Manhattan Property Investment for Singaporeans

Posted by Wei Min Tan on February 21, 2025

Manhattan Property Investment for Singaporeans is a hot topic for many Singaporeans seeking to diversify their investment portfolios. As one of the world’s most iconic and sought-after real estate markets, Manhattan, New York offers unique opportunities and challenges for investors from the Lion City. This article will delve into key aspects that Singaporeans should consider when exploring Manhattan property investment.

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

Understanding the Manhattan Real Estate Market

The Manhattan real estate market is renowned for its dynamism and exclusivity. Luxury high-rises, historic brownstones, and charming pre-war apartments dominate the landscape. Prices are consistently among the highest globally, driven by strong demand from domestic and international buyers, limited supply, and the allure of living in one of the world’s most vibrant and dynamic cities.

Compared to the Singapore real estate market, which is characterized by high land scarcity and government regulations, Manhattan offers a different investment landscape. While Singapore boasts a highly developed and government-regulated market, Manhattan presents a more market-driven environment with greater price volatility and a wider range of property types.

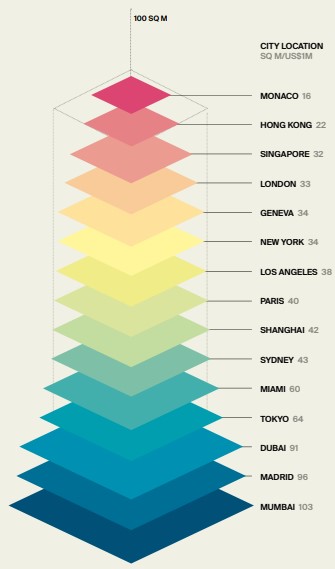

Data above from the Wealth Report by Knight Frank reveals that while both cities are considered prime global real estate markets, Singapore offers slightly less space for the same investment compared to New York. In other words, New York provides approximately 6.25% more prime property for US$1 million than Singapore (34 sq m vs 32 sq m). While the difference in square meters between New York and Singapore might seem small at first glance, it becomes more significant when considering larger investments. For example, for US$10 million, you would get approximately 340 square meters in New York versus 320 square meters in Singapore.

Read Wei Min’s article: New York (Manhattan) Property Investing Strategies

Deal Example: Client’s condo in Midtown East, close to United Nations, Blackstone, Blackrock headquarters. We booked at pre-construction, rented out immediately after closing.

Navigating the Investment Process

Investing in Manhattan property for Singaporeans involves several key considerations. Firstly, understanding the legal and regulatory framework is crucial. This includes navigating foreign ownership regulations, tax implications, and understanding local real estate laws. These laws can be complex and vary, so professional guidance is essential.

Secondly, finding the right property and securing financing can be complex. Singaporean investors will need to work with experienced local real estate agents, lawyers, and financial advisors to navigate the intricacies of the Manhattan market. It’s absolutely vital to choose professionals with a proven track record of working with foreign buyers. Real estate transactions have nuances that are amplified when dealing with international clients, from understanding currency exchange issues to navigating different legal and tax systems.

Ideally, Singaporean investors should seek out professionals who have specifically worked with buyers from Singapore. Experience with Singaporean clients indicates familiarity with their specific needs, cultural context, and potential challenges they might face when investing abroad. This specialized knowledge can streamline the process and minimize potential misunderstandings. For example, a lawyer familiar with Singaporean tax laws can help structure the purchase in a tax-efficient manner.

Options for financing include cash purchases, mortgages from US banks, and potentially utilizing Singapore-based financial institutions with international lending capabilities. A financial advisor with cross-border expertise can be invaluable in exploring these options and finding the most suitable financing solution. They can also help navigate currency exchange considerations and manage the complexities of international fund transfers.

Deal Example: Investor client’s condo at Devonshire House, one of Manhattan’s distinguished prewar condos designed by Emery Roth. Rented out in 2 days after receiving multiple applications. This was our prewar condo investment strategy and it worked out tremendously well.

Read Wei Min’s article: Buying property in New York to rent out

Potential Returns and Risks

Manhattan property investments offer the potential for capital appreciation. However, it’s important to understand that returns in Manhattan are not necessarily higher than in other markets, such as Singapore. While the city’s strong economic fundamentals and global appeal contribute to long-term value, several factors can impact an investor’s bottom line.

One significant challenge is the tenant-friendly legal environment in New York City. Dealing with delinquent tenants can be a lengthy and costly process, often taking nine months or more for court proceedings to resolve. This extended timeline can significantly impact cash flow and profitability.

Furthermore, the costs associated with property maintenance and renovations in Manhattan can be substantial. Condominium and co-op boards often have stringent requirements regarding materials, contractors, and work schedules, leading to higher expenses for painting, repairs, and upgrades compared to other locations.

Investing in Manhattan property presents a unique opportunity for Singaporeans seeking to diversify their portfolios and gain exposure to a world-class real estate market. However, thorough research, careful planning, and expert guidance are essential to navigate the complexities of this dynamic market. By understanding the market dynamics, navigating the investment process, and carefully assessing the potential returns and risks, Singaporean investors can make informed decisions and potentially achieve their investment goals in the heart of Manhattan.

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale