August 2022 Manhattan Property Market Update

Posted by Wei Min Tan on August 11, 2022

Key points for the August 2022 Manhattan Property Market Update:

1) Record rents

2) Slow summer months

3) Activity may be picking up

Record Rents

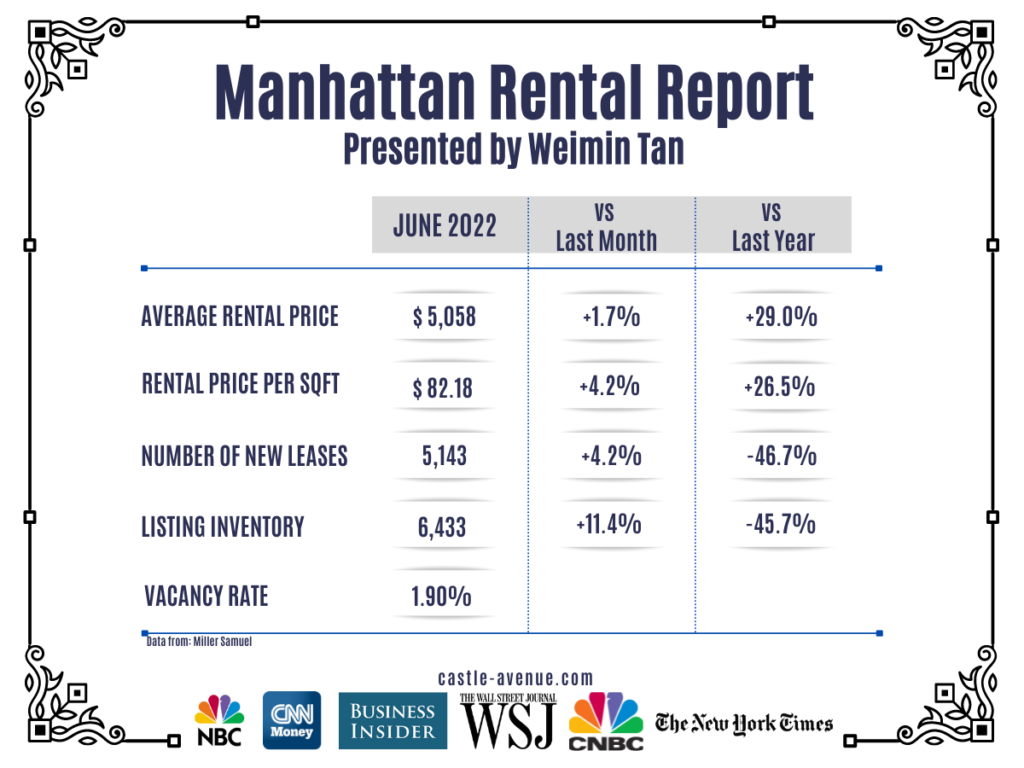

According to the June Rental Report from Miller Samuel, the average rental price set a record at $5,058, up 29 percent compared to a year ago. Since 2021, rents have been increasing. However, keep in mind two things. First, this 29 percent increase is influenced by a lot of pandemic rents. During the pandemic, rents were down by 25 to 30 percent. Second, rents in Manhattan have been stagnant for the past ten years, so it’s normal for rents to increase especially when we are in an inflationary environment with inflation at a 40-year high.

From a landlord’s perspective, rents increasing is good because rental yield improves. But from a tenant’s perspective, housing cost is now a lot more expensive. Many who enjoyed pandemic rents couldn’t afford to renew at their current places because of the rent hikes.

Rental price per square foot was up by 26.5 percent compared to a year ago. Meanwhile, the number of new leases was down by 46.7 percent. This is because there’s very little inventory, and tenants are fighting for the limited available units. Listing inventory was at 6,433 which was 45.7 percent lower than last year. Manhattan’s vacancy rate was at 1.9 percent, significantly lower than the U.S. average, which is roughly 9 or 10 percent.

Weimin’s article: Investing in NYC Real Estate

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

Slow summer months

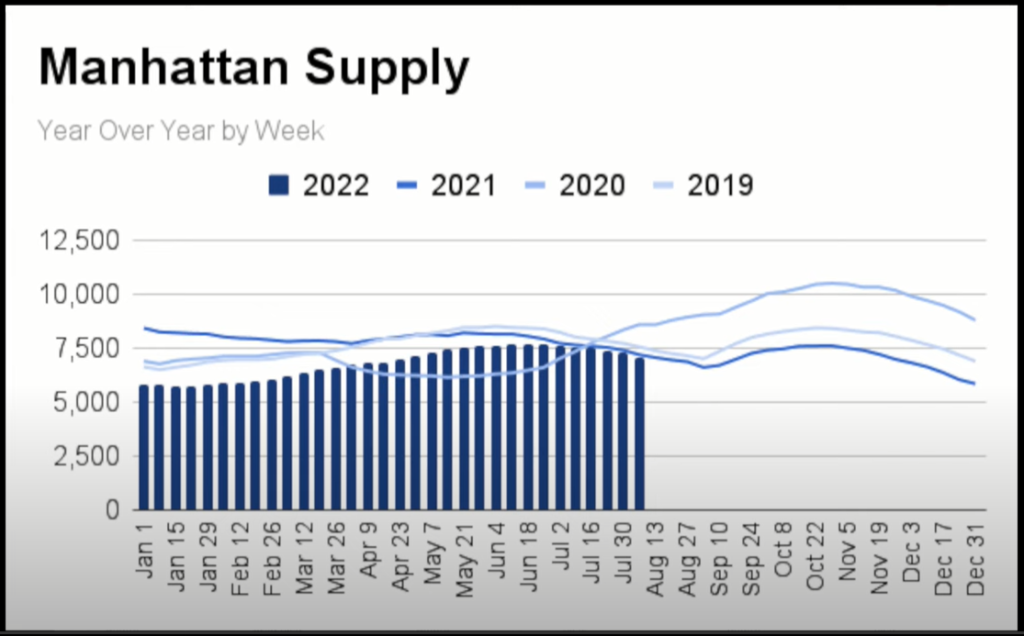

Supply was at a low in the beginning of 2022, then increased a bit in June. Currently, supply has decreased again. This is partly because we are in the slow summer months of July and August. Many sellers and buyers are on summer vacation. Since the weather is hot and humid, there is less viewing activity. Many sellers are holding off to the Fall to list their property, and this explains the low supply and slow activity.

Weimin’s article: Pros and Cons of New Property Launches in Manhattan

Graphs: UrbanDigs

Activity may be picking up

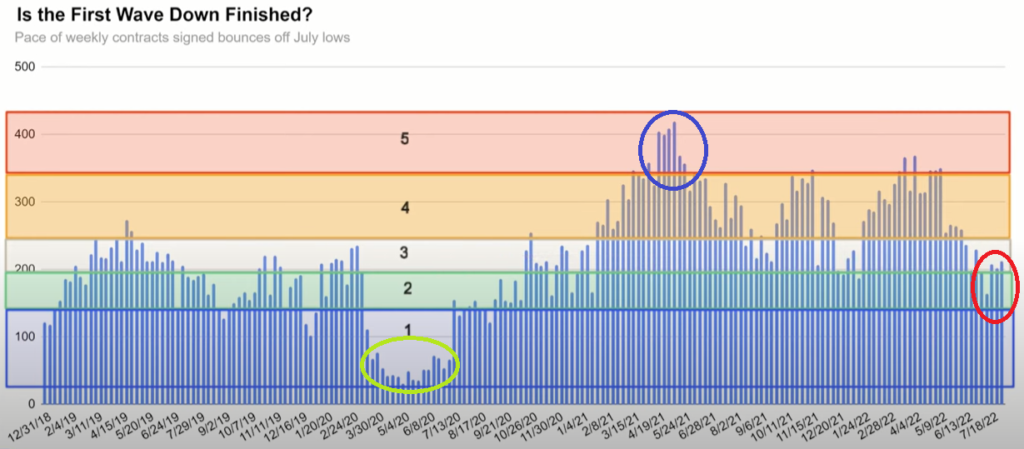

The Market Pulse is showing that we are in a seller’s market, but approaching neutral. Meanwhile, pace of weekly contracts signed dipped in June. But in the past 2 – 3 weeks, activity started picking up again (red circle in graph above). Back in spring of 2021, we were seeing the market at its fastest pace (blue circle). And in spring of 2020, during the COVID lockdown, we had the slowest pace of activity (green circle).

We should see more activity as Fall comes. The overall market slowed down because of increased mortgage rates. For context, mortgage rates almost doubled from a year ago. In the Manhattan market, about 50 percent of buyers require mortgage financing while 50 percent buy all-cash without financing. The market slowdown is an opportunity for buyers especially for those buying all cash.

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale