June 2022 Manhattan Property Market Update

Posted by Wei Min Tan on June 10, 2022

The key points for the June 2022 Manhattan Property Market Update are:

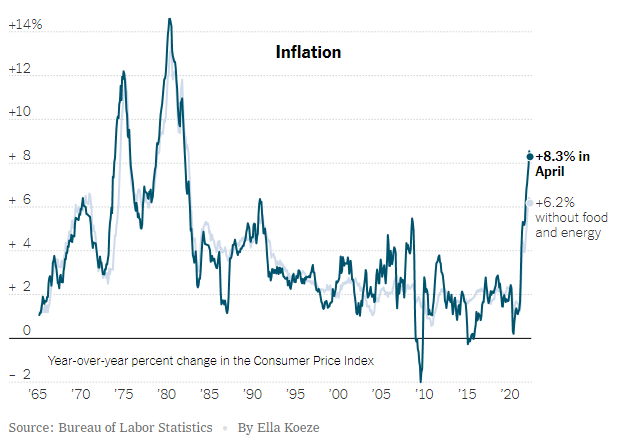

- Inflation at 8.3 percent, investors looking to real estate as a hedge

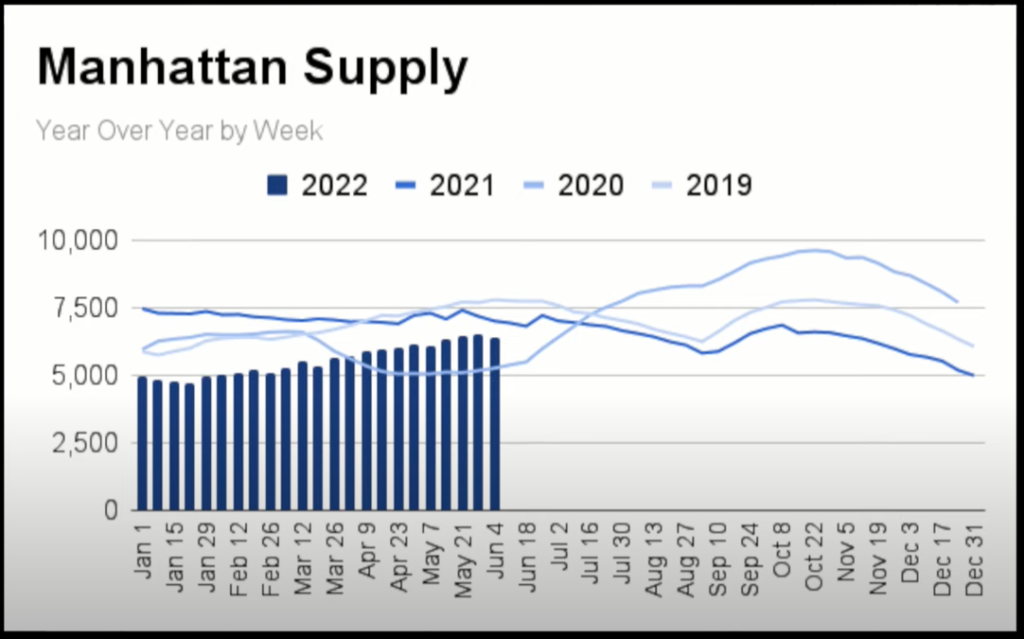

- Supply increasing but still a seller’s market

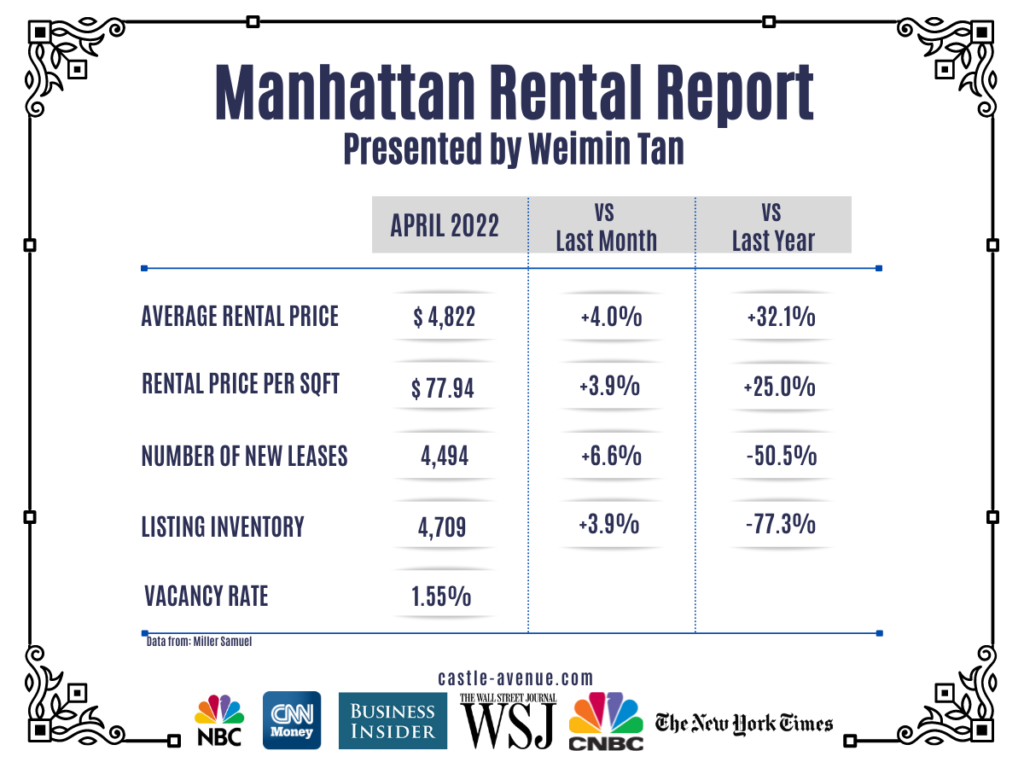

- Rents going up

Weimin’s article: How to Invest in Manhattan Property, Profit and Repeat

Inflation rate at 8.3 percent

As of April 2022, the inflation rate was at 8.3 percent. That is why global investors are looking for ways to hedge against inflation, and real estate is one of the popular ways to do this. Because when inflation rate is high, rents go up as well since housing expense is a key component of the inflation index.

The current inflation rate of 8.3 percent is a 40-year high. With the stock market not doing well, we are seeing a lot of global investor clients coming into real estate. Investors like Manhattan real estate because Manhattan is one of the most stable real estate markets in the world.

Supply increasing but still a seller’s market

Supply is increasing but we’re still in a seller’s market. We have been having limited supply for the longest time, since the beginning of 2021. Right now the market is providing some relief to buyers because there are more new listings coming onto the market. Supply is increasing slowly, and from a buyer’s perspective, the buyer would get more options to look at.

The highest supply was in late 2020 when it was close to 10,000 units on the market for sale. In early 2022 it was about 5,000 units, but it has been going up steadily. It’s still a sellers market, just a bit better for buyers vs months ago.

Weimin’s article: Manhattan Home Prices

Rents going up

From an investor perspective, rental yields are going up. From a renter’s perspective, it’s not as good because the monthly rent expenses are becoming a lot higher. It can be anywhere from 20 to 30 percent higher than what renters were paying a year ago.

For our landlord clients’ apartments, we have been increasing rents by roughly 20 to 30 percent, depending on where the prior rents were. The average rental price was up 32 percent versus last year and the price per square foot was up 25 percent. Number of new leases decreased by 50.5 percent versus last year and rental inventory decreased by 77 percent. Vacancy rate was at 1.55 percent, the lowest in the U S.

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale