April 2022 Manhattan Property Market Update

Posted by Wei Min Tan on April 13, 2022

An 8-minute overview of the April 2022 Manhattan Property Market Update by top Manhattan real estate agent, Wei Min Tan.

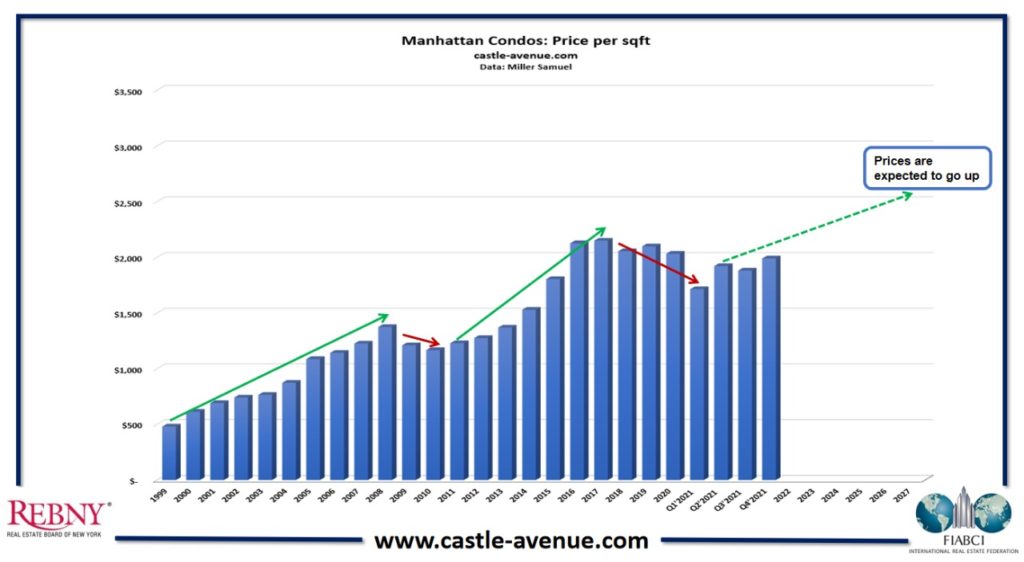

Manhattan Condo Historical Price Trend

Looking at property price data going back to 1999, Manhattan condominium prices were going up from 1999 to 2008, had a dip in 2009 and remained flat in 2010, and then went back up from 2011 to 2017. Manhattan experienced a dip between 2017 and 2019, and due to COVID 19, 2020 saw the dip extending as the market and entire U.S. economy came to a standstill.

Prices came down in Q1’2021 to $1,714 per sqft which reflected deals from 2020. The recovery started in Q1’2021. By Q1’2022, price per sqft recovered 16.2 percent from Q1’2021 to $1,992. Why? It’s because of pent up demand, low interest rates and optimism from the reopening of New York

We are in the beginning of the next up cycle and we expect prices to keep going up for roughly the next seven years or so. From history, up cycles usually last about 7 years.

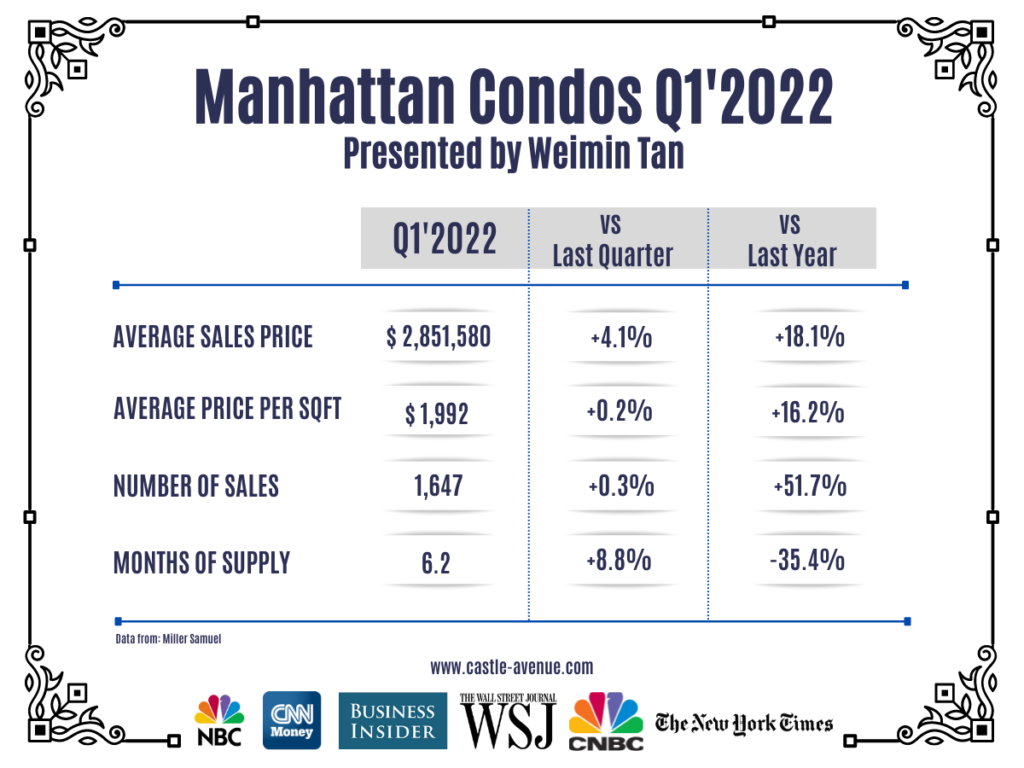

Manhattan Condos Q1’2022

The average price per sqft for a condo in Q1’2022 was $1,992. It went up by 16.2 percent versus last year and 0.2 percent versus the last quarter. The number of sales went up to 1,647, 51.7 and 0.3 percent higher compared to last year and last quarter respectively. The months of supply was at 6.2 months, 35.4 percent lower than last year.

This shows that the market is very robust.

Weimin’s article, Co-op versus Condo in Manhattan

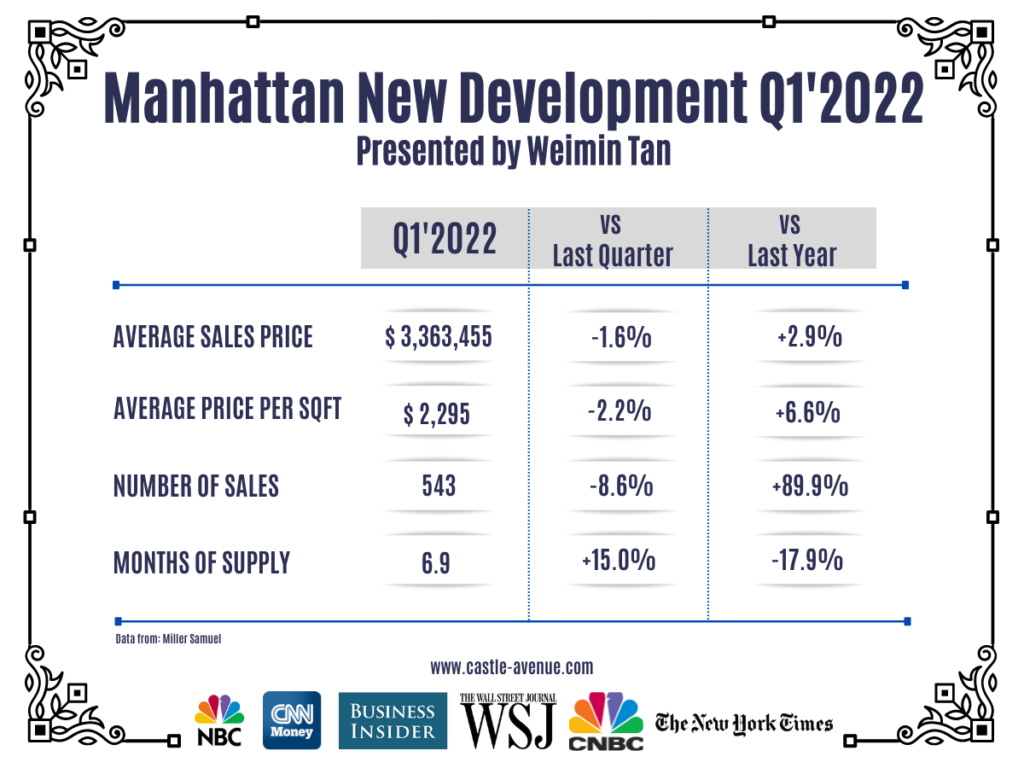

Manhattan New Developments Q1’2022

Manhattan new developments are more expensive on a price per sqft basis. The average price per sqft for a new development in Q1’2022 was $2,295, 6.6 percent higher than last year. The number of sales was at 543, 89.9 percent higher than a year ago.

The market is booming and and it is coming back. History has shown us that after a pandemic, usually the market does very well. The residential real estate market is doing well but commercial real estate is not. That is partly because many retailers have closed down as people are buying online from Amazon.

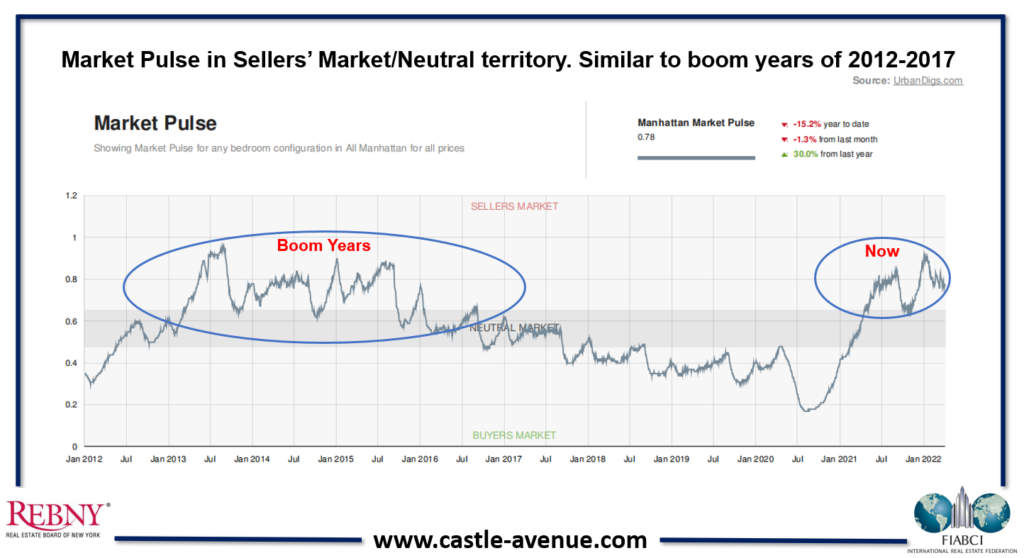

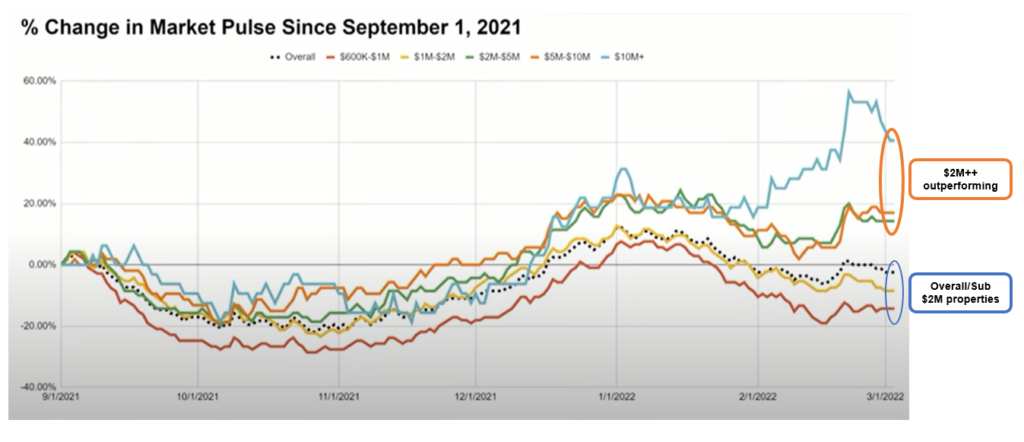

Market Pulse

The bottom of the Covid period was in July of 2020 and that was when it was most favorable to buyers. It has picked up since 2021 and right now, we’re in a seller’s market.

Source: UrbanDigs

Focus on larger apartments as people want more space post Covid

Our recommendation is to focus on larger apartments. This means that if you can get a 2-bedroom as opposed to 1-bedroom, get a 2-bedroom. If you can get a 3-bedroom, get a 3-bedroom because people want more space. The $2M+ price segment, referring to 2-bedroom and above sizes, is outperforming relative to the sub $2 million properties, which are the studios and 1-bedrooms.

Source: UrbanDigs

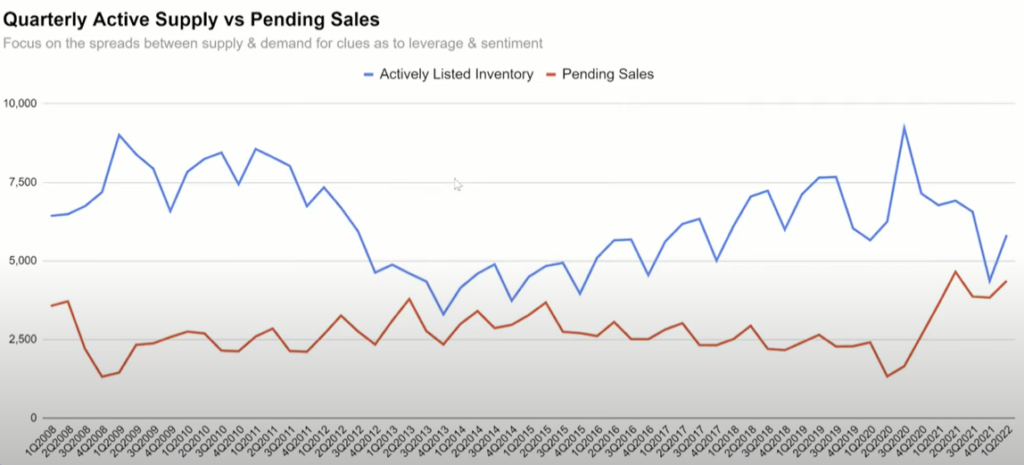

Quarterly Active Supply versus Pending Sales

The spread was the largest during the third quarter of 2020, that was when the market was weakest. Right now, the spread is very tight and it’s another indication of us being in a strong market.

Weimin’s article, Buying New York Residential Property – Setting Expectations

Source: UrbanDigs

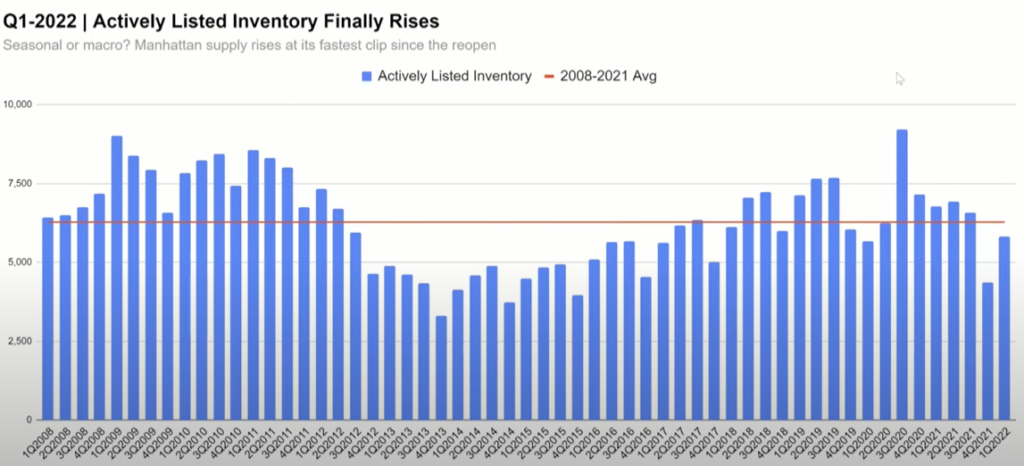

Manhattan Supply

Manhattan supply is tight now. We are below the historical average and we had a high going back to around May to July of 2020. That was when the market was weakest. Since 2021, the market has picked up tremendously.

Source: UrbanDigs

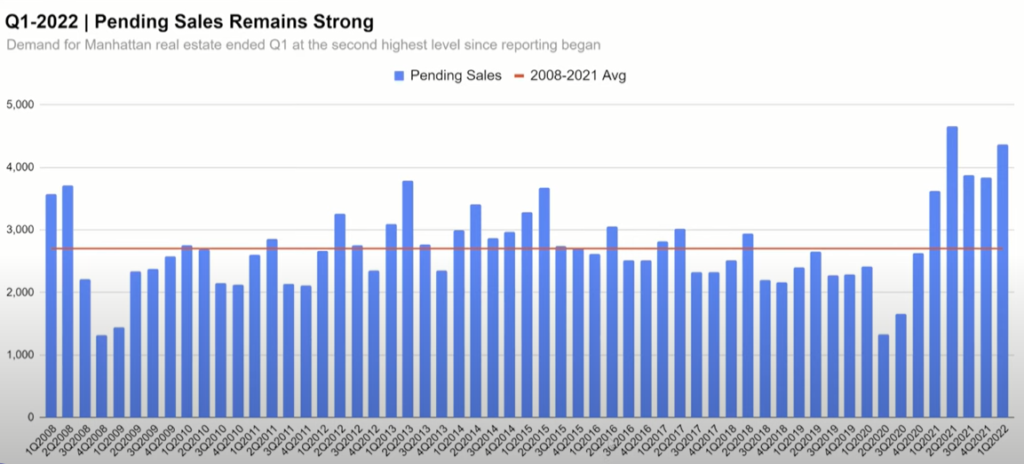

Manhattan Pending Sales

Pending sales refers to contracts in pipeline waiting to close. Right now, pending sales is higher than historical average. One of the current challenges of the market is low supply. We have a lot of buyers but there’s not enough property. Buyers are trying to lock in the still historically low interest rates and buyers want to be able to see more property.

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale

Follow On Instagram