January 2023 Manhattan Property Market Update – Weimin Tan

Posted by Wei Min Tan on January 6, 2023

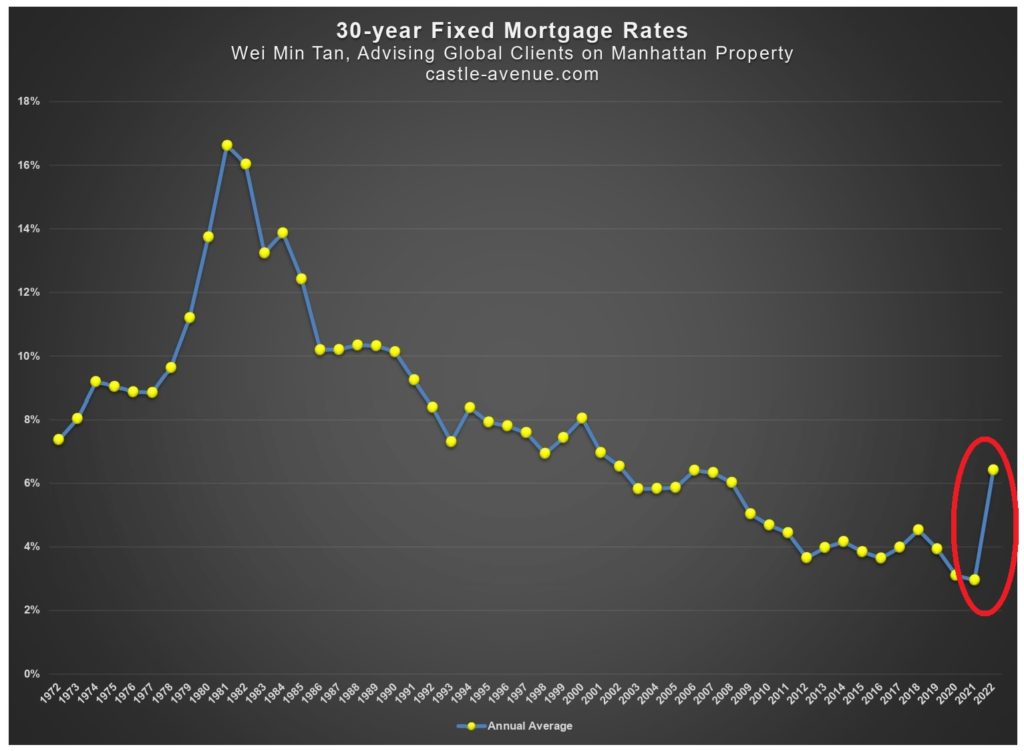

In the last 6 months – from around July 2022 to now – the Manhattan property sale market has been the quietest I’ve seen. We experienced 40-year high inflation, which led to the Fed increasing interest rates 7 times last year. This led to mortgage rates doubling in late 2022 vs a year ago. Potential buyers pulled back and rented amid rents that are 20 percent higher. Graph above shows the spike in the 30-year mortgage rate from 2021 to end of 2022.

Meanwhile, sellers decided to hold on to their properties, which have historically low mortgage rates from when they were purchased. Here are the key points for this January market update.

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

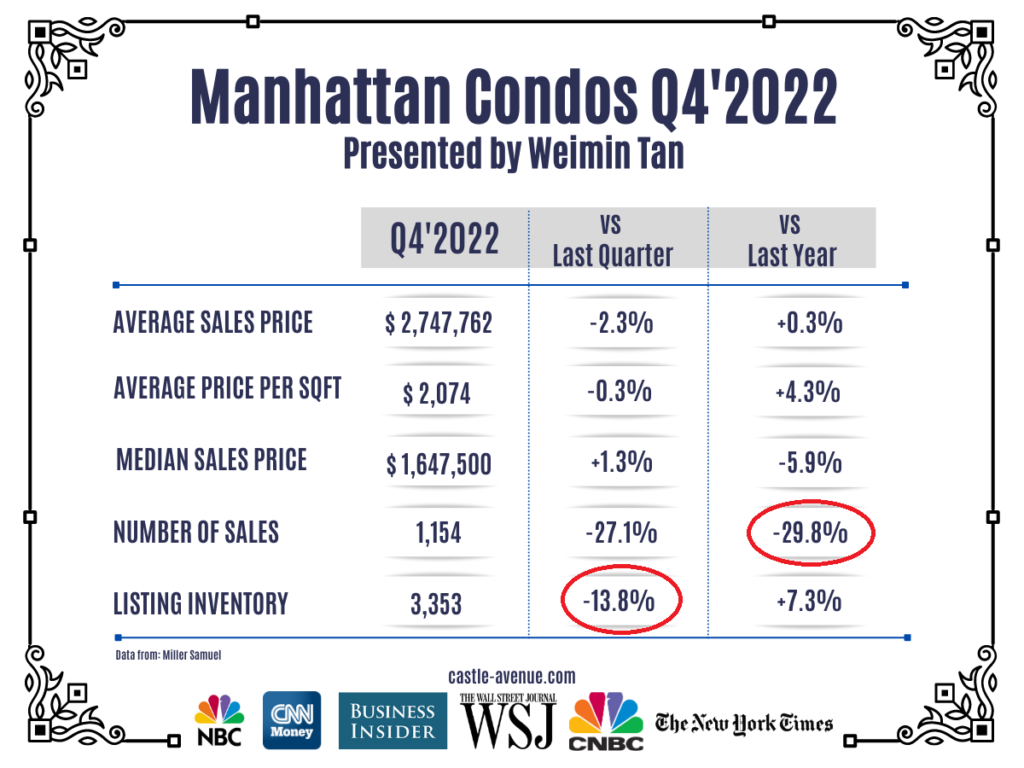

Sales volume down 29.8 percent

Recently published Q4’2022 data by Miller Samuel shows transaction volume down 29.8 percent compared to a year ago. This is driven by the spike in mortgage rates mentioned above. Inventory was down 13.8 percent compared to the prior quarter. This is because people who wanted to sell decided to either keep their property (which still have historically low mortgage rates) or they didn’t want to sell amid a weak property market. Sellers who sell would need to buy a new property, and many are avoiding that move in this high interest rate environment.

Read Wei Min’s article: Manhattan property investment performance

Cash transactions increased

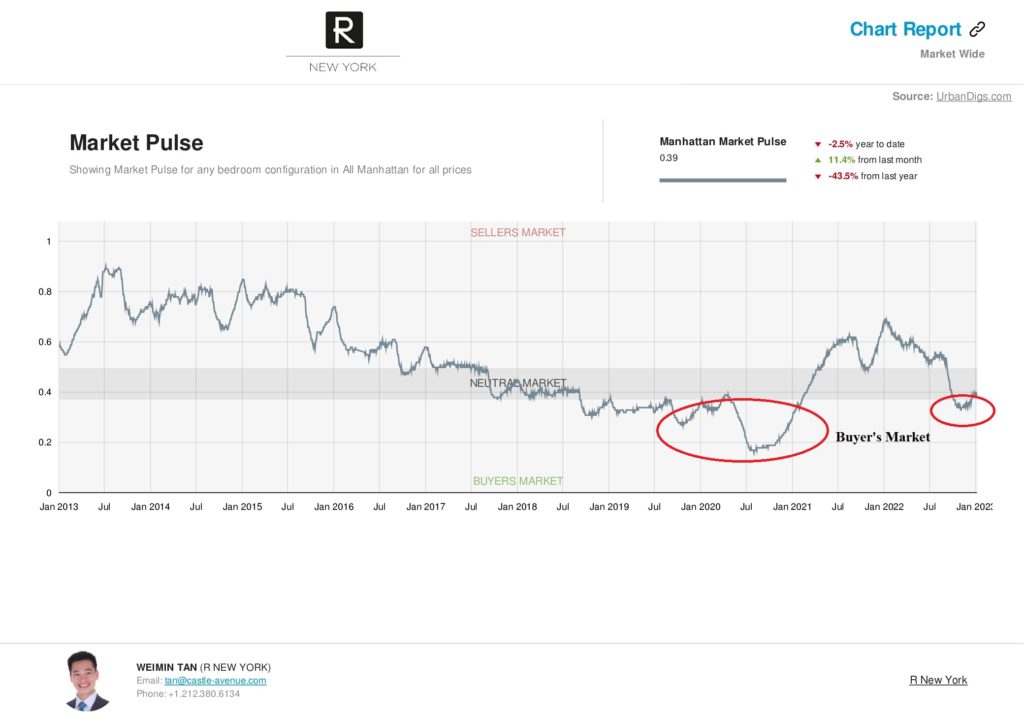

The past 6 months has been favoring all-cash buyers who are taking advantage of the buyer’s market (chart above). Expectedly, the share of all-cash transactions increased to 55 percent, a nine-year-high. For those who are investing to rent out, they benefited from the historically high rents as well.

Median price down

The median price of a Manhattan condo was down 5.9 percent for condos and 5.5 percent for the overall condo and coop market. This decline is in-line with my prediction. While the rest of the country experienced price increases of about 40 percent post pandemic, Manhattan prices were still around pre-pandemic levels. As such, it’s not overvalued and hence the decline is also less.

Read Wei Min’s article: Rental contracts with Manhattan apartments

Where do we go from here

Majority of economists are predicting a recession in 2023 because of the Federal Reserve’s tightening policies. Goldman Sachs is the optimist and expects the U.S. to avoid a recession and have a soft landing. Goldman cites recovery of supply chain issues which should bring down prices of core goods and improving inflation numbers over the past several months.

Nevertheless, further tightening is expected as the Fed tries to bring inflation down to 2 percent. High interest rates puts the real estate market and business spending to a halt. Reduction in business spending is resulting in layoffs and 50 to 70 percent stock price declines at tech companies. The S&P 500 was down 20 percent in 2022. Investors are waiting for certainty, and that happens when we get a clearer picture of when the Fed’s interest rate hikes will stop or reverse.

How about the Manhattan condo market? Cash buyers have a big advantage now in terms of negotiating a good price from sellers who really need to sell. In addition, investors can benefit from high rents that went up from the high inflation rate. The rental market has slowed down in the last 3 months but rents are still about 20 percent higher than a year ago.

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale