Manhattan Real Estate Prices

Posted by Wei Min Tan on December 13, 2023

Manhattan real estate prices enjoy stable appreciation over the long term because of limited supply. While a typical U.S. city has ample land for developers to constantly build more houses, the amount of space available for new apartment buildings in Manhattan is extremely limited. This limited supply explains why global investors look to Manhattan real estate as a means of asset preservation and diversification.

Manhattan real estate is generally divided into condos and coops. Condos are more expensive because a condo comes with real estate title, does not require board approval and has no restrictions on renting out. Meanwhile, a Coop does not have real estate title but rather the Coop owner gets a proprietary lease. Coops require board approval for each transaction and the board can reject a transaction without reason and consequence. Also, there are restrictions with renting out.

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

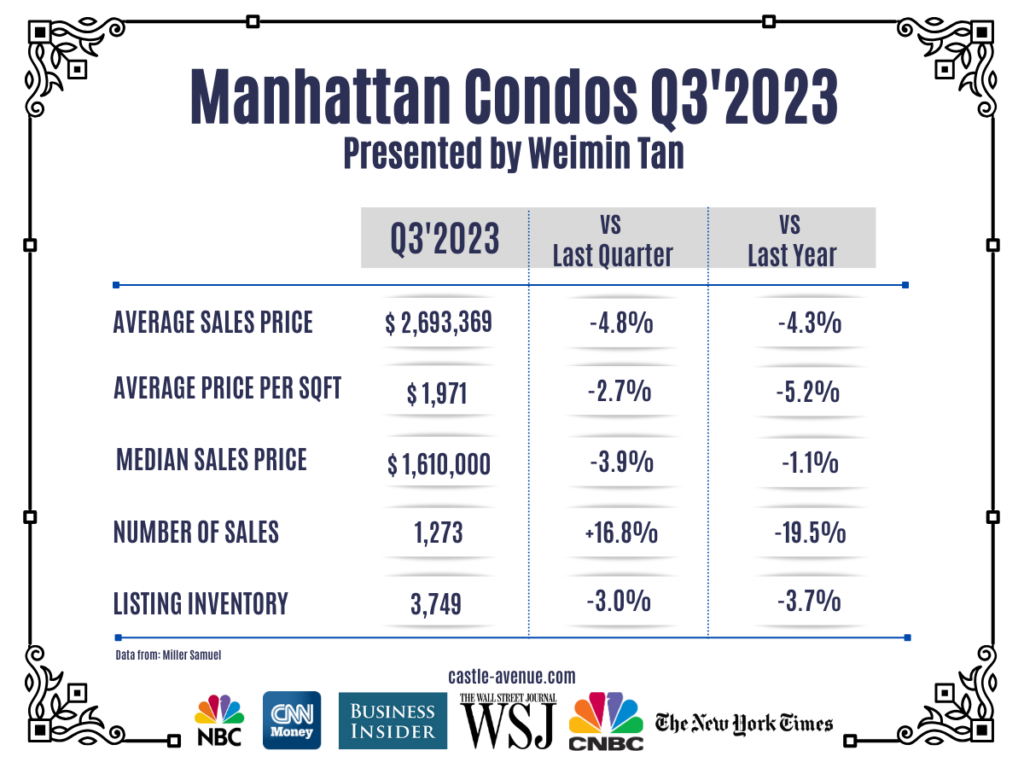

Manhattan Condo Prices

The chart above shows Q3’2023 Manhattan condominium sale prices as provided by Miller Samuel. Average sale price of a Manhattan condominium was $2.69 million while average price per sqft was $1,971. Number of sales was down 19.5 percent compared to prior year because of the doubling of mortgage rates due to the Federal Reserve’s interest rate hike actions.

Inventory decreased 3.7 percent compared to prior quarter because sellers are currently holding out from selling during this slow real estate market.

Weimin’s article, How to invest in Manhattan property, profit and repeat.

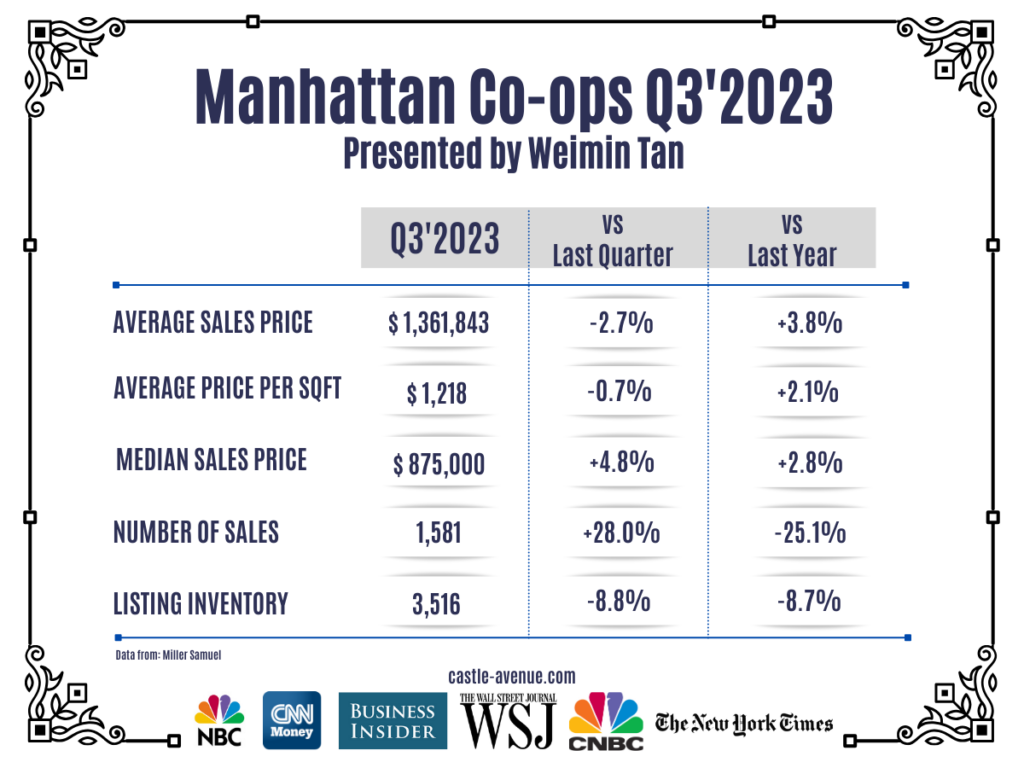

Manhattan Coop Prices

Cooperatives (Coops) are less expensive than condos because a Coop does not own real estate title, requires board approval for each sale and there are limitations to renting out. The table above shows the average price of a Coop at $1.36 million and an average price per sqft of $1,218. Notice that the average price per sqft of a Coop is about 40 percent lower than a condo.

Read Wei Min’s article: Co-op versus Condo in Manhattan

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale