Manhattan property investment performance

Posted by Wei Min Tan on October 6, 2023

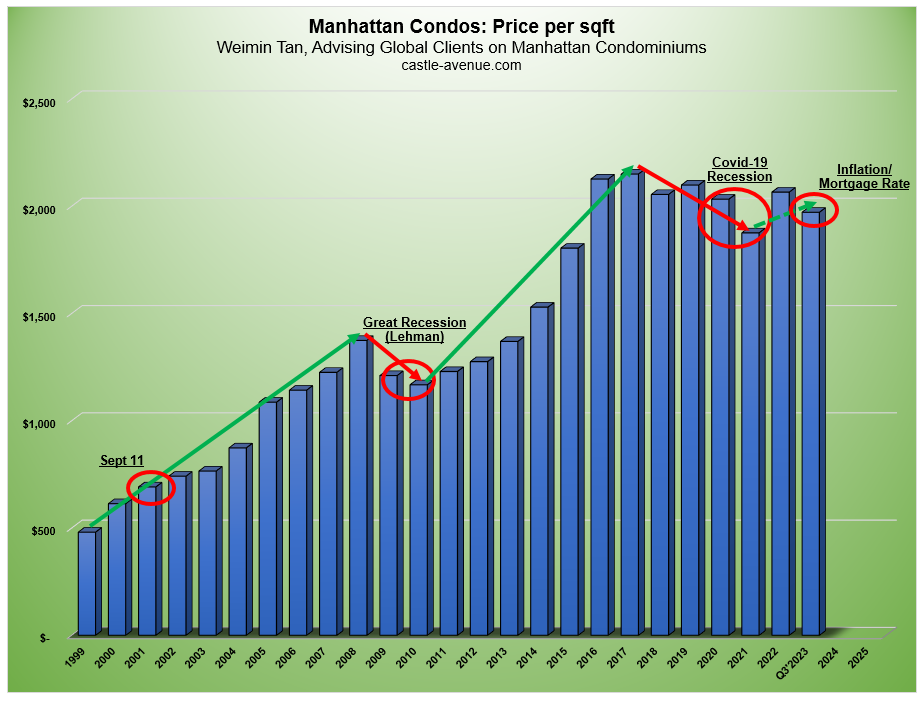

Manhattan property investment performance from 1999 to the most recent Q3’2023 shows that price per square foot increased from $480 to $1,971 during the 24 year period. This article analyzes property metrics related to how Manhattan condos performed from the Great Recession to Covid 2020 to the current slowdown driven by inflation and high mortgage rates.

Property downturns: Great Recession and 2017-2019

The Great Recession of 2007-2008 hit the Manhattan condo market a year later, in 2009. When the rest of the country’s real estate market collapsed and experienced record foreclosures due to subprime mortgages, Manhattan at first appeared to be resilient. But then Lehman collapsed in late 2008. This affected a lot of high paying financial jobs and then the property market. Manhattan property only felt the effects of the recession in 2009. In 2009 and 2010, prices were down by 12 percent and 4 percent respectively. In context, the rest of the U.S. was down by 35 percent during the 2009 recession.

From 2011 to 2016, Manhattan property experienced a boom. Condo price per sqft increased 73 percent, from $1,229 in 2011 to $2,126 in 2016.

Typical of cycles, a correction started in Q2’2017 which was driven by changes in tax laws, an oversupply of high end condos and uncertainty from global trade wars. Price per sqft of condos was down 4 percent between 2017 to 2018 but went up 2 percent between 2018 to 2019. Manhattan prices usually don’t decrease by much, it was the sales volume that was down significantly.

Read about Wei Min’s style in Best Manhattan property agents and Role of a buyer’s broker.

Covid 2020

In Q1 2020, the market can be divided into pre-March 15 and after March 15. Up to March 15, it seemed like we were starting a market recovery as evidenced by a sales transactions increase of 19.2 percent compared to prior year.

But after March 15, the coronavirus hit New York City at unprecedented levels. We became the global epicenter of the virus. The entire city, apart from essential workers, was in lockdown mode. The market stopped. The real estate market reopened in June 22, 2020, and Q2’2020 market data saw the largest sales volume decline in history, number of transactions fell by almost 60 percent!

Weimin’s article, Manhattan property report

Manhattan recovers 2021 with record sales volume

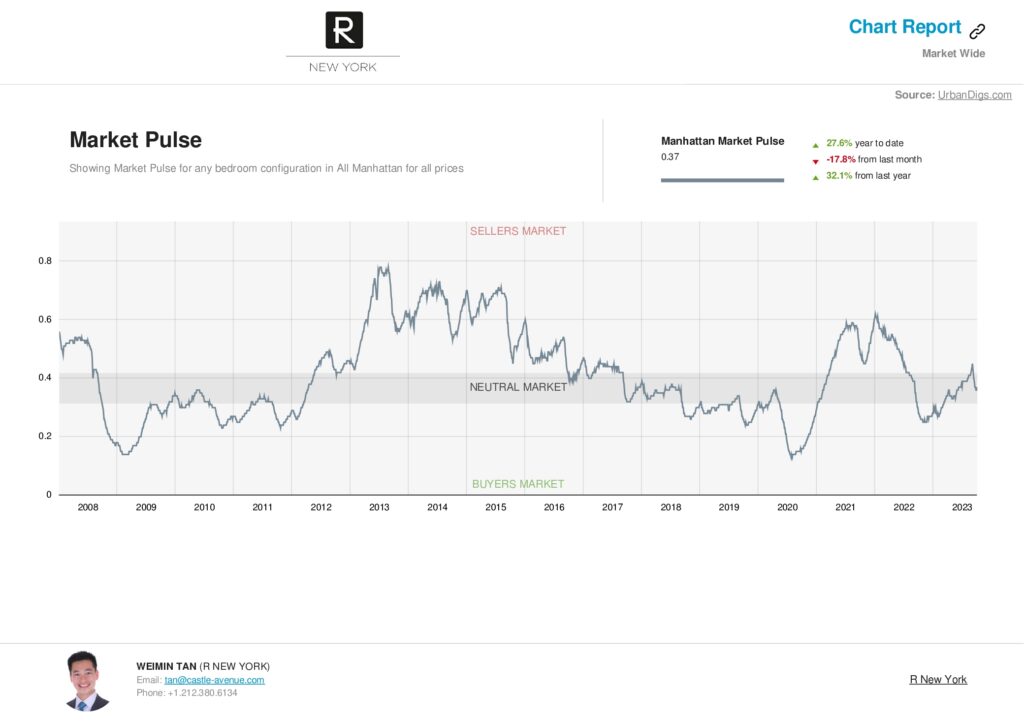

The Covid bottom of the Manhattan property market was between May to July 2020, when uncertainty was highest. From November 2020 through end of 2021, the market recovered tremendously because of low mortgage rates, pent up demand from buyers who wanted to buy in 2020 but didn’t and optimism regarding reopening of the economy and Covid vaccines. People who moved out of Manhattan moved back in. Manhattan became a seller’s market with buyers competing for limited supply.

Because of work-from-home, demand trended towards larger 2 or 3 bedroom apartments as people wanted more space. 2021 saw the highest sales volume ever recorded in 32 years of tracking. For example, sales volume in Q2’2021 was a whopping 162 percent higher than a year ago. As of Q2’2021, average price per sqft for a Manhattan condo was $1,921, a 12 percent increase vs Q1’2021.

The strong sales activity from 2021 extended through the first two quarters of 2022.

Client’s 3-bedroom apartment targeting post-Covid demand for larger spaces. We rented out in 1 week.

Currently, a buyer’s market again (mid 2022 to present)

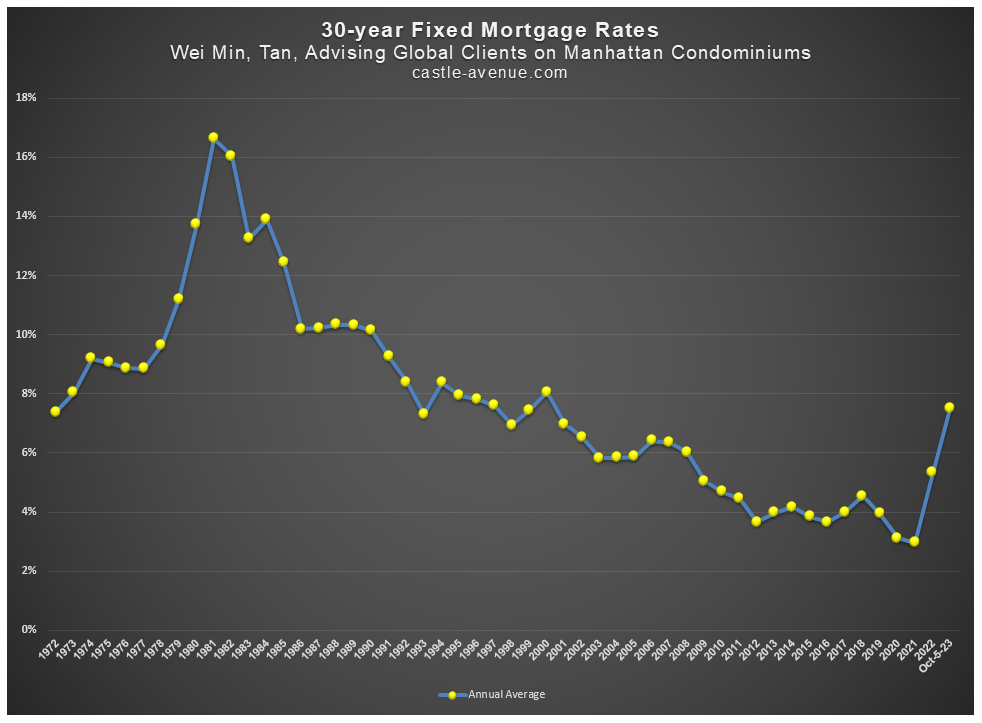

Starting early 2022, inflation has been increasing and in response, the Federal Reserve increased interest rates. While the first half of 2022 still had robust sales activity, the second half of 2022 slowed down tremendously. The Fed’s rate hikes resulted in mortgage rates more than doubling from about 3 percent in 2021 to 7 percent in late 2022. Many buyers became renters because of the significant increase in monthly mortgage payments. Rents, already at record levels because of inflation, increased further because of demand coming from buyers.

Mortgage rates spiked from 2021 to 2023, making it a lot more expensive for buyers needing financing.

Now, we are technically in a neutral market favoring cash buyers. Limited supply, low transaction volume and record high rents are current Manhattan property market trends. Rental yield is increasing for investors who are able to buy all cash. For foreign buyers, the strong US dollar is making it more expensive to invest in a Manhattan property.

Manhattan investment performance over time

The average appreciation per year during the 24 years (1999 to 2023) is about 7 percent, which is a very healthy return. Since property is often purchased with leverage, a 7 percent appreciation can be leveraged to twice or 3X that return depending on the equity invested in the property and financing used.

Rental yield

The current rental yield or cap rate for a Manhattan condominium is between 2 to 3 percent. This is based on the gross rents less common charges and property taxes as a percentage of property price. The average rent per sqft is $82 while the average rent is $5,552. For our clients’ condos, a two-bedroom gets between $8,000 to $12,000 in monthly rent while a one-bedroom gets between $4,000 to $8,000.

Manhattan’s rental yield was in the low 2 percent for many years. Because of recent inflation and rent increases, rental yields can now approach 3 percent. These are small numbers for people who are used to higher rental yields. But for Manhattan, a 3 percent rental yield is very high indeed.

While the rental yield is low, tenant credit quality and income are very high. Manhattan’s vacancy rate is also one of the lowest in the U.S., at around 2.42 percent.

Client’s dual exposure luxury condo with waterviews close to WTC.

Manhattan property is for stability, not yield.

The reason investors globally invest in a Manhattan condo is for the stable appreciation and not for the rental yield. A lot of safe and liquid investments would yield more than a Manhattan condo. For example, savings accounts in certain countries, the current 2-year Treasury, or stock dividends can easily exceed 3 percent in yield.

Global investors buy Manhattan condos for portfolio diversification. Manhattan and London have the most desirable property in the world. In Manhattan, merely 10 percent of housing units are condominiums which partly explains the consistent appreciation. Seventy percent of housing inventory comprise of rental buildings and the other 20 percent are Cooperatives (which are not investor friendly).

Investors buy a Manhattan condo property for asset diversification, capital preservation and as a badge of pride in owning a piece of Manhattan.

Read our Foreign buyer guide to New York property

Manhattan property prices appreciate with inflation

The appreciation in Manhattan is driven by inflation. About 40 percent of the CPI (inflation) index is attributed to housing cost. Prices increase because of inflation (labor and material costs go up over time). In Manhattan, appreciation is not because of speculative activity. In fact, investors make up only about 30 percent of buyers in Manhattan.

When clients ask whether Manhattan is at its “peak,” I answer that as long as there is inflation, there can never be a peak. Having a ceiling to property prices is like saying prices of goods and services must have a ceiling as well. We all remember how much goods, services and properties costed 20 or 30 years ago and know what the same items cost now.

How to invest in Manhattan property for maximum profits

Key is getting the right property

While the above are market-wide trends, the investor buyer needs to select the right apartment in the right building in the right location. This is where local expertise becomes critical.

We serve global investors who are buying Manhattan condominiums to rent out and we track every condo building in Manhattan. The analysis on which is a good buy goes into the micro level details such as which apartment line is more desirable, has a view, has a “wow” factor etc. These are the details that play a very important role in the long term investment performance of a Manhattan property.

Weimin’s article, Investing in West Village

What We Do

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right buy based on objectives

2) Manage the buy process

3) Rent out the property

4) Manage tenants

5) Market the property at the eventual sale

The Sutton, Turtle Bay, Midtown East. This Toll Brothers development only required 10 percent reservation deposit. Represented multiple buyers at the $2 million price point. Location, classic style windows and luxury finishes make this a good investment. Close to United Nations, Citigroup Center, Blackstone, Blackrock. Rented with strong cashflow from the beginning.

Weimin’s article, Pros and cons of new property launches in Manhattan

Notes:

Article updated October 6, 2023

Follow On Instagram

Manhattan real estate agent Weimin Tan

How to choose the right investment condo to rent out

CNBC interview on U.S. price to income ratio