Rising 30 year mortgage rate driving Manhattan property sales volume

Posted by Wei Min Tan on January 28, 2022

Manhattan real estate agent Wei Min Tan provides a 2-minute overview on the historical trend of the 30 year fixed mortgage rate, and how it affects the Manhattan property sales volume.

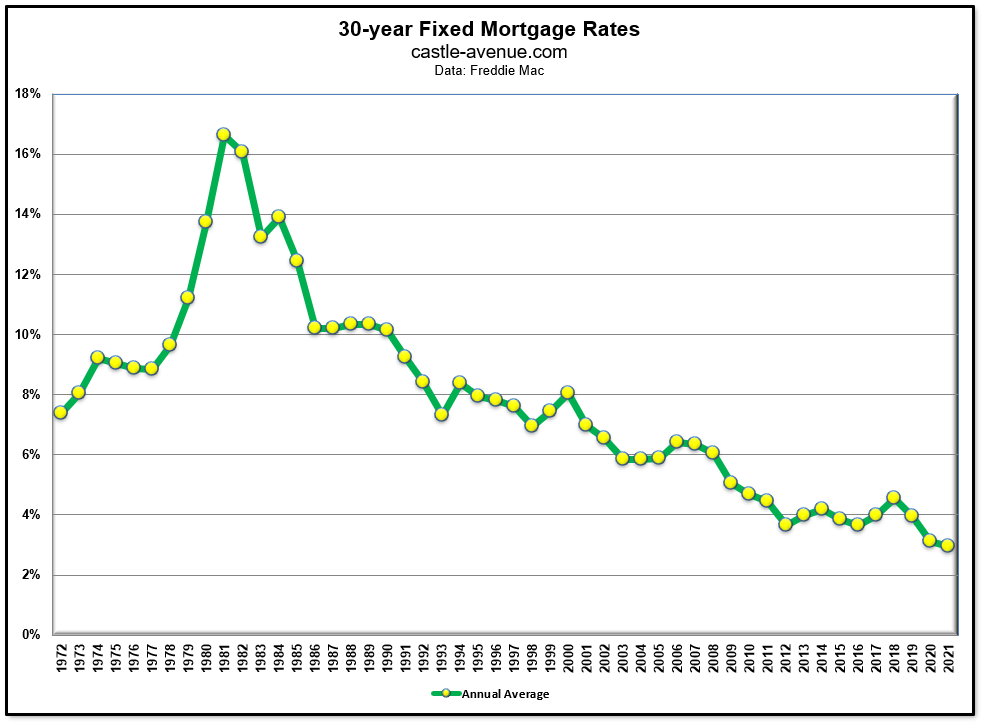

Historical Trend

Current data shows that we’re still experiencing record low mortgage rates. Back in 1982, the 30 year fixed mortgage was 16 percent, in 2000 it was 8 percent, and in 2010 it was 4.7 percent. The 2021 average was around 2.9 percent, slightly higher compared to the lowest rate ever recorded at 2.7 percent from December 2020 to January 2021.

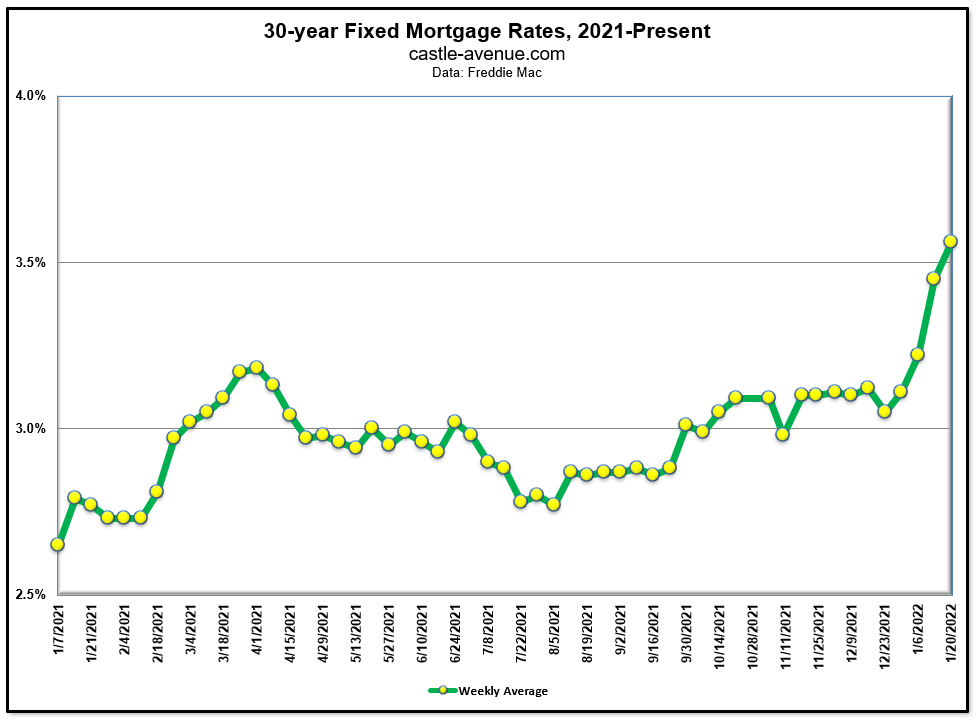

2021 to Present

The latest data shows that the 30 year fixed mortgage rate from the third week of January 2022 was at 3.56 percent. Rates have been going up because of inflation. This is one reason why investors are coming into the market, to take advantage of still historically low rates because the 30-year fixed mortgage is a great product.

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale

Follow On Instagram

Related Articles

Performance of the U.S. stock market S&P 500 vs Manhattan condos