Buying Property in New York

Posted by Wei Min Tan on February 28, 2024

Buying property in Manhattan, New York is a big decision even for sophisticated people with strong financials. In the context of buying for primary residence, some believe one should buy a property as soon as possible, while others do the cost benefit and prefer to rent (despite having enough funds to buy). Here are the key considerations on whether to buy or rent.

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

Buying vs Renting in Manhattan, New York – the basic analysis

The basic rent vs buy analysis is to look at the cashflow of each.

How much does it cost to rent and how much to buy assuming the down payment you have? For example, to rent a two-bedroom condo in a luxury building costs $10,000 per month. But to buy the same two-bedroom condo, it costs $2.6 million. With a 20 percent down payment and a mortgage rate of 5.5 percent, the monthly carrying costs, including common charges and property taxes, would be $15,500. From a cashflow perspective, it’s more expensive to buy. But what if the down payment is higher, say at 40 percent? The monthly cost to buy decreases.

Buying benefits from appreciation, but renting does not. If the property appreciates 5 percent a year, the homeowner’s net worth grows by that amount. But the renter’s net worth does not.

Read Wei Min’s article: Buying property in New York to rent out

Buying vs Renting in Manhattan, New York- opportunity cost of other investments

Sometimes people prefer renting despite having the funds to buy. This is because there is an opportunity cost of tying up equity in a property. By renting, the renter’s equity that otherwise would be used for the down payment can be invested in the financial markets, e.g. the S&P500, hedge funds, private equity funds etc. The historical returns of the S&P500 ranges from 7 percent to 11 percent per year, depending on the timeframe used.

From this point of view, it only makes sense to buy if the appreciation from owning is higher than what the investor can earn from the financial markets. It takes financial modeling, but you get what I mean. Hence, this is another way of looking at it.

Ultimately, it’s not all about maximizing returns. Renting leaves individuals at the mercy of landlords, who may reclaim the property or increase rent. However, purchasing a property offers stability. While the appreciation of Manhattan condos may not yield the highest returns compared to other investments, buying is primarily a lifestyle choice. It provides stability and eliminates the risk of having to move when the landlord wants the property back. Owning a property ensures peace of mind that there will always be a place to call home, a stability that renting cannot provide.

Property types to buy in New York

In Manhattan, residential properties are divided into cooperatives (co-ops), condominiums, and multifamily/mixed-use buildings. Only co-op/condo buildings allow individual apartment purchases, while rental or mixed-use buildings require buying the entire structure.

Within the apartment category, co-ops require board approval and have limitations on renting out. This is because someone who owns a co-op apartment is technically an indefinite tenant of the building and the co-op owner does not own real estate title. Meanwhile, condo owners get real estate title which allows flexibility in renting out. Condos also do not require board approval. Given the differences, condos are about 50 percent more expensive than co-ops.

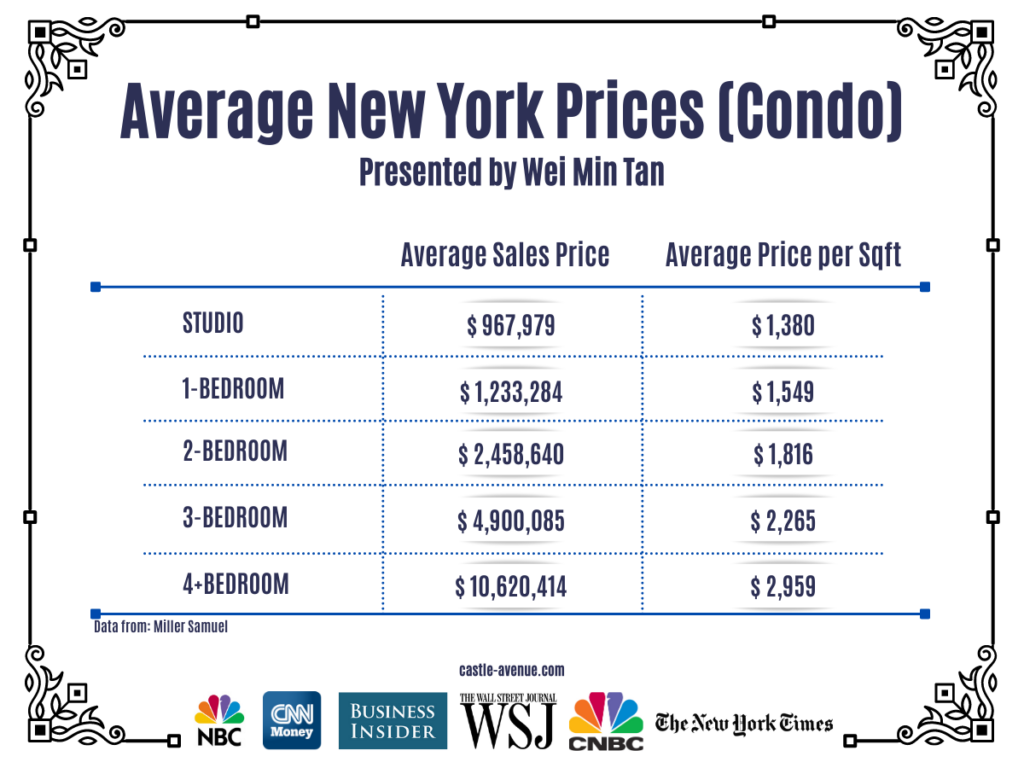

Condo Prices in New York

In Manhattan’s real estate market, studios range from $500,000 to $1.2 million and one bedrooms from $800,000 to $2.5 million. Two bedrooms range from $1.8 million to $4.5 million. Three bedrooms start at $3 million, while four+ bedroom condos are averaging at $10.6 million.

We usually guide investment buyers to buy studios to three-bedroom apartments. Four-bedroom and above are huge by Manhattan standards with commensurately high rents. It is more difficult to find a tenant for apartments that are four bedrooms or larger. Post-Covid, we’ve successfully guided clients towards investing in three-bedroom condos to meet the demand for larger apartments.

Read Wei Min’s article: How to Buy New Launch Property in Manhattan

Client’s luxury condo in Tribeca with tree-line views. This was purchased as an investment property and always rented out at high rental yields.

Costs associated with buying and selling a condo in New York

Transaction costs at purchase are about 2 to 5 percent of the property price for an all-cash purchase, higher if buying new development. Reason is that with new developments, the buyer pays extra expenses such as transfer taxes, contribution to the resident manager’s apartment and working capital etc.

At the sale, the transaction costs are about 5 to 8 percent of the property price. These are the same for foreigners and U.S. citizens.

How we select property

When selecting a Manhattan condo, we consider three key criteria: location, building, and the apartment line.

Firstly, we evaluate the location based on strong demand and proximity to amenities like grocery stores, restaurants, and subway lines. Since most Manhattan residents don’t own cars, easy access to public transportation is crucial.

Secondly, we assess the building’s demand by examining the number of units available for sale or rent. A desirable building will have limited inventory, while high availability suggests lower demand.

Lastly, we consider the apartment line. Given the side-by-side nature of Manhattan buildings, there’s often a preferred exposure. For example, for a particular building, the north-facing units offer street views, while south-facing units look at the building behind.

Client’s condo located opposite Google’s downtown headquarters. Reserved at pre-construction stage to benefit from appreciation that came after building was completed.

Role of a Buyer’s Broker

A buyer’s broker plays a key role in safeguarding the buyer’s interest throughout the purchasing process. As a buyer’s broker, our role includes recommending suitable condominiums for the buyer and conducting thorough due diligence and market analysis on the property. Then, negotiating on behalf of the buyer’s best interest. And finally, managing the entire buying process, including coordination with attorneys and bankers.

Read Wei Min’s article: Buyer’s Agent, New York Property

Timeline of the purchase

The process typically begins with helping the buyer identify the desired property. Once the property has been selected, we will proceed to make a formal offer and negotiate terms of the deal.

Once a deal is reached, both parties sign the contract with the buyer putting down a 10 percent contract deposit. After the contract is fully executed, the brokers will help submit the board package. For buyers needing financing, the formal mortgage process starts. Closing of the transaction is usually around 60 days from contract signing. The closing marks the official transfer of ownership to the buyer, completing their acquisition of the property.

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale