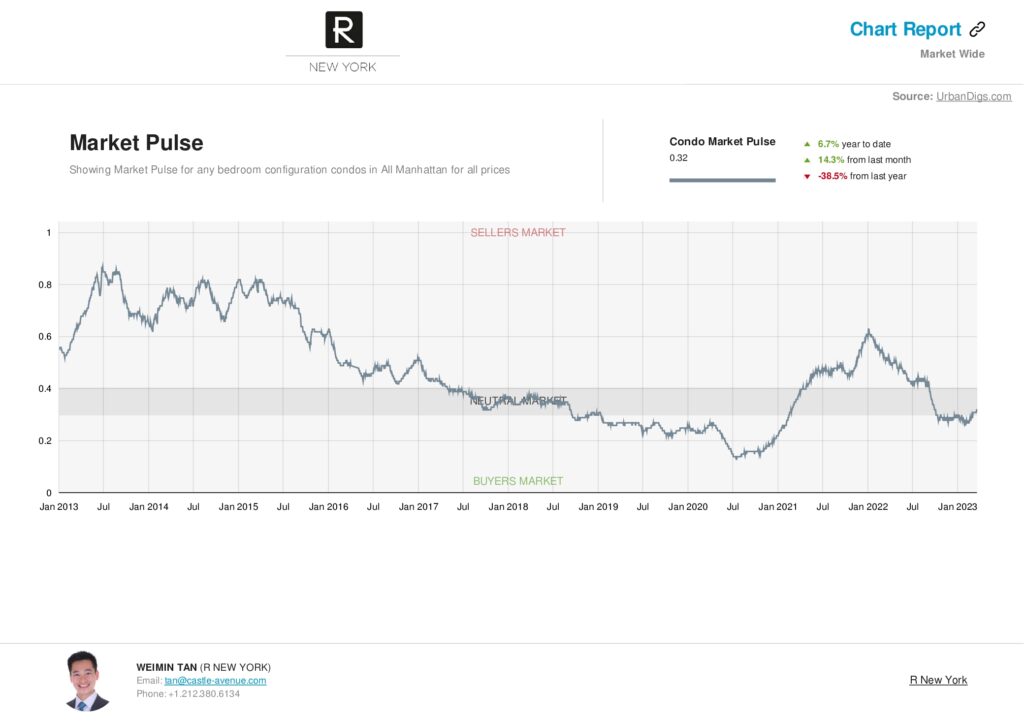

Meanwhile, the Market Pulse for condos has been recovering, going towards neutral territory as indicated by the graph below.

Rental Market

The rental market is showing an untick as well after being very slow from November to January. The slowdown was because of the seasonally slow winter months and because of the 20+ percent jump in rents from inflation.

In February, new leases increased by 17 percent compared to January, and by 44 percent compared to last year. Listing inventory also increased, with February’s listing inventory up 32 percent compared to last year. The vacancy rate is currently at 2.5 percent, which is an increase compared to last year but still the lowest in the country.

Read Wei Min’s article: Manhattan Real Estate Prices

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale